Opinion: Why did Bitget seize more than $200,000 of my money?

The blockchain industry has actually been innovative, to say the least. In the last three years, the crypto market has actually affected and changed lives positively– mine consisted of. As an industry still in its nascent phases, I have actually had my fair share of regrettable occasions take place to me, but none as bad as what Ive experienced with Bitget.

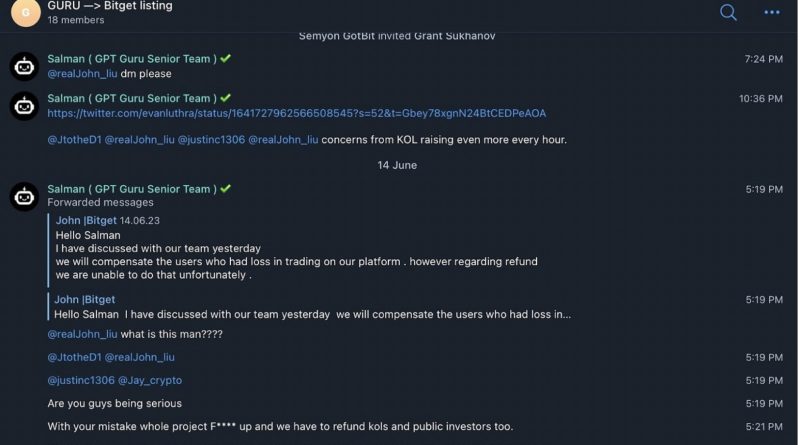

One may think an exchange as big as Bitget would be all about openness. Ive recognized that is regrettably not the case. Crypto exchanges have actually seen their downfall because of an absence of openness. FTX is a rather unpleasant example, and it is still fresh in our memories. According to reports, FTX CEO Sam Bankman-Fried moved up to $10 billion in FTX consumer funds (without the understanding or approval of stated consumers) to his trading company Alameda Research, whose assets were held primarily in the exchanges native token, FTX Token (FTT). Binance CEO Changpeng Zhaos statement that Binance was selling its stake in FTT created panic among clients, which led to a bank run and, ultimately, the personal bankruptcy of the FTX Group. My experience with BitgetIve been a user of Bitget for a while now. In the first quarter of this year, Bitget avoided me from withdrawing my tokens– in spite of being in complete compliance with Know Your Customer protocols.The issue developed in connection with my function in recommending a task, ReelStar, starting in October 2022. ReelStars announcement about my advisory role was extremely public. Its safe to state it was public knowledge. In the very same fashion, it was public knowledge that I was going to be paid with the projects tokens. Unlike what a lot of individuals– consisting of Bitget executives– may think, I dont get paid in dollars to promote projects Im unknown with, unlike stars including the Kim Kardashians or Floyd Mayweathers of the world. Related: Its time for the SEC to settle with Coinbase and RippleAs such, I just generate income when a tasks token grows in worth. This is pretty standard, as I am an adviser– not an influencer. I get paid in tokens because I bring more than just impact to the table. I connect tasks with partners, bring capital, and eventually, increase reliability. On March 23, it was time for ReelStars native token, Reel Token (REELT), to be listed on exchanges. Bitget charged money for this right– six figures, in dollars, just so you have some concept of what occurs behind the scenes.I had been an advisor on the project for months at that point and was promised payment in the type of REELT. Having not earned anything for the work I had actually put in, I sold less than 3% of my personal REELT holdings– less than.03% of the total REELT supply– with the true blessings of ReelStars creators, Navdeep Sharma and Nick Bahl.But my funds– including the Bitcoin and altcoins I already had on the exchange before REELT– were obstructed without explanation. I and my attorney, Charles Slamowitz, are now filing suit through my to figure out whether Bitget took my funds, as Bitget is refusing to notify me.Related: An ETF will bring a transformation for Bitcoin and other cryptocurrenciesAt this time, I have no concept where my funds are. As far as I know, Bitget might be utilizing them to make its own investments– and might be preparing to keep my money permanently.At initially, I thought there was a mistake which I could clarify things with Bitget– but I soon realized that it had not made a mistake.Is Bitget the next FTX?I lost more than $2 million to the FTX debacle and was welcomed by Fox, CNBC and numerous others to talk about what I believed failed. Now, Bitget is acting in a manner that is probably reminiscent of FTX prior to its fall. It would be wise for users to consider what that implies. Ive been burned already, and I think Im in a position to explain the concerns surrounding this exchange.I likewise discover it odd that a business like Bitget would employ a former host for a state-owned Chinese tv network– Gracy Chen, who worked for Phoenix Television– as an essential public face for its organization. Outside of Chen, we understand little about the exchanges executives. Who are Bitgets real owners? Who is on its management team? Whos managing the user funds in Bitgets custody? Couple of are asking these questions, and the exchange is refusing to offer lots of answers.And in an extension of its weird hiring practices, it has actually caused non-expert celebs, including actor Adam DeVine and Lionel Messi, to market its services. This is an unsafe precedent initially set by FTX, and it is worrying. Utilizing stars to market cryptocurrency items to unwary members of the general public– especially millennials and Gen Z– arguably isnt ideal for the market. FTX fell, in part, since it depended on influencers and marketing to win over casual users while stopping working to focus on difficult work on the back end.In another parallel with FTX and its reliance on its own FTT token, a substantial part of Bitgets reserves are held in its native token, Bitget Token (BGB), rendering the exchange susceptible if the cost of its token falls.Bitget sabotaging token listings?Recently, GPT Guru accused Bitget of sabotaging its GPTG token listing on the exchange. According to GPT Guru, GPTGs listing rate was set at $0.0035, however Bitget in fact noted it at $0.084– 24x higher. This caused a big red candle light, which ruined the launch.”Upon asking more about how it took place, we found out that it was Bitgets own group who was accountable for [the] screwed up $GPTG listing,” Guru stated. “Not only that, the Bitget team itself admitted to GPT Gurus CEO about an insider job from within the Bitget group.”Bitget at first consented to compensate users who had lost funds, according to GPT Guru, however has actually since deleted its messages and ceased interaction with the GPT Guru group. This led GPT Guru to threaten legal action against Bitget– however not everyone can manage expensive lawyers.These actions are unfair and reflect improperly on Bitget as a crypto exchange, which takes pleasure in control over its users funds. Whats to stop it from participating in the very same doubtful– arguably dishonest– behavior in the future? These concerns need to concern us all. At a time of market unpredictability and looming regulative action around the world, we are worthy of more openness from the exchanges we utilize– and clear assurances of the habits we can expect.The main concern for crypto exchanges is what legal responsibilities they specifically owe to their users– if any. My suit is going to find out.This column is a counterpoint to Bitgets viewpoint: Bitget acted morally on crypto influencers accountEvan Luthra is a 28-year-old cryptocurrency business owner who offered his very first business, StudySocial, for $1.7 million at 17 and had actually established over 30 mobile apps before he was 18. He ended up being included with cryptocurrency in 2014 and is currently constructing CasaNFT. He has bought more than 400 crypto projects.This post is for basic information purposes and is not meant to be and need to not be taken as legal or financial investment recommendations. The viewpoints, ideas and views expressed here are the authors alone and do not necessarily reflect or represent the views and viewpoints of Cointelegraph.

In the first quarter of this year, Bitget avoided me from withdrawing my tokens– despite being in complete compliance with Know Your Customer protocols.The issue developed in connection with my function in encouraging a job, ReelStar, beginning in October 2022. I and my attorney, Charles Slamowitz, are now filing suit through my to determine whether Bitget took my funds, as Bitget is declining to inform me.Related: An ETF will bring a revolution for Bitcoin and other cryptocurrenciesAt this time, I have no idea where my funds are. As far as I understand, Bitget might be using them to make its own financial investments– and might be preparing to keep my cash permanently.At first, I believed there was an error and that I could clarify things with Bitget– however I soon understood that it had actually not made a mistake.Is Bitget the next FTX?I lost more than $2 million to the FTX fiasco and was invited by Fox, CNBC and numerous others to talk about what I thought went wrong. FTX fell, in part, because it relied on influencers and marketing to win over casual users while failing to focus on difficult work on the back end.In another parallel with FTX and its reliance on its own FTT token, a significant portion of Bitgets reserves are held in its native token, Bitget Token (BGB), rendering the exchange susceptible if the rate of its token falls.Bitget screwing up token listings?Recently, GPT Guru implicated Bitget of undermining its GPTG token listing on the exchange. “Not only that, the Bitget team itself confessed to GPT Gurus CEO about an insider task from within the Bitget team.

Related Content

- Gemini’s Travel Rule measures reflect ‘worrying creep’ of overregulation

- Evaluating Bitcoin’s Risk-On Tendencies

- Adversarial Thinking And Ways To Attack Bitcoin

- Temasek, Sequoia Capital, Softbank and 15 VCs face lawsuit for “abating” FTX fraud

- Bitcoin price support at $30K opens the door for gains from UNI, ARB, AAVE and MKR