CoinFLEX creditors dissatisfied with restructuring to OPNX: Report

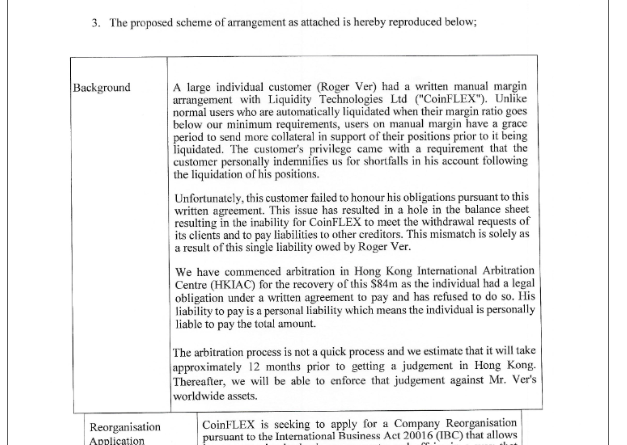

The document claims that the previous CEO diverted clients and business chances to the rival exchange, misappropriated possessions that belonged to the lenders, incorrectly represented that OPNX was associated with CoinFLEX creditors, divulged private trade secrets to third parties, solicited staff members and contractors to move to OPNX, created a phony nondisclosure agreement between himself and a third-party, and engaged in other actions that harmed the creditors.According to a financial institution who spoke with Cointelegraph, CoinFLEXs terms of service needed users to settle disputes through arbitration in Hong Kong, which is why the lenders have actually pursued legal action in Hong Kong rather of Seychelles, the firms place of residence. In contrast to this statement, the Writ of Summons submitted with the Court claims that OPNX is a different exchange that CoinFLEX lenders never authorized.In a conversation with Cointelegraph, a CoinFLEX creditor, who wanted to be recognized as “Kirill,” provided even more details of the claims being made by financial institutions. The restructuring was approved on March 7, according to a CoinFLEX blog post.According to Kirill, once the restructuring was approved, CoinFLEX creditors found that Mark Lamb was acting against the interests of financial institutions in the methods described in the Writ of Summons.Related: Roger Ver rejects CoinFLEX CEOs claims he owes firm $47M USDCAfter discovering these activities, the financial institutions filed the Writ of Summons, which Kirill claims was a required first step to acquiring an injunction versus Mark Lamb to wrest control of the company away from him.

Thank you for reading this post, don't forget to subscribe!

Citing the document, lenders state that Lamb dedicated “time, effort, attention and/or skill” to setting up OPNX while simultaneously being utilized as the CEO of CoinFLEX. The document claims that the previous CEO diverted clients and business opportunities to the rival exchange, misappropriated possessions that belonged to the lenders, wrongly represented that OPNX was associated with CoinFLEX financial institutions, divulged private trade tricks to third parties, solicited workers and contractors to move to OPNX, forged a phony nondisclosure agreement in between himself and a third-party, and engaged in other actions that damaged the creditors.According to a creditor who spoke with Cointelegraph, CoinFLEXs terms of service needed users to settle disputes through arbitration in Hong Kong, which is why the financial institutions have pursued legal action in Hong Kong instead of Seychelles, the firms place of domicile. In contrast to this declaration, the Writ of Summons filed with the Court declares that OPNX is a different exchange that CoinFLEX lenders never ever authorized.In a discussion with Cointelegraph, a CoinFLEX lender, who wanted to be recognized as “Kirill,” supplied even more information of the allegations being made by creditors. The restructuring was approved on March 7, according to a CoinFLEX blog post.According to Kirill, as soon as the restructuring was approved, CoinFLEX financial institutions found that Mark Lamb was acting versus the interests of lenders in the ways explained in the Writ of Summons.Related: Roger Ver rejects CoinFLEX CEOs claims he owes firm $47M USDCAfter discovering these activities, the creditors submitted the Writ of Summons, which Kirill claims was a needed very first action to obtaining an injunction versus Mark Lamb to wrest control of the company away from him. On October 31, the main OPNX account for X (formerly Twitter) posted a “Creditor Tender Offer” to CoinFLEX stakeholders.