How to buy Bitcoin with Cash app

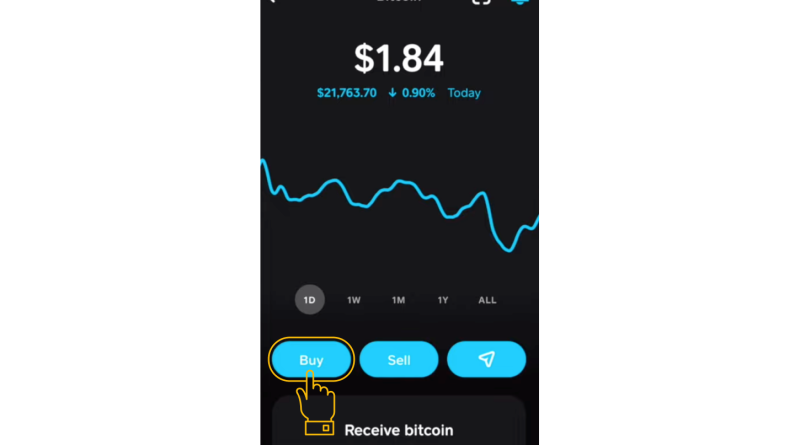

Cash App, a multipurpose monetary app, offers different abilities, consisting of cash transfers, financial investment options and cryptocurrency purchases. Serving as a detailed monetary tool, Cash App supplies users the capability to manage deals, invest in stocks, and explore digital currencies like Bitcoin (BTC). The app intends to streamline financial tasks and help users in browsing the modern monetary landscape.What is Cash App?Cash App, produced by Block Inc (formerly Square Inc), is a peer-to-peer (P2P) mobile payment service offering saved worth services resembling bank account. This innovative platform empowers users to gain access to monetary services without incurring the basic charges that accompany conventional banks. As a non-banking financial service, Cash App makes it possible for people to get and move money, pay costs, file taxes and invest in stocks, matched by the benefit of debit cards. With a sizable user base of 51 million people, Cash App provides an alternative to selling and purchasing Bitcoin on crypto exchanges. The apps growth started in 2018, opening the doors to cryptocurrency deals limited solely to Bitcoin and cementing its place as one of the popular mobile payment apps available in the United Kingdom and the United States. Starting from 2023, Cash App users can conveniently monitor their Bitcoin transactions to simplify tax reporting using the TaxBit combination, simplifying the process of calculating taxes for BTC holdings. Buy Bitcoin with Cash AppBefore starting the process of acquiring Bitcoin through Cash App, numerous preliminary actions are vital to ensure a smooth experience. Set up the Cash App and create an account. Link the Cash App account to a monitoring or bank account. Once this link is established, Bitcoin purchases can be made. Extra security confirmation may be needed to allow investment features of Cash App, consisting of purchasing Bitcoin.Its important to understand that Cash App only allows Bitcoin deals, and its investing balances are not Federal Deposit Insurance Corporation (FDIC)- and Financial Services Compensation Scheme (FSCS)-insured. There is limited Securities Investor Protection Corporation (SIPC) protection of fiat investing balances. As you start the journey to buy Bitcoin on Cash App, remember these fundamental prerequisites for a hassle-free transaction process.Steps to purchase Bitcoin on Cash AppLaunch Cash App and log in to your account.Ensure that your Cash App account has sufficient funds. You can include money to your account utilizing your linked debit or charge card or getting direct deposits.Tap on the “Investing” section situated at the bottom of the screen.Look for the “Buy Bitcoin” alternative and tap it to proceed.Enter the quantity of Bitcoin you want to utilize the slider or buy to pick a specific amount.Enter your PIN and examine the transaction information, consisting of the current BTC rate and any relevant fees.Tap the “Buy” button to confirm your instant Bitcoin purchase.Auto Invest Bitcoin on Cash AppThe Auto Invest feature can be used on Cash App to arrange recurring Bitcoin purchases that represent ones preferences. By simplifying the accumulation of BTC with time, this function gets rid of the requirement for manual transactions. This function enables users to assign a portion of their income to Bitcoin consistently and spread out Bitcoin purchases to reduce rate fluctuations.Steps to set up Auto Invest on Cash App: Access the “Bitcoin Investing” screen and tap “Buy.”Click the drop-down menu labeled “Change Order Type.”Choose a frequency– daily, weekly or every two weeks– and tap “Done.”Opt for a preset quantity or customize by tapping “…” and entering your preferred quantity. Press “Next,” keeping in mind that theres a $10 minimum for Auto Invest purchases.Confirm your choice to establish automated investments.Cash App costs for buying BitcoinCash App might enforce charges for Bitcoin deals depending upon transaction size, and the current mid-market cost of Bitcoin will use to the purchase. The app also includes a spread, resulting in paying somewhat more than the marketplace worth for the Bitcoin or offering slightly listed below market value.The margin may vary when buying Bitcoin utilizing Cash App compared to offering it. The margin and costs can also differ from what is promoted on other marketplaces.During transactions with Bitcoin, Cash App will impose two types of fees: One of them is the service charge, and the other is an extra cost based upon the cost volatility throughout exchanges in the United States. The costs will appear on the confirmation of the trade before completing the deal. In this way, if there is an argument with the last cost, the alternative not to continue is available.Who can buy Bitcoin with Cash App?To buy Bitcoin on Cash App, users should meet particular requirements. To utilize the application, a person needs to be at least 18 years of ages and over the age of maturity in their house state. In addition, they should be individuals, not services or other entities, and use the service for personal usage only. Money App is available in the U.K. and the U.S., and all 50 U.S. states can access the platform to buy Bitcoin.However, complete anonymity might not constantly be achievable. Particular government-issued or digital currency transfers might request users to offer individual info, such as their name, contact number, address, taxpayer recognition number, birth date, e-mail, government recognition number and savings account information. Furthermore, users might likewise be asked to divulge their money source and work information.Get Bitcoin with Cash app via Bitcoin Boost Another method to get Bitcoin on Cash App is to make it. The Bitcoin Boost function allows you to accumulate Bitcoin with each Cash Card deal. Upon picking a Bitcoin Boost and acquiring a Cash Card, the earned Bitcoin is immediately contributed to your Bitcoin balance.Steps to implement a Cash app Bitcoin BoostAccess the “Cash Card” tab on your home screen.Tap “Save with Boost,” pick a Boost and after that click to include Boost.Cash App does not charge any costs on Bitcoin Boost. For transaction-specific Bitcoin incomes, describe your “Activity” tab and tap the appropriate Cash Card transaction.Security and security measures used by Cash appCash App abides by PCI Data Security Standard (PCI-DSS) Level 1, the greatest security compliance standard for merchants that accept payments. As a user, this implies that your data is secured and encrypted.While Cash App offers a practical method to buy Bitcoin, its necessary to focus on security. Consider implementing two-factor authentication (2FA) and using a unique and robust password for your account to safeguard your Bitcoin wallet and transactions. By allowing 2FA, needing a PIN to move money and activating alerts for account activity, you might increase the security of your Cash App account. If your card is lost or stolen, its possible to deactivate it to prevent fraudulent charges. Prevent sharing sensitive details with anybody and be cautious of possible frauds related to cryptocurrency purchases.Drawbacks to buying Bitcoin by means of Cash AppWhile Cash App provides an alternative platform to purchasing Bitcoin, there are some downsides to consider. If you are a financier interested in diversifying your crypto portfolio beyond Bitcoin, Cash App falls short, as it only uses the choice to buy Bitcoin and does not support other cryptocurrencies. Unlike conventional brokers, Cash Apps investment choices are restricted, limiting your ability to check out various digital assets.Moreover, it is necessary to keep in mind that, unlike conventional banks, Cash Apps Bitcoin and investing balances are not insured by the FDIC or FSCS. This suggests that your funds held within the app are not protected in the exact same way as they would remain in a savings account. Nevertheless, investing balances might be covered by SIPC in some cases. Also, in the U.S., Cash Card offers your account advantages from FDIC protection, making sure security for as much as $250,000 of your Cash App account balance. Therefore, exploring devoted crypto exchanges may be preferable for investors looking for a more thorough variety of investment options and the security of FDIC insurance.

Purchase Bitcoin with Cash AppBefore starting the procedure of purchasing Bitcoin through Cash App, several preliminary steps are essential to ensure a smooth experience. As you embark on the journey to purchase Bitcoin on Cash App, keep in mind these fundamental requirements for a hassle-free deal process.Steps to buy Bitcoin on Cash AppLaunch Cash App and log in to your account.Ensure that your Cash App account has enough funds. You can include cash to your account utilizing your linked debit or credit card or getting direct deposits.Tap on the “Investing” area situated at the bottom of the screen.Look for the “Buy Bitcoin” alternative and tap it to proceed.Enter the quantity of Bitcoin you want to buy or utilize the slider to select a specific amount.Enter your PIN and evaluate the deal information, including the current BTC rate and any relevant fees.Tap the “Buy” button to confirm your instant Bitcoin purchase.Auto Invest Bitcoin on Cash AppThe Auto Invest feature can be used on Cash App to set up recurring Bitcoin purchases that correspond to ones preferences. Additionally, users may likewise be asked to disclose their money source and employment information.Get Bitcoin with Cash app through Bitcoin Boost Another method to get Bitcoin on Cash App is to make it. Upon picking a Bitcoin Boost and acquiring a Cash Card, the made Bitcoin is immediately included to your Bitcoin balance.Steps to execute a Cash app Bitcoin BoostAccess the “Cash Card” tab on your house screen.Tap “Save with Boost,” pick a Boost and then click to add Boost.Cash App does not charge any costs on Bitcoin Boost.

Related Content

- Price analysis 8/23: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

- Judge dismisses class-action suit against Uniswap over token scam losses

- What common mistakes do beginners make with bitcoin?

- Multichain saga screws users, Binance fires 1,000 staff: Asia Express

- Opinion: Why did Bitget seize more than $200,000 of my money?