SEC’s first deadlines to approve 7 Bitcoin ETFs coming over the next week

What are the SECs options post-Grayscale decision?After the Aug. 29 judgment in favor of Grayscale, the regulator has 90 days to submit an appeal with the U.S. Supreme Court or obtain an en banc review– where a complete circuit court can overturn a judgment made by a three-judge panel.However, the SEC hasnt explained what its next relocation will be.If the SEC doesnt appeal the court will require to specify how its judgment is performed which could consist of instructing the SEC to approve Grayscales application, or at least review it.Related: BTC rate jumps to 2-week highs on Grayscale vs. SEC Bitcoin ETF winEither way, Seyffart just saw 2 feasible options for the regulator.The first is for it to concede defeat and approve Grayscales conversion of its GBTC to a Bitcoin area ETF.Alternatively, the SEC would need to withdraw the listing of Bitcoin futures ETFs totally or reject Grayscales application based on a new argument, said Seyffart.The 2nd potential avenue is to reject on factors not utilized before/yet … which i have actually been saying for months might relate to Custody or settlement of #Bitcoin which is not something that futures ETFs need to stress over. SEC has actually made a lot of noise around custodians– James Seyffart (@JSeyff) August 29, 2023

Magazine: Hall of Flame: Wolf Of All Streets worries about a world where Bitcoin strikes $1M.

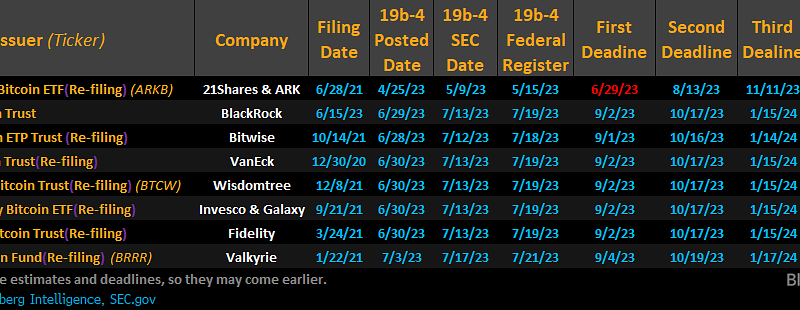

The United States Securities and Exchange Commission is facing its very first deadlines to decide on seven new Bitcoin (BTC) spot exchange-traded fund applications, with the latest being Sept. 4 amid its defeat to Grayscale Investments in a U.S. federal appeals court.Investment firm Bitwise will find out if its ETF will win the SECs approval on Sept. 1 while BlackRock, VanEck, Fidelity, Invesco and Wisdomtree will all be waiting for the SECs choice for their funds by Sept. 2, according to numerous SEC filings.Meanwhile, Valkyrie is set to hear back from the SEC on Sept. 4. For the waiting for applicants, the final due dates for the SEC are all mid-March next year.99.99999% of the world does not know that the SEC has to decide on 7 BTC ETFs within the next 3 days:- blackrock-bitwise-vaneck-wisdomtree-invesco-fidelity -valkyriethe fits at our doorstep– odin free (@odin_free) August 29, 2023

However, fellow Bloomberg ETF expert Eric Balchunas thought about the odds of the SEC revoking the Bitcoin futures ETFs as “highly unlikely” because of the SECs reported openness to Ethereum futures ETFs.Lol, this man turned the last paragraph of Judge Raos legal smackdown today into an MGMT-esque sythe banger. Really records the mood rn, well done. https://t.co/BBJZR5O6To— Eric Balchunas (@EricBalchunas) August 29, 2023

Related Content

- Newly discovered Bitcoin wallet loophole let hackers steal $900K — SlowMist

- White House advisors renew push for 30% digital mining energy tax

- How Bitcoin Found Its Purpose At Oslo Freedom Forum

- What common mistakes do beginners make with bitcoin?

- Ron DeSantis’ falling polls: Could crypto lose its candidate?