Rethinking Bitcoin ‘dominance’ at 51% — A misleading metric?

Bitcoins (BTC) market dominance has typically been seen as a crucial indication of its market strength. USDTs market cap growth is often not a direct outcome of cryptocurrency market activity however rather an increase of what can be described “sidelined” capital– funds that are essentially in dollars and frequently waiting to enter the market faster or later on. Moments when Bitcoins dominance appeared to subside, as seen with the Shapella upgrade impacting ETH costs, were more a sign of Ethereums market motions rather than a reduction in Bitcoins total market “strength.

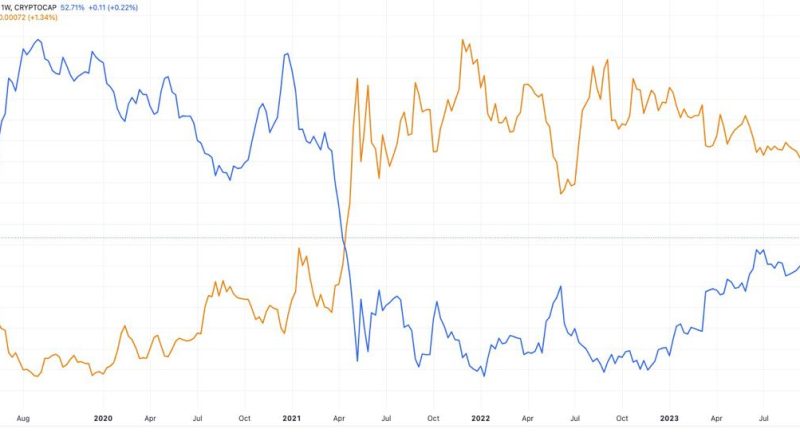

Bitcoins (BTC) market supremacy has traditionally been viewed as an essential indicator of its market strength. Presently, the metric is at a multi-year high above 51%. Bitcoin supremacy. Source: Coinmarketcap.comHowever, a better analysis suggests that the principle of “Bitcoin dominance” might not be as helpful as it seems, specifically when considering the broader dynamics of the cryptocurrency market.Dominance: A deceptive BTC indicator? The term “Bitcoin dominance” describes BTCs share of the overall market capitalization of all cryptocurrencies. While on the surface, it seems to show Bitcoins market strength, this metric largely represents the trading activity in between Bitcoin and Ether (ETH), the second-biggest cryptocurrency and the largest altcoin by market cap. This dynamic can misshape the viewed supremacy of Bitcoin, particularly when major shifts take place within the ETH/BTC trading pair.Related: Ethereum losing streak vs. Bitcoin strikes 15 months– Can ETH price reverse course?That said, ETHs “supremacy” or share of the crypto market has stayed relatively stable for the previous few years around 17%– while the relatively inverted relationship in between BTC.D and ETH/BTC is clearly visible in the chart below. Bitcoin dominance (blue) vs. ETH/BTC (orange). Source: TradingViewThe function of stablecoins and “sidelined” capital Adding complexity to the interpretation of Bitcoins supremacy is the function of stablecoins like Tether (USDT), the second-biggest “altcoin” by market supremacy at around 6.3% today. USDTs market cap growth is often not a direct result of cryptocurrency market activity however rather an increase of what can be described “sidelined” capital– funds that are essentially in dollars and often waiting to enter the market eventually. The increasing market cap of stablecoins like USDT doesnt necessarily reflect a financial investment in cryptocurrencies, but rather the readiness of financiers to engage or hedge their crypto exposure.Meanwhile, the share of whatever else thats not Bitcoin, ETH or USDT is just at around 25% and falling from multi-year highs of 35% in 2022. Bitcoin “strength” or Ethereum market characteristics? Throughout 2023, the story of Bitcoins dominance has actually varied. While it appeared to regain supremacy early in the year, this was more reflective of the ETH/BTC trading characteristics rather than an aggregate market motion. Likewise, minutes when Bitcoins dominance appeared to wane, as seen with the Shapella upgrade impacting ETH rates, were more indicative of Ethereums market motions instead of a reduction in Bitcoins general market “strength.”Ultimately, the supremacy chart might not be the conclusive metric for comprehending Bitcoins position in the market. Swayed greatly by the ETH/BTC trading set, and artificial dollars, uses a narrow view of the marketplace. Its essential to think about a more nuanced technique to market metrics that includes the complex nature of cryptocurrency investments and movements.This article does not include investment recommendations or recommendations. Every investment and trading move includes danger, and readers ought to perform their own research when deciding.