Bitcoin’s ‘Difficult’ Past: Exponential Network Growth Powered By Perfect Competition

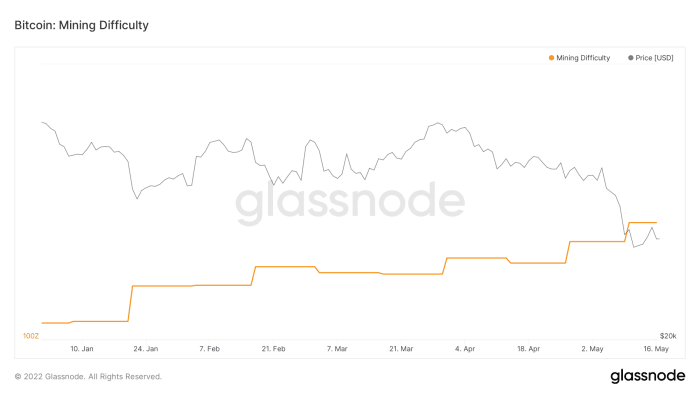

As of the date of this writing, block 737,000, Bitcoin is nearly two-thirds into its 366th difficulty epoch. A difficulty epoch is a period in which 2,016 blocks are included to Bitcoins ledger, ideally in 20,160 minutes, or 14 days. If the epoch ends in less time, the network changes the problem of effectively mining a Bitcoin block upwards to restore a 10-minute block cadence, and vice versa. The whole history of Bitcoins problem is revealed in the graphic listed below (you might need to focus– its quite a substantial graphic). Figure one: Historical Difficulty Changes Since InceptionFigure one: Historical Difficulty Changes Since InceptionIn total, 15 epochs, around 4% of all epochs, experienced no difficulty modification. These so occurred to be the very first 15 epochs where generally simply Satoshi Nakamoto, Hal Finney and a couple of dozen other individuals were mining. Of the remaining 351 epochs, 283 (77.5% of all dates) would see a difficulty increase, with 67 epochs seeing a difficulty reduction. We will explore these periods of decrease later on in this piece.Toward completion of 2009, Nakamoto made a plea to the greedy, opportunistic Bitcoiner neighborhood to not mine with their GPUs. And I price estimate, “We must have a gentlemans contract to delay the GPU arms race as long as we can for the good of the network. Its much easer [sic] to get brand-new users up to speed if they dont have to fret about GPU drivers and compatibility. Its great how anybody with simply a CPU can contend relatively equally right now.” Bitcoiners being the greedy opportunists that they are (this, by the way, is fantastic for Bitcoin, as it drives all development) broke this gentlemans arrangement, and the GPU mining era would commence, and eventually, so too the ASIC mining age, but more on that later.Figure two: Difficulty Vs. Price, Log-Log Scale, 2009. Here we see that Bitcoin does not even have a market rate, and difficulty is stable for the entire year, save for one large jump at the commencement of the GPU mining age at years end.In 2009, the typical problem increase was 0.966%, with a basic deviation of 3.865%. Undoubtedly, considering that bitcoin didnt have a market value in 2009, success computations are moot, but if you didnt include any CPU or GPU power, for the year, if you were making 1 BTC at the start of the year, you would make 14.39% less, or around 0.8561 BTC, by the end. Clearly, this assumes the miner has 100% absolute uptime, and doesnt lose earnings thusly (highly unlikely, but lets be generous!).2010 To 2013: The GPU Mining EraSummary Difficulty Statistics: 2010 to 20132010In 2010, we saw bitcoin get a market rate for the very first time in its history, along with its very first rapid “price rip” upwards. Aside from one problem drop in May (before Bitcoin had a market value), we saw 32 difficulty increases with an average of 22.85%, and a basic deviation of 15.54%. If you were making 1 BTC per hashing unit on January 1 of that year, and didnt invest any more cash on additional GPUs, by December 31 you were earning 99.98% less, or about 19,178 sats instead of a whole coin. Rough.Figure 3: Difficulty Vs. Price, Log-Log Scale, 201020112011 wasnt better for the miners than 2010, where if you were earning 1 BTC per hashing unit at the start of the year without contributing to your GPU fleet, you would be making 97.81% less, or about 2.19 million sats– technically over 100 times much better off than you remained in 2010, a minimum of! 2011 saw bitcoins first mega-pump, with price increasing about 100 times from $0.30 to $30 in the very first 6 months of the year, before taking a 93.3% bath back down to $2 by November. One difficulty drop was experienced during the 50% cost drop between February and April, with the other eight drops for the year taking place during “bath time.” There were 21 increases throughout the year. The average difficulty modification was 11.96%, with a standard deviation of 16.96%. Figure 4: Difficulty Vs. Price, Log-Log Scale, 201120122012 was a fascinating year, as it was the first time that the market would ever experience going through a block benefit halving. While you could fetch around $7 for a bitcoin in early January, a Valentines Day massacre almost cut in half the cost, and price was consistently down 30% to 35% from the January high up until the middle of the year. This led to five difficulty drops in that six-month duration. A doubling in price from June to August saw healthy problem increases once again, without any drops in problem to be seen till “The Halving” in late November, which saw two successive difficulty drops to end the year.There were 20 boosts throughout the year, and seven drops, with the typical difficulty adjustment being a boost of 3.26%, with a basic deviation of plus 6.04%. If you had not invested in any new hardware for the year, you would be earning 59.11% less on December 31. Excusable compared to previous years.Figure 5: Difficulty Vs. Price, Log-Log Scale, 20122013Aside from a 9.46% drop in trouble in late January, 2013 would be an “up only” year thanks to 2 mega-pumps, the very first a near-20-timeser, going from $13.22 at the start of the year to $229.47 on April 9, and a 17-bagger from early July until early December. Along with the solitary problem drop to begin the year, there were 30 favorable changes, balancing 17.16% with a basic variance of plus 8.34%. Similar to 2010, your 1 BTC of revenues on January 1 minimized to 292,156 sats if you didnt add any GPUs to your farm, a 99.71% drop. Nevertheless, as of the end of 2013, no one would be adding any GPUs to their farms (aside from shitcoin miners of course!), as the age of the ASIC was now upon us.Figure six: Difficulty Vs. Price, Log-Log Scale, 20132014 To 2020: The ASIC Mining EraSummary Difficulty Statistics: 2014 to 20192014Despite the collapse of Mt. Gox starting the longest bearishness in the history of Bitcoin, with the high watermark of $1,134.39 not to be passed again for the final time till April 2017– a complete 1,218 days later (trust me, as a November 2013 first-time purchaser, I lived it and was counting the days!). 2014 was yet another apparently “up only” year for trouble, with 28 increases, and two little declines of 0.73% and 1.39% to round out the year. The average difficulty modification was plus 10.9% with a standard discrepancy of plus 6.57%. If you didnt include any ASICs to your farm in 2014, your 1 BTC of earning power was slashed by 96.86% to 3.14 million sats.Figure 7: Difficulty Vs. Price, Log-Log Scale, 20142015Even with Mt. Gox being dead for nearly 2 years, the “Goxxings” simply appeared to keep coming, with cost bouncing in between $300 and $150 for the majority of the year, with all 5 of the problem drops taking place in 2015 accompanying sharp 30% to 50% drops in rate over a brief time duration. ASIC producers were still feeling out the space and perfecting their art, as displayed in the graphic listed below from the Cambridge University SHA256 technology tracker. This suggested that the typical problem modification for 2015 was only plus 3.31% with a standard deviation of plus 4.62%. Still, if you didnt include any rigs to your farm, your 1 BTC of earnings on January 1 was cut by almost 60% to 0.403 BTC.Figure 8:. Source: Cambridge University SHA-256 State of Technology TrackerFigure 9: Difficulty Vs. Price, Log-Log Scale, 201520162016 was one of the most unique years in mining history, as it saw a halving along with the release of the AK-47 of mining rigs, the Antminer S9, which would delight in successful service for 6 years up till the extremely recent significant rate drop saw in May 2022. Price development for the year was slow, save for the last couple of months which saw considerable development, and the goxxings would still continue during 2016 regardless of the exchange collapsing more than 2 years prior. All of this would lead to 22 difficulty increases, and five drops, three of which happened prior to the halving.The typical modification was plus 3.93% with standard discrepancy of plus 4.93%, leading to a decrease of BTC earnings of 47.36% for the year.Figure 10: Difficulty Vs. Price, Log-Log Scale, 201620172017 saw two major events, a 20-times run up in rate throughout the year, and the resolution of “the blocksize war” towards the very end of the year. I certainly can not do justice to the blocksize war in one paragraph, so I will price estimate the blurb of Jonathan Biers seminal March 2021 book “The Blocksize War: The Battle Over Who Controls Bitcoins Protocol Rules”:” [The Blocksize War] was about the quantity of data enabled in each Bitcoin block, however it exposed much deeper concerns, such as who manages Bitcoins procedure rules.” The supreme resolution was the production of a new fork of Bitcoin, understood as Bitcoin Cash (BCH), which might also be mined using the SHA-256 protocol. Substantial increases in the price of BCH towards the end of the year were enough to coax miners far from mining the Bitcoin network and mine on the BCH network on three occasions after its launch in August, with a small drop in July taking the tally to four down changes for the year. There were still 23 boosts for the year however, and with a typical modification of plus 6.16% with standard variance of plus 6.15%, these changes resulted in a reduction of income of 82.06% for the year. More mining rig makers would get in the game this year, but no significant enhancements in rig efficiency were achieved.Figure 11: Difficulty Vs. Price, Log-Log Scale, 201720182018 saw far more competition in the ASIC hardware space, with rig performance nearly doubling. Rigs were becoming so effective, having an 80% drawdown in rate for many years did little to stop hash rate growth. There was an average change of plus 3.59% with basic discrepancy of plus 7.31%, across 23 difficulty boosts, a drop in July when bitcoins price was at about $6,000, and four drops which took place throughout the final price capitulation from about $6,000 to about $3,000 late in the year. The end result was a reduction of earnings of 64.09% for the year compared to your start-of-year earnings.Figure 12: Difficulty Vs. Price, Log-Log Scale, 20182019After the ruthless bear market of 2018, traders saw a relief rally that took the cost from $4,000 at the start of the year to about $13,000 mid-year. Aside from 5 small negative difficulty adjustments of less than 1% in the first half of the year, and 2 drops in the second half of the year when bitcoin would return to a price of $6,000, there were 19 boosts. The average change of plus 3.06% with a standard variance of plus 4.49% led to a reduction of income of 55.42% for the year.This was primarily driven by a lot more competition and effectiveness gains in the ASIC hardware market instead of chasing after price-cost arbitrage, with the 2019 fleet of brand-new rigs being more than twice as effective as their 2017 peers. 2019 was also the very first year we saw modular mining techniques at large scale, where miners would essentially turn shipping containers into portable ASIC farms, and just deliver them to the worlds most inexpensive power sources. The big drop in trouble in late October was more likely from Chinese miners physically migrating to cheaper hydroelectric power sources due to the wet season, than a miner capitulation over a small drop in rate. This would become even more apparent in the migrations of 2020. Figure 13: Difficulty Vs. Price, Log-Log Scale, 2019Summary Difficulty Statistics: January 1, 2020 to May 10, 20222020The most problem drops in Bitcoin history would occur in 2020, with 11 drops, a few of previously-unseen magnitudes, occurring throughout the year, for various factors. Despite the “COVID-19 everything crash of March 2020,” the substantial hash rate drops experienced in April and late October would mostly be the result of Chinese miners physically moving from Xinjiang province (which is coal heavy) to Sichuan province (which is hydro heavy) throughout the damp season, and after that back at the conclusion of the wet season. The earnings available was so terrific as an outcome of more affordable power that it was worth it for miners to merely evacuate, move and establish themselves elsewhere, in spite of the associated threat and downtime. Obviously, the halving of May 2020 would result in two successive drops of 6.39% and 10.24%. Mining strategies and rigs would continue to improve, with firmware provider like Braiins.OS supplying miners with software that drastically increased the performance of their rigs and was easy enough to use by mining enthusiasts. Immersion-cooled mining would also start being used by various operations as a method to more boost effectiveness and lower downtime and maintenance costs.The typical modification of plus 1.06% with standard discrepancy of plus 7.74% resulted in a decrease of bitcoin-denominated earnings by 24.91% for the year. Thinking about that the price of bitcoin would grow by four times in 2020 however, this would begin a time period where home and collocated mining started to look more attractive to a far larger user base due to the apparently alluring cost-price arbitrage on offer in a flourishing market, apparently safeguarded from competitors, at least briefly, due to the COVID-induced worldwide supply chain concerns affecting the market.Figure 14: Difficulty Vs. Price, Log-Log Scale, 20202021 To Current: China Bans Bitcoin And The (Near) Instant Recovery20212021 was the year mining “struck the streets,” with colocation business expanding despite long preparations for shipment, hardware costs were skyrocketing (in near lockstep with the price). Mining companies were still moving for the most affordable power. They were going public at a rate of knots, and business treasuries were collateralizing their bitcoin in fascinating methods. Simply some of the mania you would anticipate to see during a meteoric bull run. To top it all off, there was a huge blackout in China which triggered a near 15% unfavorable trouble modification, then, just a month later China absolutely banned Bitcoin mining, causing 4 consecutive negative trouble changes of 19%, 5.6%, 38.8% and 5%. This implied that anyone who was currently mining saw a huge short-term bump in revenues, and would be forgiven for believing, “Whoever isnt thinking about entering mining right now would be foolish!”But if youve stuck with me up until this point, you know how this story ends. Great times are brief, and are always followed by cripplingly difficult times for miners. These times would come quickly. Those stating the Chinese hash rate would not return for years or months were selling the most choices and shovels, but return it did, mainly within three months, and all of it by the end of the year.There were 19 increases, and seven drops– five of which were associated with China, the other two little and within tolerance. The intriguing fact to take a look at is the standard variance, and while difficulty averaged a change of plus 0.5%, its standard discrepancy was 10.9%. So, if you were in the game at the start of the year, you carried out stellarly, and just had your earnings reduced by 12.33% for the year. Nevertheless, if you were one of the unfortunate ones who started in late July 2021 (or later on), you had 12 changes for the rest of the year (11 of which were favorable), and approximately plus 4.61%, meaning you d lost about 77% of your income by the end of the year, with the bitcoin price going south, rapidly. Once again, if you were currently developed, 2021 was a fantastic year. For everyone else, buying bitcoin would have been the wiser choice. Figure 15: Difficulty vs. Price, Log-Log Scale, 20212022We are 10 problem changes into 2022– seven increases and three drops. Regardless of a 20% crash in price given that the last difficulty change, it is anticipated that the upcoming difficulty modification will be a drop of around 1%. Of the 10 changes up until now, the average modification was plus 2.44% with a basic deviation of plus 3.39%, resulting in a decrease of earnings of 21.89% year to date, but I forecast it will be a reduction of 50% by year end. House miners beware!Most remarkably, 2022 saw Intel get in the mining game, forming a large collaboration with green miner GRIID, and word that even oil-and-gas giants Exxon Mobil and Conoco Philips had begun flare mining utilizing mobile, containerized mining services. Even with bitcoins rate remaining in the doldrums, competitors has actually been getting stiffer and stiffer.2022 has actually seen more COVID-19 supply chain concerns clearing, more development in mining firmware and strategies and, with what seems yet another drawn-out bearishness for cost, will see an eliminating of low-margin or over-leveraged miners, as we have actually witnessed in previous bear markets.Figure 16: Difficulty Vs. Price, Log-Log Scale, 2022 to DateConclusion: Bitcoin Mining Is Perfectly CompetitiveThe nature of competition in Bitcoin mining is near ideal which indicates miners will work incredibly hard to have the most effective operation, and indeed, the most effective supply chain. It also indicates that they are ready and able to physically go anywhere is needed to accomplish this. Mining is hard, and for a home miner, is similar to panning for gold in 2022– it sounds much more rewarding and glamorous than it in fact is! There are much better methods to stimulate your interest about mining than investing cash trying it out yourself (read: going short spot-Bitcoin in hopes youll make more by mining versus going long spot-BTC)– however you will never ever hear this from the people selling shovels and choices! Bitcoin mining has actually had the ability to soak up the majority of my time and intellectual capacity for eight years, yet I have never even switched on a miner in my life. When it concerns mining, its finest to leave the bread to the baker, as they are most efficient in determining, assuming and handling the risks. The history speaks for itself: When it comes to hash rate and trouble, “number increase” harder, quicker and more consistently than cost, and while this is excellent for Bitcoin, it is terrible for those aiming to compete in what is a perfectly competitive space.This is a guest post by Hass McCook. Viewpoints revealed are totally their own and do not always reflect those of BTC Inc or Bitcoin Magazine.

If you didnt include any ASICs to your farm in 2014, your 1 BTC of earning power was slashed by 96.86% to 3.14 million sats.Figure 7: Difficulty Vs. Price, Log-Log Scale, 20142015Even with Mt. Gox being dead for nearly 2 years, the “Goxxings” just seemed to keep coming, with cost bouncing in between $300 and $150 for many of the year, with all five of the difficulty drops taking place in 2015 coinciding with sharp 30% to 50% drops in cost over a short time duration. All of this would result in 22 difficulty boosts, and 5 drops, 3 of which took place prior to the halving.The average change was plus 3.93% with standard discrepancy of plus 4.93%, resulting in a reduction of BTC income of 47.36% for the year.Figure 10: Difficulty Vs. Price, Log-Log Scale, 201620172017 saw 2 major events, a 20-times run up in rate throughout the year, and the resolution of “the blocksize war” toward the very end of the year. Immersion-cooled mining would also begin being utilized by various operations as a method to additional increase efficiency and lower downtime and maintenance costs.The typical modification of plus 1.06% with basic discrepancy of plus 7.74% resulted in a decrease of bitcoin-denominated income by 24.91% for the year. To top it all off, there was a substantial blackout in China which triggered a near 15% unfavorable trouble modification, then, only a month later China completely banned Bitcoin mining, triggering four successive negative problem changes of 19%, 5.6%, 38.8% and 5%. Of the 10 modifications so far, the typical modification was plus 2.44% with a standard variance of plus 3.39%, resulting in a decrease of income of 21.89% year to date, however I predict it will be a reduction of 50% by year end.

Related Content

- 3 reasons why Bitcoin’s price is primed to hold the $30,000 level as support

- Decoding Cryptocurrency: A Beginner’s Guide to Digital Currency

- 6 Questions for Adelle Nazarian on crypto, journalism and the future of Bitcoin

- Crypto 101: A Beginner’s Guide to Understanding Cryptocurrency

- The Risks and Rewards of Investing in Cryptocurrency: A Comprehensive Guide for Beginners