Bitcoin price dips below $25K — Opportunity, or sign of incoming disaster?

Bitcoin stands at the edge of a bearish breakdown, with a little possibility that the $25,000 support level might hold.On Sept. 11, Bitcoin (BTC) broke from its parallel range between $25,500 and $26,500, falling to an intraday low at $24,950. A day-to-day close below $24,750 threatens a drop to the sub-$ 20,000 variety, however theres a minor opportunity that the bullish momentum could revive.According to pseudonymous trader Horse, Bitcoin at $25,000 provides a short-term purchasing opportunity, as its the “finest area to trap sellers” and “probably the finest location for long contextual” risk-to-reward ratio.I feel like the possibilities that the market smokes this level after the very first significant test is slim.

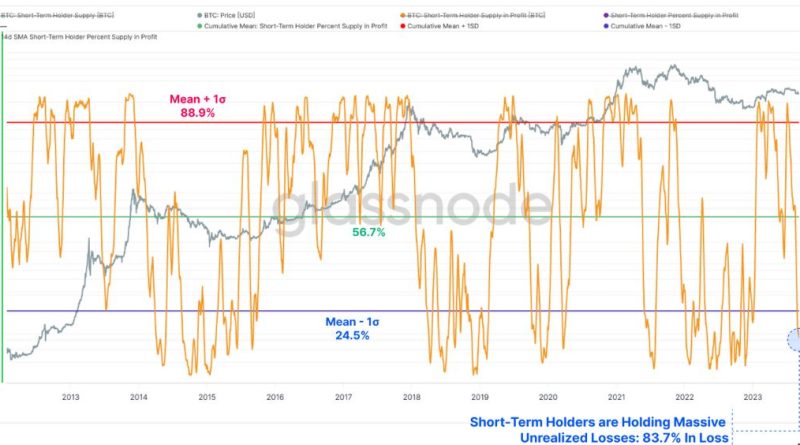

The price action in on-chain indicators and international markets tapping historic lows could provide purchasers hope that a positive pattern could thrive.Is DXY tapping out? Bitcoin tends to preserve a negative connection with the U.S. dollar and a favorable connection with stocks.On Sept. 11, when the S&P 500 and Nasdaq stock market indexes were trading higher, the U.S. Dollar Index (DXY) was falling.The DXY is tapping its long-lasting range high levels around 104.8 points, hinting at the possibility of an unfavorable rate reversal. A bearish dollar could add tailwinds to Bitcoins price.Daily chart of the DXY. Source: TradingViewThe Consumer Price Index (CPI) print in the United States on Sept. 13 will likely provide a decisive instructions to the worldwide markets.Bitcoin traders could secure earnings at $26,000 According to the most current report by on-chain analytics outlet Glassnode, Bitcons rate drop over the last few weeks has actually caused a number of metrics to tap historical lows.The current market conditions are defined by low liquidity and low trading volumes. While this makes complex bulls ability to press the BTC cost through several resistance levels, long-lasting holders might start to build up as bullish hype cools down.According to Glassnode: “Realized Profit and Loss are likewise at levels equivalent to the 2020 market, highlighting what is perhaps a total and total wash-out of the exuberance from the 2021 booming market.”Moreover, Bitcoins unfavorable cost action because mid-August has seen a “vast bulk” of short-term supply plunge “into an unrealized loss,” which might serve as a prospective short-term reversal level.Bitcoins short-term holder supply in earnings. Source: GlassnodeHowever, Glassnode likewise noted that “volatility, liquidity, trade volumes and on-chain settlement volumes are at historic lows,” which has actually pushed the market into “severe apathy, fatigue, and probably monotony.”Related: GBTC discount rate hits smallest considering that 2021 in spite of BTC cost at 3-month lowsThus, a great deal of sellers might show up in case of a bullish turnaround, specifically near the break-even level of short-term buyers around the $26,000 level.Combined, the cost action of the DXY and on-chain information recommend that purchasers could return faster than anticipated, making the present cost action a potentially profitable opportunity to open Bitcoin longs.This post does not consist of financial investment suggestions or suggestions. Every investment and trading relocation includes danger, and readers ought to conduct their own research when making a decision.

Related Content

- BlackRock ETF will be ‘big rubber yes stamp’ for Bitcoin: Interview with Charles Edwards

- SEC’s Gensler taken to task over crypto custody guidance again in House hearing

- How to send and receive payments on the Lightning Network

- The Rise of Cryptocurrency: Everything You Need to Know

- Satoshi-era Bitcoin awakens: 1,005 BTC mined in 2010 on the move