$28,000 Bitcoin is in the cards, but it won’t happen without a struggle

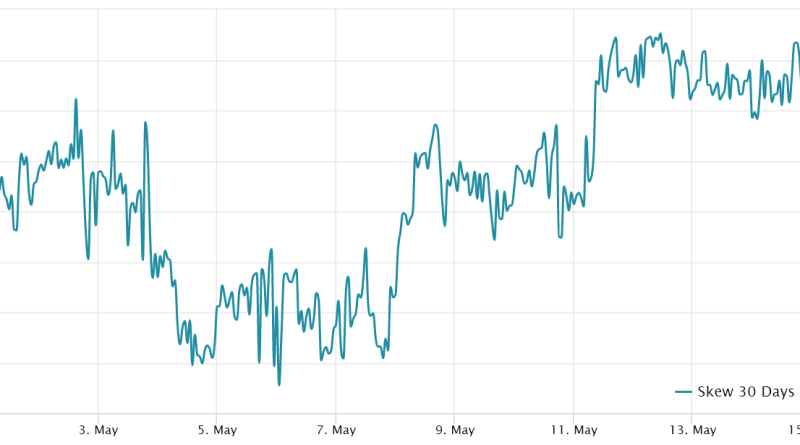

As pointed out by financier and Bitcoin activist Jogi, high fees most likely make the network unusable for smaller players, but they also impact the use of layer-2 scaling services such as the Lightning Network, as opening and closing payment channels need on-chain transactions.The present FUD is quickly losing steamRegardless of the rationale behind the rising demand for blockchain area, by May 12, the average transaction fee had currently dropped 83% to $5.10 from a $31 peak on May 7, according to Blockchain.com data. It is also worth noting that the Ethereum networks average deal charge held above $18 between May 5 and May 11, according to Blockchair data.Traders now question whether Bitcoin can bounce back above $28,000 offered the unpredictability on the crypto regulatory front. Bitcoin futures and choices information display screen moderate weak point, however a BTC price rally could happen as financiers rate in greater chances of a U.S. government debt default.The current high-interest rate environment is helpful for fixed-income trades, while the threats of an economic slump adversely weigh on dangerous assets such as Bitcoin. The 25% delta alter is an informing sign of when arbitrage desks and market makers overcharge for benefit or downside protection.In short, if traders expect a Bitcoin cost drop, the skew metric will rise above 7%, and stages of excitement tend to have a negative 7% skew.Related: Bitcoin a leading 3 asset in the event of US financial obligation default: SurveyBitcoin 30-day options 25% delta skew.

The last time such a losing streak took place was on June 14, 2022, after the Celsius financing platform halted withdrawals and FUD– uncertainty, worry and doubt– emerged from United States software firm MicroStrategys loan being liquidated at $21,000. Traders and experts hypothesized that a coordinated attack was intended at triggering network instability.Bitcoin is under DoS attack. High deal costs are the selected discomfort point by the enemy, most likely to makes bitcoin unusable for smaller gamers.

As pointed out by financier and Bitcoin activist Jogi, high costs most likely make the network unusable for smaller gamers, however they also affect the usage of layer-2 scaling solutions such as the Lightning Network, as opening and closing payment channels require on-chain transactions.The present FUD is rapidly losing steamRegardless of the rationale behind the rising need for blockchain area, by May 12, the average transaction cost had already dropped 83% to $5.10 from a $31 peak on May 7, according to Blockchain.com information. Bitcoin futures and choices information display moderate weak point, however a BTC rate rally might happen as financiers price in greater chances of a U.S. government financial obligation default.The present high-interest rate environment is helpful for fixed-income trades, while the threats of a financial decline adversely weigh on risky assets such as Bitcoin. The 25% delta skew is an informing sign of when arbitrage desks and market makers overcharge for advantage or drawback protection.In short, if traders expect a Bitcoin rate drop, the alter metric will increase above 7%, and stages of enjoyment tend to have an unfavorable 7% skew.Related: Bitcoin a top 3 property in the occasion of United States debt default: SurveyBitcoin 30-day options 25% delta alter.

Related Content

- Polychain Capital, Coinfund raise $350M for new crypto funds: Report

- Binance-linked HKVAEX still preparing to apply for license in Hong Kong

- Tokenizing music royalties as NFTs could help the next Taylor Swift

- Satoshi Nak-AI-moto: Bitcoin’s creator has become an AI chatbot

- Research the dynamics of market manipulation before you jump in Bitcoin ETFs