Bitcoin user pays $3.1M in transition fee for one 139 BTC transfer

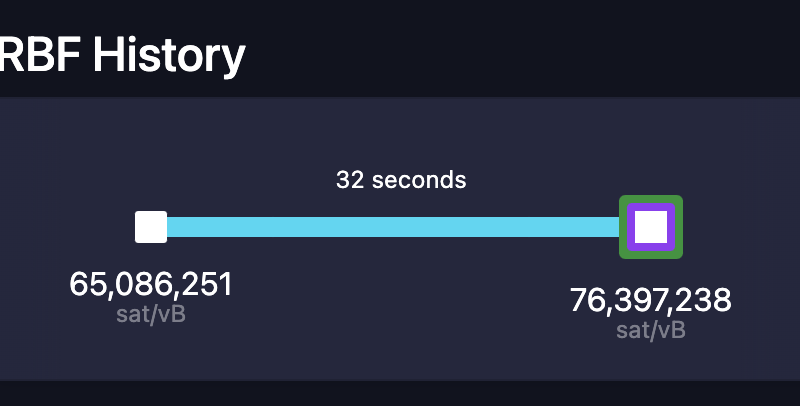

A Bitcoin user paid 83.7 Bitcoin (BTC), worth $3.1 million, in transaction charges for transferring 139.42 BTC. The transaction cost of $3.1 million is the eight-highest in Bitcoins 14-year history.The BTC wallet address bc1qn3d … wekrnl attempted moving 139.42 BTC to bc1qyf … km36t4 on Nov. 23, just to pay over half the actual worth in the deal cost. The destination address received only 55.77 BTC. The mining swimming pool Antpool recorded the absurdly high mining fee on block 818087. Antpool mining reward history. Source: MempoolUsers on social networks recommended that the sender might have selected the high deal fee, but replace-by-fee (RBF), a node policy, and the senders unawareness likewise appear to have played a part. RBF permits an unofficial transaction in the mempool to be replaced with a various deal that pays a higher transaction charge to get it cleared previously. The mempool is where all BTC deals are queued before approval and addition to the Bitcoin blockchain.A mempool developer who goes by the Twitter name of Mononaut said that the user behind the transfer most likely didnt understand RBF orders can not be canceled. The user might have replaced the costs numerous times in hopes of canceling it. The RBF history suggests that the last replacement increased the fee by another 20%, including 12.54824636 BTC in fees.RBF History of the 83.7 BTC deal cost. Source: MempoolThis is not the first time a Bitcoin user unintentionally sent out a ridiculously high transaction charge for a single Bitcoin deal. In September, Bitcoin exchange platform Paxos unintentionally sent out $500,000 in deal charges for $2000 worth of BTC transfer. In that event, the f2pool miner who validated the deal returned the $500,000 accidental transaction charge to Paxos.However, this is the largest Bitcoin deal charge ever paid, in dollar terms, supplanting the September Paxos transfer of $500,000. The largest fee in Bitcoin terms was paid in 2016, when someone unintentionally sent 291 BTC in transaction fees.Related: Binances DOJ settlement provides a glimmer of expect the crypto industryMononaut informed Cointelegraph that although the present instance of accidental shift fee has similarities to the Paxos case, the possibility the funds would be returned by Antpool would depend upon their own payout policies, “which may have ramifications for what commitments they need to share transaction costs with their miners.”Antpool has yet to discuss the concern and hasnt reacted to Cointelegraphs ask for comments.Magazine: Deposit danger: What do crypto exchanges truly finish with your cash?

Related Content

- Research the dynamics of market manipulation before you jump in Bitcoin ETFs

- Bitcoin bulls battle to reclaim $30K amid BTC price RSI ‘reset’

- Bitcoin: The Risks, Rewards, and Realities of Investing in Digital Currencies

- Bitcoin price taps $29.3K as data shows ‘most resilient’ US jobs market

- 7 Surprising Facts About Bitcoin Pizza Day