Ethereum LSDFi sector grew nearly 60x since January in post-Shapella surge: CoinGecko

Diva uses token benefits to stakers that secure their ETH and Lido staked ETH (stETH) for divETH. Because the start of October, Divas TVL rose 650% to 15,386 stETH valued at around $24 million, according to Divascan.Magazine: Blockchain investigators– Mt. Gox collapse saw birth of Chainalysis

Thank you for reading this post, don't forget to subscribe!

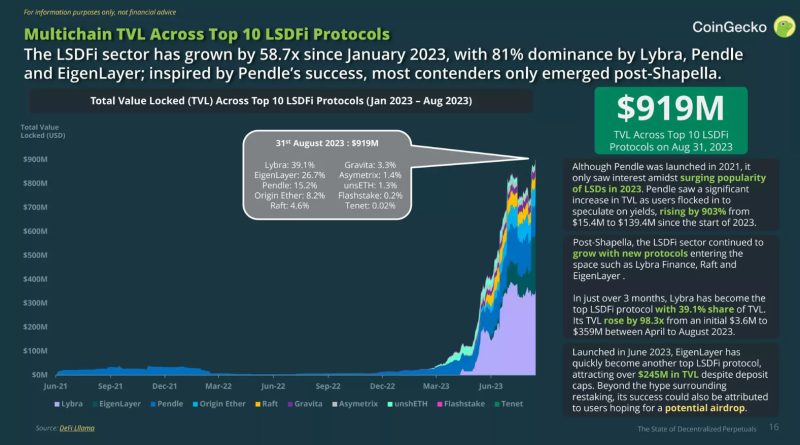

Regardless of ETH withdrawals being made it possible for with the Ethereum Shapella upgrade in April 2023, an Oct. 16 LSDFi report from crypto data aggregator CoinGecko stated the sector grew by 58.7 x because January.By August 2023, LSD procedures accounted for 43.7% of the overall 26.4 million ETH staked, with Lido having the lions share at practically a third of the overall staked market. The LSDFi sector development stats show ETH holders would rather re-stake for much better yield chances than liquidate their assets after withdrawing.CoinGecko noted that because withdrawals were enabled, the exit line remained at absolutely no for more than half of the time (55%) and stayed below 10 validators for 77% of the time.LSDs were introduced to make it possible for smaller sized ETH holders to participate in staking and unlock liquidity after the Ethereum Beacon Chain launch in December 2020. Comparatively, the overall decentralized finance TVL contracted by around 8% over the exact same period, according to DefiLlama.The average yield for LSD procedures considering that January 2022 has actually been 4.4% though this will decline as the quantity of staked ETH increases.

Related Content

- Islamic finance and Web3 take stage at Istanbul Blockchain Week

- IMF, FSB release joint policy recommendations for crypto assets

- Windows tool targeted by hackers deploys crypto mining malware

- Tragedy or rug pull? Inside the collapse of a ‘charitable’ NFT project

- 3 reasons why Ethereum price could struggle at the $1.9K level