Ethereum price falls as regulatory worries and pause in DApp use impact investor sentiment

Ether (ETH) is having a hard time to maintain the $2,000 support as of Nov. 27, following its 3rd not successful attempt in 15 days to exceed the $2,100 mark. Source: DappRadarNotably, while many Ethereum DeFi applications saw a substantial drop in activity, contending chains like BNB Chain and Solana experienced an 11% boost and steady activity, respectively.Related: Changpeng Zhao might not leave the US pending court review, states judgeConsequently, Ethereum network procedure fees have decreased for four successive days, amounting to $5.4 million on Nov. 26, compared to a daily average of $10 million in between Nov. 20 and Nov. 23, as reported by DefiLlama. Ethers present cost pullback on Nov. 27 reflects growing issues over regulative obstacles and the potential impact of exploits and sanctions on stablecoins utilized in DeFi applications.

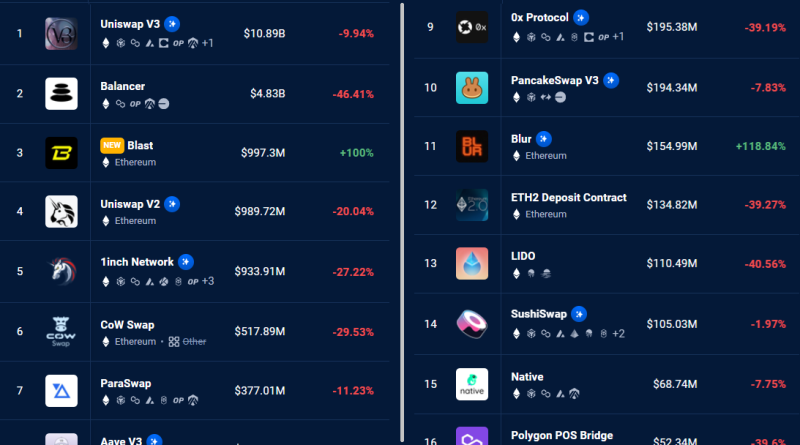

Ether (ETH) is having a hard time to maintain the $2,000 assistance since Nov. 27, following its 3rd not successful effort in 15 days to exceed the $2,100 mark. This slump in Ethers efficiency comes as the broader cryptocurrency market belief deteriorates, hence one requires to examine whether Its possible that current developments, such as the U.S. Department of Justice (DOJ) signaling possible extreme consequences for Binance founder Changpeng “CZ” Zhao, have actually contributed to the negative outlook.In a filing on Nov. 22 to a Seattle federal court, U.S. prosecutors sought a review and reversal of a judges choice permitting CZ to go back to the United Arab Emirates on a $175-million bond. The DOJ argues that Zhao presents an “undesirable danger of flight and nonappearance” if permitted to leave the U.S. pending sentencing.Ethereum DApps and DeFi face brand-new difficulties The recent $46 million KyberSwap exploit on Nov. 23 has actually even more moistened demand for decentralized finance (DeFi) applications on Ethereum. In spite of being previously audited by security specialists, including a couple in 2023, the incident has actually increased concerns about the security of the total DeFi industry. For investors, the attacker expressed willingness to return some of the funds, yet the event underscored the sectors vulnerabilities.Additionally, financier confidence was shaken by a Nov. 21 blog site post from Tether, the company behind the $88.7 billion stablecoin USD Tether (USDT). The post announced the U.S. Secret Services recent combination into its platform and hinted at forthcoming involvement from the Federal Bureau of Investigation. The lack of details in the announcement has actually caused speculation about an increasingly rigid regulatory landscape for cryptocurrencies, specifically with Binance facing heightened examination and Tethers closer cooperation with authorities. These elements are likely contributing to Ethers underperformance, with numerous on-chain and market indicators recommending a decrease in ETH demand.Investors become mindful as ETH on-chain information shows weak point Ether exchange-traded items (ETPs) saw just a $34 million inflow in the last week, according to CoinShares. This figure is a modest 10% of the inflow seen by equivalent Bitcoin (BTC) crypto funds during the exact same period. The competition in between the 2 assets for spot exchange-traded fund (ETF) approval in the U.S. makes this variation particularly noteworthy.Moreover, the current 7-day typical annualized yield of 4.2% on Ethereum staking is less attractive compared to the 5.25% return offered by traditional fixed-income properties. This variation caused a substantial $349 million outflow from Ethereum staking in the previous week, as reported by StakingRewards.High transaction expenses continue to be a challenge, with the seven-day typical deal charge standing at $7.40. This cost has actually negatively affected the demand for decentralized applications (DApps), leading to a 21.8% decrease in DApps volume on the network in the recently, as per DappRadar.Top Ethereum Dapps by volume, USD. Source: DappRadarNotably, while most Ethereum DeFi applications saw a considerable drop in activity, contending chains like BNB Chain and Solana experienced an 11% boost and stable activity, respectively.Related: Changpeng Zhao may not leave the US pending court review, says judgeConsequently, Ethereum network procedure fees have reduced for 4 successive days, amounting to $5.4 million on Nov. 26, compared to a daily average of $10 million in between Nov. 20 and Nov. 23, as reported by DefiLlama. This pattern might potentially produce a negative spiral, driving users towards completing chains looking for much better yields. Ethers existing rate pullback on Nov. 27 reflects growing issues over regulatory challenges and the prospective effect of exploits and sanctions on stablecoins used in DeFi applications. The increasing participation of the DOJ and FBI with Tether elevates the systemic threat for liquidity swimming pools and the whole oracle-based rates mechanism. While theres no immediate cause for panic offering or fears of a drop to $1,800, the uninspired demand from institutional financiers, as indicated by ETP circulations, is definitely not a favorable sign for the market.This article is for general information functions and is not intended to be and need to not be taken as legal or investment recommendations. The views, opinions, and thoughts revealed here are the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Related Content

- The first-world debt crisis means you can expect more pain ahead

- ‘Elegant and ass-backward’: Jameson Lopp’s first impression of Bitcoin

- How to understand and interpret ChatGPT’s output

- NFT collapse and monster egos feature in new Murakami exhibition

- Bitcoin supercycle 2024: Is this the cycle to end them all?