Bitcoin may hit $100K by capturing ‘even 2%–5% of gold’s market cap’ — Hut8 VP Sue Ennis

The companys set up ASIC hashrate capacity sits at 2.6 ETH/s and Hut8 mined 44.6 BTC in July.In the interview, Barron inquired whether rising Bitcoin problem for miners could induce a fresh wave of sell pressure versus BTC cost.– 5 things to understand in Bitcoin this weekHigher rates are configured thanks to the halving and ultimate BTC ETFCrypto financiers have waited years for the launch of a spot Bitcoin ETF and even with the recent increase of applications, an approval by the U.S. Securities and Exchange Commission stays elusive. Regarding a prospective target for Bitcoin price, Ennis said: “I definitely do believe we could see in this next cycle $100,000 expense per Bitcoin and thats based on if BTC were to catch even 2% to 5% of golds $13 trillion location in institutional portfolios.

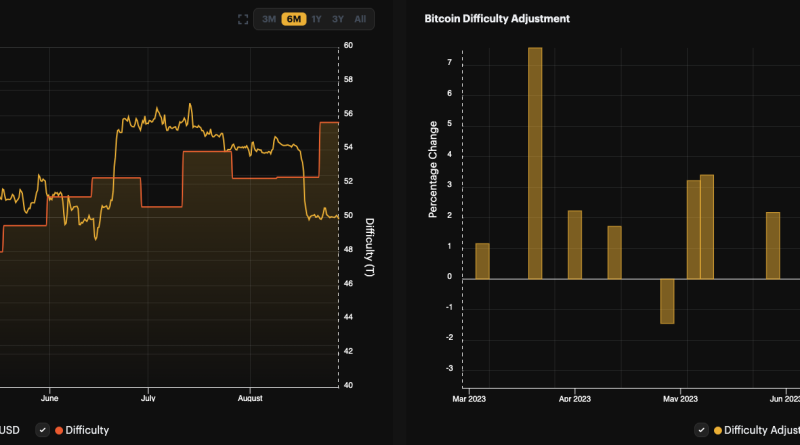

In a recent interview with Paul Barron, Hut8 vice president Sue Ennis shared her thoughts on how Bitcoin rate will rise above $100,000 in the next year and how the upcoming halving will impact BTC miners. The companys set up ASIC hashrate capability sits at 2.6 ETH/s and Hut8 mined 44.6 BTC in July.In the interview, Barron inquired whether rising Bitcoin trouble for miners might cause a fresh wave of sell pressure versus BTC cost. Source: Hashrate IndexBarron questioned if miners were offering Bitcoin as an outcome of the upcoming halving developing a requirement for more effective ASICS, and whether BTCs pre- and post-halving price action would not be as bullish as financiers anticipated.– 5 things to know in Bitcoin this weekHigher costs are configured thanks to the halving and eventual BTC ETFCrypto investors have waited years for the launch of an area Bitcoin ETF and even with the recent increase of applications, an approval by the U.S. Securities and Exchange Commission stays evasive. Concerning a prospective target for Bitcoin rate, Ennis stated: “I certainly do believe we could see in this next cycle $100,000 cost per Bitcoin and thats based on if BTC were to record even 2% to 5% of golds $13 trillion place in institutional portfolios.

Related Content

- 5050 Bitcoin for $5 in 2009: Helsinki’s claim to crypto fame

- The Pros and Cons of Investing in Cryptocurrency: What You Need to Consider Before Taking the Plunge

- Meet the judges that will preside over Coinbase and Binance’s SEC lawsuits

- CME Bitcoin trading volume surpasses Bybit, but is it impacting BTC price?

- Arkansas counties rush to pass noise regulations for crypto miners