Uptober might be over: Bitcoin price data shows investor sentiment at 3-month low

Bitcoin (BTC) faced a 4.9% correction in the 4 days following the failure to break the $28,000 resistance on Oct. 8, and derivatives metrics reveal fear is controling belief in the market, however will it be enough to shake Bitcoin price from its existing range?Looking at the bigger photo, Bitcoin is holding up very well, especially when compared to gold, which has fallen by 5% since June, and Treasury Inflation-Protected bonds (TIP), which have actually seen a 4.2% drop during the very same duration. Merely preserving its position at $27,700, Bitcoin has actually outshined 2 of the most safe properties in standard finance.Given Bitcoins cost rejection at $28,000 on Oct. 8, financiers must examine BTC derivatives metrics to figure out whether bears are indeed in control.Bitcoin/ USD vs. inflation-protected TIP ETF vs. Gold.$27,600 Bitcoin is not necessarily a bad thingRegardless of how you frame this historic achievement, Bitcoin lovers might not be completely satisfied with its present $520 billion market capitalization, even though it surpasses worldwide payment processor Visas ($493 billion) and Exxon Mobils ($428 billion) market capitalizations. Source: Laevitas.chAs shown above, the Bitcoin choices 25% delta skew changed to “fear” mode on Oct. 10, with protective put (sell) choices presently trading at a 13% premium compared to comparable call (buy) options.Bitcoin derivatives metrics recommend that traders are becoming less positive, which can be partly associated to the several posts ponement of the Bitcoin spot ETF decisions by the U.S. Securities and Exchange Commission, and issues concerning exchanges direct exposure to terrorist organizations.For now, the negative sentiment towards cryptocurrencies appears to invalidate any advantages arising from macroeconomic uncertainty and the natural hedge protection provided by Bitcoins foreseeable monetary policy.

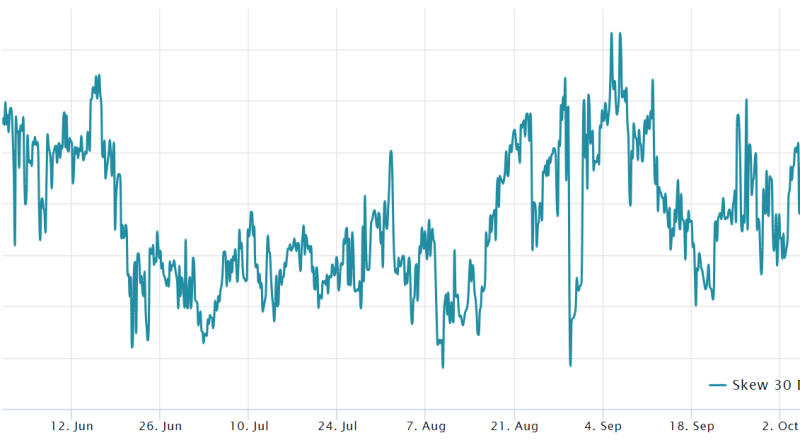

Bitcoin (BTC) dealt with a 4.9% correction in the four days following the failure to break the $28,000 resistance on Oct. 8, and derivatives metrics show worry is controling belief in the market, but will it be enough to shake Bitcoin cost from its existing range?Looking at the bigger picture, Bitcoin is holding up very well, specifically when compared to gold, which has fallen by 5% given that June, and Treasury Inflation-Protected bonds (TIP), which have seen a 4.2% drop during the very same period. Simply maintaining its position at $27,700, Bitcoin has actually exceeded 2 of the most safe and secure possessions in conventional finance.Given Bitcoins rate rejection at $28,000 on Oct. 8, financiers must examine BTC derivatives metrics to figure out whether bears are certainly in control.Bitcoin/ USD vs. inflation-protected TIP ETF vs. Gold. Source: TradingViewTreasury Inflation-Protected Securities are U.S. government bonds created to secure against inflation. The ETFs worth tends to increase with increasing inflation since the bond principal and interest payments change to inflation, preserving the acquiring power for investors.$27,600 Bitcoin is not necessarily a bad thingRegardless of how you frame this historical accomplishment, Bitcoin enthusiasts may not be entirely satisfied with its present $520 billion market capitalization, although it goes beyond international payment processor Visas ($493 billion) and Exxon Mobils ($428 billion) market capitalizations. This bullish expectation is partly based on Bitcoins previous all-time high of $1.3 trillion in November 2021. Its essential to note that the DXY index, which determines the U.S. dollar against a basket of foreign currencies, including the euro, Swiss Franc and British Pound, is nearing its highest level in 10 months. This indicates a strong vote of self-confidence in the durability of the U.S. economy, a minimum of in relative terms. This alone should be sufficient to justify decreased interest in alternative hedge instruments like Bitcoin.Some might argue that the 3% gains in the S&P 500 index since June contradict the idea of financiers seeking cash positions. The top 25 business hold a combined $4.2 trillion in money and equivalents, in addition to being extremely successful. This describes why stocks are likewise being used as a hedge rather than a risk-seeking venture.In essence, there is no reason for Bitcoin investors to be disappointed with its current performance. This belief modifications when we examine BTC derivatives metrics. Bitcoin derivatives reveal decreasing need from bullsTo begin with, Bitcoins future contract premium, also called the basis rate, reached its most affordable level in four months. Generally, Bitcoin regular monthly futures trade at a minor premium compared to find markets, indicating that sellers demand additional cash to postpone settlement. As a result, futures agreements in healthy markets must trade at an annualized premium of 5% to 10%, a circumstance not special to crypto markets.Bitcoin two-month futures annualized premium. Source: Laevitas.chThe existing 3.2% futures premium (basis rate) is at its most affordable point considering that mid-June, before BlackRock declared an area ETF. This metric suggests a lowered cravings for take advantage of purchasers, although it doesnt necessarily reflect bearish expectations.To identify whether the rejection at $28,000 on Oct. 8 has actually resulted in reduced optimism among investors, traders must examine Bitcoin options markets. The 25% delta alter is an informing indication, specifically when arbitrage desks and market makers overcharge for upside or disadvantage protection.Related: Did SBF really use FTX traders Bitcoin to keep BTC rate under $20K? If traders prepare for a drop in Bitcoins rate, the alter metric will rise above 7%, and periods of enjoyment tend to have a negative 7% skew.Bitcoin 30-day alternatives 25% delta alter. Source: Laevitas.chAs revealed above, the Bitcoin options 25% delta alter switched to “fear” mode on Oct. 10, with protective put (sell) choices currently trading at a 13% premium compared to similar call (buy) options.Bitcoin derivatives metrics recommend that traders are becoming less confident, which can be partly credited to the numerous postponements of the Bitcoin spot ETF choices by the U.S. Securities and Exchange Commission, and concerns concerning exchanges exposure to terrorist organizations.For now, the negative sentiment towards cryptocurrencies appears to revoke any advantages developing from macroeconomic uncertainty and the natural hedge security provided by Bitcoins predictable monetary policy. A minimum of from a derivatives perspective, the likelihood of Bitcoins cost breaking above $28,000 in the short-term appears slim.This post is for basic info functions and is not meant to be and must not be taken as legal or financial investment suggestions. The ideas, opinions, and views revealed here are the authors alone and do not always show or represent the views and opinions of Cointelegraph.

Related Content

- A brief history of the internet

- Bitcoin Is Breaking Barriers For Self-Sovereignty Across The Globe

- Lower-middle income countries lead in crypto adoption, but not volume: Chainalysis

- Crypto 101: A Beginner’s Guide to Understanding Cryptocurrency

- Bitcoin price chases after $35K as BTC derivatives data signals fresh inflow