Crypto market ‘dramatically underestimates’ bullishness of spot Bitcoin ETFs

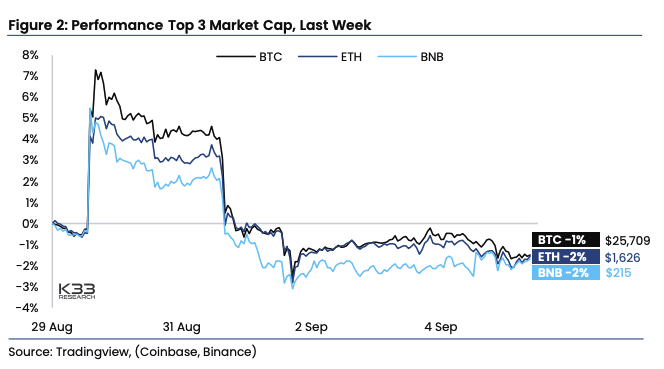

In a Sept. 5 market report, K33 senior analyst Vetle Lunde and vice president Anders Helseth said the last three months had actually significantly improved the chances of a spot Bitcoin ETF approval in spite of the belief not being reflected in the price of Bitcoin or other mainstay crypto possessions. Source: K33 ResearchHowever, the downside of a possible area ETF rejection would be “minimal” and Bitcoin prices would merely keep company as normal, they wrote.Lunde and Helseth included that offered the increased possibility of area ETF approvals– with a number of Bloomberg experts now anticipating a 75% chance of approval within the year– the markets outlook on ETFs is basically incorrect.” Bolstering their bullish prediction, the analysts looked to the current 2% gain in the tech-heavy Nasdaq-100 index, frequently viewed as a sign of the broader markets danger appetite.ETH set to outshine BTCAdditionally, Lunde and Helserth shared their optimism for the price of Ether (ETH), describing that ETH appears most likely to outshine Bitcoin over the next 2 months as it will benefit from strong momentum ahead of a futures-based ETF listing.Related: BTC bull market began in March, more will understand in a year– Arthur HayesThey explained Ether might track a similar path to Bitcoin which got approximately 60% in the weeks leading up to the launch of the very first Bitcoin futures-based ETF on Oct. 19, 2021.

Thank you for reading this post, don't forget to subscribe!

Related Content

- Student interest in ChatGPT skills on Udemy increased by 4,419% since 2022: Report

- Coinbase crypto lobbying campaign to focus on four swing states

- Maybe Bitcoin didn’t bottom? SEC lawsuit against Binance shakes BTC bulls’ confidence

- SEC to seek appeal and stay in Ripple Labs court case

- Ripple to power Georgia’s central bank digital currency, the digital lari