FTX has $222M in Bahamas real estate, 1,300 tokens: shareholder presentation

More than 75 prospective bidders to relaunch FTX and/or FTX United States have been gotten in touch with, according to the discussion. They have till Sept. 24 to place quotes. Verification of the recovery plan is targeted for the second quarter of 2024. There are reports that FTX might liquidate a considerable part of its crypto holdings in the near future. Those privy to the restricted part of the discussion will likewise learn more about its present tax status and get an update on United States Department of Justice restitution and outgoing litigation, amongst other sensitive matters.Magazine: How to secure your crypto in an unpredictable market: Bitcoin OGs and specialists weigh in

The claims are worth $65 billion, although those from FTX Digital Markets are “assumed to be invalid/redundant,” and the United States Internal Revenue Services claim– the largest at $43.5 billion– is presumed to be subordinated.Based on info from August, 36,075 customer claims, worth $16 billion, have been submitted versus FTX and FTX US, and 10% of those have been agreed on. Related: Binances Richard Teng rejects FTX contrasts: We invite the scrutinyThe company has actually generated income from $588 million in avoidance claims so far. Choice Exposure in FTX presentationMethodologyWithdrawals: Valued at present prices (31st Aug) Deposits: Transaction timeOwed to FTX estate15-Day: $11.2 bn (intl) + $2.2 bn (US) 90-Day: $21.4 (intl)+$ 3.6 bn (US) pic.twitter.com/wlsAr8MP6C— Sunil (FTX Creditor Champion) (@sunil_trades) September 11, 2023

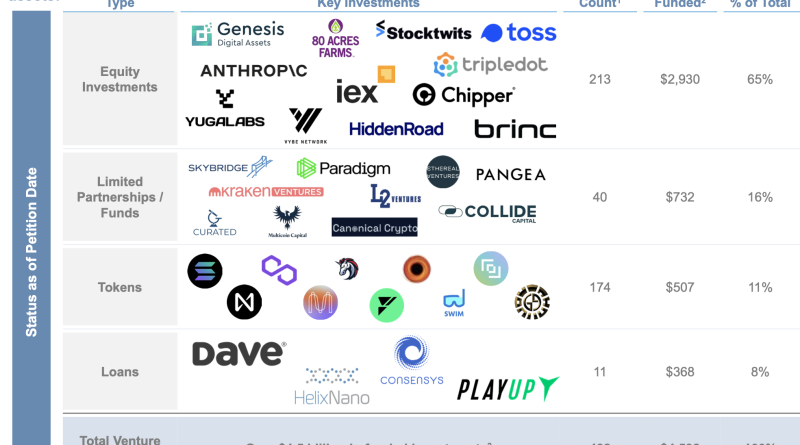

FTX has released the discussion products for its investor meeting happening Sept. 11– 12. The unrestricted portion offers a clear introduction of the businesss existing state and its slow march towards settlement.The investors will begin their day with an account of the claims against the cryptocurrency exchange. Over 2,300 non-customer claims have actually been filed against it, including those from Genesis, Celsius and Voyager. The claims deserve $65 billion, although those from FTX Digital Markets are “presumed to be invalid/redundant,” and the United States Internal Revenue Services claim– the largest at $43.5 billion– is assumed to be subordinated.Based on details from August, 36,075 consumer claims, worth $16 billion, have actually been submitted versus FTX and FTX United States, and 10% of those have been concurred on. FTXs possessions top $7 billion and include digital properties, money, brokerage financial investments, its endeavor portfolio, tokens and genuine estate. The company owns 38 properties in the Bahamas, worth $222 million at book worth. Related: Binances Richard Teng rejects FTX contrasts: We invite the scrutinyThe company has generated income from $588 million in avoidance claims up until now. All that cash has actually come from financial investments made by FTX, and it is looking at another $16.6 billion in determined prospective avoidance claims from financial investments. In addition, it has determined over 50 possible actions against “experts,” including Sam Bankman-Fried, Nishad Singh, Gary Wang, Caroline Ellison and 46 others, for a total of $2.2 billion. FTX venture portfolio summary. Source: FTXFTX might claw back $86.6 million in political and charitable donations and $190.3 million through 884-plus possible actions versus suppliers as well.FTX has determined about $833 million in Bitcoin (BTC) and Ether (ETH), not counting $487 million in BTC- and ETH-denominated securities. In addition, the company has holdings of over 1,300 other tokens. The biggest of those are $362 million in Serum (SRM), $309 million in Maps (MAPS) and $164 million in Oxygen (OXY). Its venture portfolio deserved about $4.5 billion throughout 438 investments at the time of its bankruptcy. Of that sum, $3.8 billion has been recovered. Equity financial investments in 202 companies comprise the bulk of the remaining funded investments, with the largest portion being $1.2 billion in crypto-miner Genesis Digital, followed by $500 million in artificial intelligence firm Anthropic and $110 million in Voyager Digital. Preference Exposure in FTX presentationMethodologyWithdrawals: Valued at present pricing (31st Aug) Deposits: Transaction timeOwed to FTX estate15-Day: $11.2 bn (intl) + $2.2 bn (United States) 90-Day: $21.4 (intl)+$ 3.6 bn (United States) pic.twitter.com/wlsAr8MP6C— Sunil (FTX Creditor Champion) (@sunil_trades) September 11, 2023

More than 75 potential bidders to relaunch FTX and/or FTX United States have actually been contacted, according to the discussion.

Related Content

- Bitcoin traders say ‘get ready’ as BTC price preps 2023 bull market

- SBF ordered to jail, Bitcoin ETF delayed and SEC to appeal Ripple case: Hodler’s Digest, Aug. 6-12

- The Future of Cryptocurrency: Predictions and Possibilities for 2022

- Bitcoin price settles at $26.5K as key Fed inflation week dawns

- Bitcoin has bottomed despite ‘astonishing’ BTC price action — Analyst