BlockFi argues FTX, Three Arrows Capital aren’t entitled to repayments

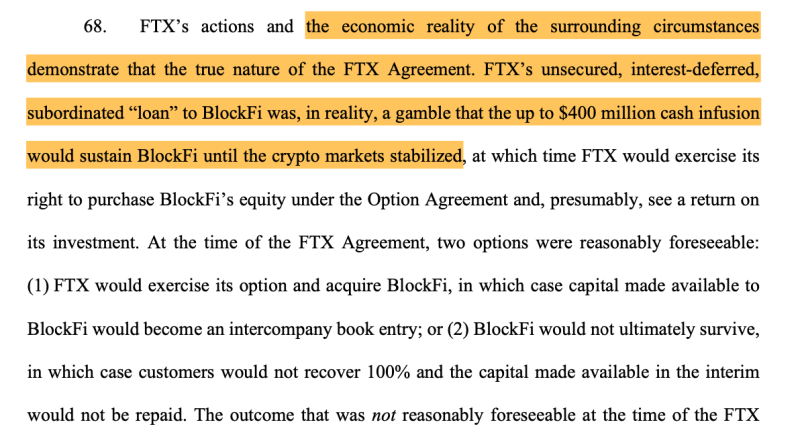

Bankrupt cryptocurrency loan provider BlockFi is attempting to block attempts by the likewise bankrupt FTX and Three Arrows Capital (3AC) that aim to retrieve hundreds of countless dollars to pay back their creditors.BlockFi declared in an Aug. 21 filing to a New Jersey bankruptcy court that its own financial institutions should not be pushed to the back of the line because FTXs lenders were hurt by the exchange supposedly misappropriating $5 billion BlockFi provided it.”FTX seeks to recuperate on over $5 billion of claims submitted versus the BlockFi estates at the direct expense of the ultimate victims of FTXs scams: BlockFis customers and other genuine financial institutions.””To prevent more injustice to the creditors of BlockFis estates, the Court needs to prohibit the FTX Claims under the doctrine of unclean hands,” BlockFi added.FTX also offered $400 million to BlockFi in June 2022 in addition to purchasing BlockFi equity pursuant to a loan agreement, the filing stated.However, BlockFi claimed it wasnt a standard loan arrangement– it was an unsecured, 5-year term that was well below market rates of interest and payments werent due till the company would apparently mature.BlockFi described FTXs financial investment as a “gamble” that BlockFi creditors shouldnt be responsible for.”Just since FTXs deceptive actions triggered FTXs bet to stop working does not indicate BlockFis lenders are now in some way liable to reimburse the purchase price,” it argued.BlockFi recommended a loan from FTX was a “gamble” that the market would stabilize. Source: KrollEstimates show BlockFi owes approximately $10 billion to over 100,000 financial institutions, consisting of $1 billion to its 3 largest lenders and $220 million to bankrupt crypto hedge fund 3AC. BlockFi declared 3AC committed scams with the cash it obtained and argued it also shouldnt be entitled to a potential repayment.BlockFi declares its litigation with FTX, 3AC and other firms might cost it approximately $1 billion– impacting the quantity its creditors are owed.Related: BlockFi opens crypto withdrawals for qualified United States users following court orderSeveral BlockFi creditors previously implicated the company of neglecting numerous warnings before negotiating with FTX and its trading company Alameda Research in the months prior to FTXs collapse in November 2022. Regardless of this, financial institutions settled with BlockFi last month to move on with a payment plan.BlockFi submitted for Chapter 11 insolvency on Nov. 28, about two weeks after FTX similarly declared bankruptcy.Magazine: Deposit risk: What do crypto exchanges actually do with your cash?

Related Content

- Faroe Islands postal service issues NFT-embedded stamps

- Weekend Wrap: $50M NFT platform shutters, OpenSea’s ‘HUGE mistake’ and more

- ‘Pick your targets’ — Bitcoin analyst believes Fed will favor bulls

- China’s surprise NFT move, Hong Kong’s $15M Bitcoin fund: Asia Express

- Bitcoin options tantalizing bears to push BTC price below $30K before Friday’s expiry