Australian CBDC could be useful for payments, tokenization, says RBA

Australias central bank has actually finished its pilot of a central bank digital currency (CBDC) exploring use cases for a possible e-AUD, finding its beneficial in 4 primary locations consisting of enabling complex payments and possession tokenization.The Reserve Bank of Australia (RBA) and the Digital Finance Cooperative Research Study Centre (DFCRC) revealed their findings in an Aug. 23 report that also detailed a variety of cases where a CBDC wasnt specifically needed to attain the stated use case.We have actually released a report with the Digital Financing CRC @DigiFinanceCRC today on the findings from an Australian main bank digital currency pilot.https:// t.co/ k3Zn0VFbwG #RBA #CBDC #Payments #DigitalPayments #Blockchain #FinTech pic.twitter.com/N3mp1ID6gd— Reserve Bank of Australia (@RBAInfo) August 23, 2023

Thank you for reading this post, don't forget to subscribe!

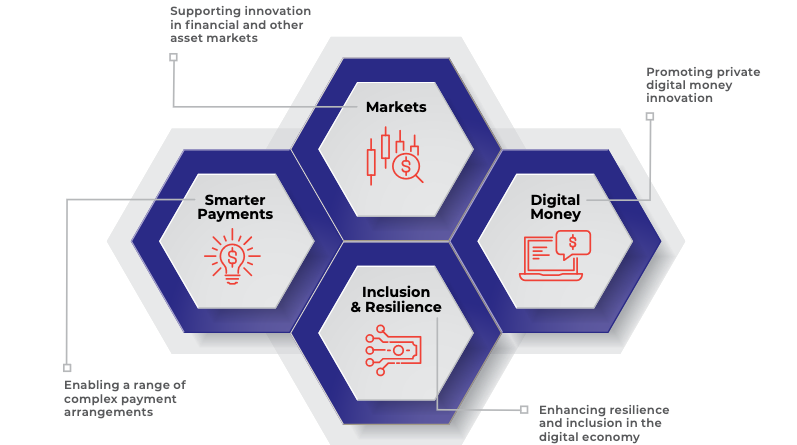

The pilot found a CBDC could be beneficial in four main locations, including for some payments and asset tokenization. Source: RBAThe CBDC pilot program was structured as a genuine legal claim on the RBA rather than a proof-of-concept which caused uncertainty over its legal status and regulatory treatment with participants.”Some individuals were unpredictable if they were offering custody services or dealing in a regulated monetary product due to the fact that of holding or dealing in the pilot CBDC,” the report stated.

Related Content

- Legal scholars file amicus brief in support of Coinbase

- Price analysis 11/29: BTC, ETH, BNB, XRP, SOL, ADA, DOGE, TON, LINK, AVAX

- Bitcoin price is ‘stuck’ at $30K — Here are 3 reasons why

- 11 ChatGPT prompts for maximum productivity

- PayPal applies for NFT marketplace patent for on- or off-chain asset trading