100%+ BTC price gains? Bitcoin faces ‘massively overvalued’ stocks

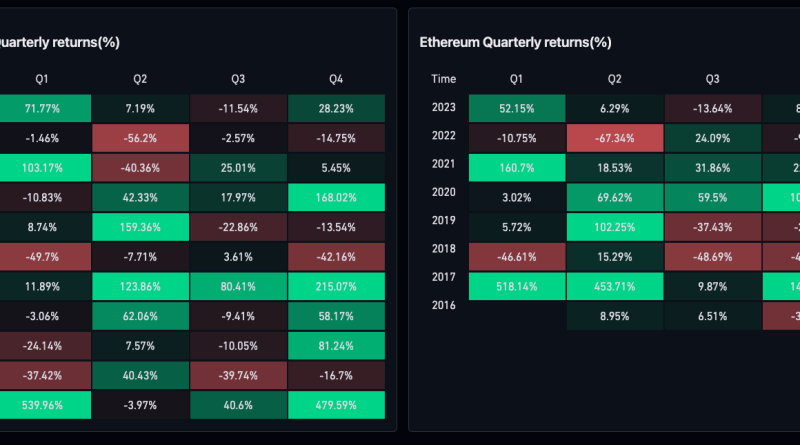

Bitcoin (BTC) will “reassert” itself to provide over 100% yearly BTC cost gains, says one of the crypto markets major proponents.In an interview with CNBC airing Oct. 5 and published Oct. 31, Dan Morehead, CEO of hedge fund Pantera Capital, anticipated continued crypto expansion.Morehead: “We could easily see” 40% stocks meltdownBitcoin closed October up 29%, seeing its 2nd best month of 2023 and returning to 18-month highs in the process.Eyeing macroeconomic conditions, however, Panteras Morehead and others are concerned about another danger property class– what he refers to as “massively miscalculated” stocks.” Equities are overvalued because the P/E is the very same level it was when rates were falling, but now rates are much greater and increasing,” he informed CNBC. “If you took the 50-year average equity danger premium with a 5.00% 10-year note, equities need to be 23% lower than today.” Morehead described altering macro conditions in the U.S., with rate of interest at their highest in over twenty years.” Im not stating -43% is going to take place over night, however we have to keep in mind there have been two 13-year durations where equities were flat– in the 2000s and in the 70s, 80s,” he advanced the topic. “We might easily see that once again.” Despite the grim prognosis, Morehead was complimentary of both Bitcoin and largest altcoin Ethereum (ETH), predicting the former to more than double every year, in line with average performance to date.” Bitcoin has a 14-year trend development of 145% a year,” he mentioned. “Thats my generic projection– it will re-assert its trend and will more than double every year.” Bitcoin, Ethereum quarterly returns (screenshot). Source: CoinGlassBTC price risks pre-halving collapseThe good times for BTC price performance may just follow a fresh bout of pain for hodlers.Related: Bitcoin beats S&P 500 in October as $40K BTC price predictions circulation inPrior to the 2024 block aid halving, some are concerned that a major retracement might enter.For Filbfilb, co-founder of trading suite DecenTrader, the timing will likely focus on a month before the halving– around March next year.A month before or so seems the meta.– filbfilb (@filbfilb) November 1, 2023

Must this come as an outcome of an equities comedown, the circumstance is not clear cut. As Cointelegraph reported, Bitcoin has actually nevertheless managed to ditch its favorable connection to stocks, something which research firm Santiment this week called a traditional early booming market signal.This article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes risk, and readers must perform their own research study when making a decision.

Related Content

- Second-biggest US bank failure — 5 things to know in Bitcoin this week

- A Based week: Looking back at the first 7 days of Onchain Summer

- Pepe would be ashamed by PEPE investors

- Cricket World Cup to feature Web3 fan app as ICC taps into NEAR blockchain

- Latest update — Former FTX CEO Sam Bankman-Fried trial [Day 4]