Bitcoin, The Purchasing Power Preserver

Part 2 and Part 3 work to demonstrate how Bitcoin may serve as a solution.Unprecedented debt levels that exist in todays financial system spell one thing in the long run: currency debasement. Bitcoin stands alone as the first-ever manifestation of withstanding digital deficiency and financial immutability– a protocol implementing a dependable supply schedule by method of a decentralized mint, powered by utilizing genuine world energy through Bitcoin mining and validated by a globally-distributed, radically-decentralized network of nodes. Bitcoin is probably the soundest monetary technology ever found and its development aligns with the end of a long-lasting debt cycle when tough assets will plausibly be in greatest need.(Photo/Regia Marinho)The following excerpt from Vijay Boyapatis well known “Bullish Case for Bitcoin” essay5 explains this well, particularly in relation to monetary technologies:”When the acquiring power of a financial excellent boosts with increasing adoption, market expectations of what makes up “cheap” and “pricey” shift appropriately. My base case is that bitcoin will continue to do something comparable to this in relation to the worlds contemporary basket of fiat currencies.Ultimately, the proposition of bitcoin bulls is that the addressable market of this asset is mind numbing.

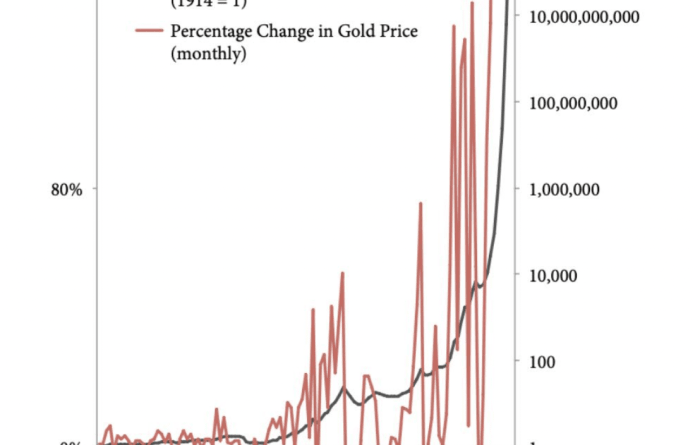

This is an opinion editorial by Dan, cohost of the Blue Collar Bitcoin Podcast.Series ContentsPart 1: Fiat Plumbing IntroductionBusted PipesThe Reserve Currency ComplicationThe Cantillon ConundrumPart 2: The Purchasing Power PreserverPart 3: Monetary DecomplexificationThe Financial SimplifierThe Debt DisincentivizerA “Crypto” CautionConclusionA Preliminary Note To The Reader: This was originally composed as one essay that has since been divided into three parts. Each area covers unique ideas, but the overarching thesis relies on the 3 areas in totality. Part 1 worked to highlight why the current fiat system produces economic imbalance. Part 2 and Part 3 work to demonstrate how Bitcoin may serve as a solution.Unprecedented financial obligation levels that exist in todays financial system spell something in the long run: currency debasement. The word “inflation” is tossed around frequently and flippantly these days. Few value its real meaning, real ramifications or real causes. For numerous, inflation is absolutely nothing more than a rate at the gas pump or supermarket that they grumble about over red wine and cocktails. “Its Bidens, Obamas or Putins fault!” When we zoom out and believe long term, inflation is a huge– and I argue unsolvable– fiat mathematics issue that gets tougher and harder to reconcile as decades progress. In todays economy, efficiency lags financial obligation to such a degree that any and all approaches of restitution need battle. A crucial metric for tracking financial obligation progression is financial obligation divided by gross domestic product (debt/GDP). Digest the chart below which specifically reflects both overall debt and public federal debt as associates with GDP.(Chart/Lyn Alden)If we concentrate on federal financial obligation (blue line), we see that in just 50 years weve gone from sub-40% debt/GDP to 135% throughout the COVID-19 pandemic– the highest levels of the last century. Its also worth keeping in mind that the existing situation is significantly more remarkable than even this chart and these numbers suggest because this does not reflect gigantic unfunded entitlement liabilities (i.e. Social Security, Medicare and Medicaid) that are expected in perpetuity.What does this excessive financial obligation imply? To understand it, lets boil down these realities down to the individual. Suppose someone racks up outrageous liabilities: two home loans well outside their price variety, 3 automobiles they cant afford and a boat they never utilize. Even if their earnings is sizable, eventually their financial obligation load reaches a level they can not sustain. Maybe they procrastinate by tallying up charge card or getting a loan with a local cooperative credit union to merely service the minimum payments on their existing financial obligation. If these routines continue, the camels back undoubtedly breaks– they foreclose on the homes; SeaRay sends someone to take back the boat out of their driveway; their Tesla gets repossessed; they go insolvent. No matter how much she or he felt like they “required” or “deserved” all those items, the mathematics finally bit them in the ass. If you were to create a chart to encapsulate this persons dilemma, you would see two lines diverging in opposite instructions. The space between the line representing their debt and the line representing their earnings (or performance) would expand till they reached insolvency. The chart would look something like this:(Chart/St. Louis Fed)And yes, this chart is genuine. Its a distillation of the United States total debt (in red) over gross domestic item, or productivity (in blue). I first saw this chart posted on Twitter by widely known sound cash advocate and tech investor Lawrence Lepard. He consisted of the following text above it.”Blue line produces earnings to pay interest on red line. See the problem? Its just mathematics.” The mathematics is catching up to sovereign nation states too, however the method the chickens come house to roost looks rather various for central governments than for the person in the paragraph above, especially in countries with reserve currency status. You see, when a government has its paws on both the supply of cash and the price of cash (i.e. rates of interest) as they perform in todays fiat monetary system, they can attempt to default in a much softer fashion. This sort of soft default always causes development in money supply, due to the fact that when central banks have access to recently produced reserves (a cash printer, if you will) its extremely unlikely financial obligation service payments will be missed or disregarded. Rather, debt will be monetized, indicating the government will obtain recently fabricated money1 from the reserve bank instead of raising genuine capital through increasing taxes or offering bonds to genuine purchasers in the economy (actual domestic or international investors). In this way, money is synthetically produced to service liabilities. Lyn Alden puts financial obligation levels and debt money making in context:”When a nation starts getting to about 100% debt-to-GDP, the situation ends up being almost unrecoverable … a study by Hirschman Capital noted that out of 51 cases of federal government debt breaking above 130% of GDP because 1800, 50 governments have actually defaulted. The only exception, so far, is Japan, which is the largest creditor country worldwide. By “defaulted,” Hirschman Capital consisted of nominal default and significant inflations where the bondholders stopped working to be repaid by a broad margin on an inflation-adjusted basis … Theres no example I can discover of a large country with more than 100% federal government debt-to-GDP where the main bank does not own a significant chunk of that debt.”2The excessive financial power of fiat reserve banks and treasuries is a large factor to the extreme take advantage of (debt) accumulation in the first location. Central control over money makes it possible for policymakers to postpone economic discomfort in an apparently perpetual manner, repeatedly relieving short-term problems. However even if intents are pure, this game can not last permanently. History demonstrates that excellent intentions are inadequate; if rewards are improperly lined up, instability waits for. Lamentably, the threat of hazardous currency debasement and inflation significantly increases as financial obligation levels end up being more unsustainable. In the 2020s, we are starting to feel the damaging results of this shortsighted fiat experiment. Those who apply monetary power do certainly have the capability to palliate pressing financial pain, but in the long run its my contention that this will amplify total economic destruction, especially for the less privileged in society. As more monetary systems go into the system to relieve pain, existing units lose buying power relative to what would have transpired without such money insertion. Pressure ultimately develops in the system to such a level that it must get away somewhere– that escape valve is the debasing currency. Career-long bond trader Greg Foss puts it like this:”In a debt/GDP spiral, the fiat currency is the mistake term. That is pure mathematics. It is a spiral to which there is no mathematical escape.”3This inflationary landscape is especially problematic to members of the middle and lower classes for numerous crucial reasons. Initially, as we spoke about above, this group tends to hold less assets, both in total and as a percentage of their net worth. As the currency melts, assets like stocks and genuine estate tend to increase (at least somewhat) along with cash supply. Alternatively, development in earnings and incomes is likely to underperform inflation and those with less complimentary cash quickly start treading water. (This was covered at length in Part 1.) Second, middle and lower class members are, by and large, demonstrably less nimble and financially literate. In inflationary environments knowledge and gain access to are power, and it typically takes navigating to keep purchasing power. Members of the upper class are even more most likely to have the tax and financial investment knowledge, as well as egress into option financial instruments, to leap on the life raft as the ship decreases. Third, many typical wage earners are more reliant on specified benefit plans, social security or traditional retirement techniques. These tools stand directly in the scope of the inflationary firing squad. During periods of debasement, properties with payouts specifically denominated in the inflating fiat currency are most susceptible. The financial future of numerous typical folks is heavily reliant on among the following: Nothing. They are not conserving nor investing and are therefore maximally exposed to currency debasement.Social security, which is the worlds biggest ponzi scheme and very well might not exist for more than a decade or 2. It will be paid out in debasing fiat currency.Other specified benefit strategies such as pensions or annuities if it does hold up. When again, the payouts of these properties are defined in fiat terms. Furthermore, they often have big amounts of fixed income direct exposure (bonds) with yields denominated in fiat currency.Retirement portfolios or brokerage accounts with a threat profile that has worked for the last forty years but is unlikely to work for the next forty. These fund allocations frequently consist of intensifying direct exposure to bonds for “security” as investors age (risk parity). This effort at risk mitigation makes these folks significantly reliant on dollar-denominated fixed earnings securities and, for that reason, debasement risk. The majority of these individuals will not be active sufficient to pivot in time to maintain purchasing power.The lesson here is that the daily employee and investor remains in desperate need of a useful and available tool that leaves out the error term in the fiat financial obligation formula. I am here to argue that nothing serves this purpose more marvelously than bitcoin. Although much remains unidentified about this procedures pseudonymous creator, Satoshi Nakamoto, his inspiration for unleashing this tool was no secret. In the genesis block, the first Bitcoin block ever mined on January 3, 2009, Satoshi highlighted his ridicule for central monetary manipulation and control by embedding a recent London Times cover story: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”The inspirations behind Bitcoins development were definitely multifaceted, but it appears apparent that one of, if not the, primary issue Satoshi set out to fix was that of unchangeable monetary policy. As I write this today, some thirteen years given that the release of this very first block, this goal has been unceasingly achieved. Bitcoin stands alone as the first-ever manifestation of enduring digital scarcity and financial immutability– a protocol implementing a reputable supply schedule by method of a decentralized mint, powered by harnessing genuine world energy by means of Bitcoin mining and verified by a globally-distributed, radically-decentralized network of nodes. Approximately 19 million BTC exist today and no greater than 21 million will ever exist. Bitcoin is conclusive monetary reliability– the antithesis of, and option to debasing fiat currency. Absolutely nothing like it has ever existed and I believe its emergence is timely for much of humanity. Bitcoin is a profound gift to the worlds financially marginalized. With a little amount of knowledge and a smartphone, members of the middle and lower class, as well as those in the developing world and the billions who remain unbanked, now have a trustworthy placeholder for their hard earned capital. Greg Foss typically describes bitcoin as “portfolio insurance coverage,” or as Ill call it here, effort insurance coverage. Purchasing bitcoin is a working guys exit from a fiat monetary network that ensures deficiency of his capital into one that mathematically and cryptographically ensures his supply stake. Its the hardest money mankind has actually ever seen, competing with a few of the softest cash in human history. I motivate readers to heed the words of Saifedean Ammous from his critical book “The Bitcoin Standard:””History reveals it is not possible to insulate yourself from the repercussions of others holding cash that is harder than yours.”On a zoomed out timeframe, Bitcoin is constructed to protect purchasing power. Those who choose to take part earlier in its adoption curve serve to the benefit the many. Few comprehend the implications of what takes place when tremendously growing network effects satisfy a monetary protocol with absolute supply inelasticity (hint: it may continue to look something like the chart listed below).(Chart/LookIntoBitcoin. com)Bitcoin has the makings of an innovation whose time has come. The evident impenetrability of its financial architecture contrasted with todays economic plumbing in incredible disrepair shows that incentives are aligned for the fuse to meet the dynamite. When hard possessions will plausibly be in highest need, Bitcoin is perhaps the soundest financial technology ever discovered and its introduction lines up with the end of a long-lasting financial obligation cycle. Its poised to catch much of the air getting away the balloons of a variety of extremely monetized4 asset classes, including low- to negative-yielding financial obligation, genuine estate, gold, art and collectibles, offshore banking and equity.(Chart/@Croesus_BTC) Its here where I can sympathize with the eye rolls or chuckles from the portion of the readership who point out that, in our present environment (July 2022), the cost of Bitcoin has actually plunged in the middle of high CPI prints (high inflation). However I recommend we be mindful and zoom out. Todays capitulation was pure euphoria a little over 2 years ago. Bitcoin has been declared “dead” over and over again through the years, just for this possum to reappear larger and much healthier. In relatively short order, a similar BTC cost point can represent both extreme greed and consequently extreme fear on its roadway to intensifying worth capture.(Tweet/@DocumentingBTC)History reveals us that innovations with strong network results and profound utility– a category I think Bitcoin fits in– have a way of gaining huge adoption right beneath mankinds nose without many fully recognizing it.(Photo/Regia Marinho)The following excerpt from Vijay Boyapatis well known “Bullish Case for Bitcoin” essay5 describes this well, especially in relation to financial innovations:”When the buying power of a monetary good boosts with increasing adoption, market expectations of what constitutes “cheap” and “costly” shift accordingly. Similarly, when the cost of a financial good crashes, expectations can change to a general belief that prior prices were “unreasonable” or overly pumped up … The reality is that the concepts of “low-cost” and “pricey” are essentially useless in recommendation to monetary goods. The cost of a monetary good is not a reflection of its capital or how helpful it is however, rather, is a measure of how extensively embraced it has actually become for the numerous functions of money.”If Bitcoin does one day accumulate massive worth the method Ive recommended it might, its upward trajectory will be anything however smooth. Very first think about that the economy as a whole is likely to be progressively unstable moving forward– systemically delicate markets underpinned by credit have a propensity to be volatile to the drawback in the long run versus tough assets. Assures developed on pledges can quickly fall like dominoes, and in the last couple of decades weve experienced progressively regular and substantial deflationary episodes (typically followed by spectacular recoveries helped by financial and financial intervention). Amidst a total backdrop of inflation, there will be fits of dollar conditioning– we are experiencing one presently. Now include in the fact that, at this phase, bitcoin is nascent; its improperly comprehended; its supply is completely unresponsive (inelastic); and, in the minds of a lot of huge monetary players, its speculative and optional. As I compose this, Bitcoin is almost 70% down from an all-time high of $69,000, and in all possibility, it will be extremely volatile for some time. However, the crucial distinction is that BTC has been, and in my view will continue to be, volatile to the benefit in relation to soft possessions (those with a subjective and broadening supply schedules; i.e. fiat). When talking about forms of money, the words “sound” and “steady” are far from synonymous. I cant consider a better example of this vibrant at work than gold versus the German papiermark throughout the devaluation in the Weimar Republic. Soak in the chart listed below to see how tremendously unpredictable gold was during this duration.(Chart/Daniel Oliver Jr.)Dylan LeClair has said the following in relation to the chart above:”Youll typically see charts from Weimar Germany of gold priced in the paper mark going parabolic. What that chart doesnt reveal is the sharp drawdowns & & volatility that occurred throughout the hyper-inflationary period. Speculating utilizing utilize got erased multiple times.”Despite the papiermark pumping up completely away in relation to gold over the long run, there were durations where the mark substantially surpassed gold. My base case is that bitcoin will continue to do something akin to this in relation to the worlds contemporary basket of fiat currencies.Ultimately, the proposition of bitcoin bulls is that the addressable market of this possession is mind numbing. Staking a claim on even a small portion of this network might enable members of the middle and lower classes to power on the sump pump and keep the basement dry. My plan is to accumulate BTC, secure the hatches and hang on tight with low time choice. Ill close this part with the words of Dr. Jeff Ross, former interventional radiologist turned hedge fund supervisor:”Checking and cost savings accounts are where your money goes to die; bonds are return-free threat. We have a chance now to exchange our dollar for the best sound cash, the best cost savings technology, that has actually ever existed.”6In Part 3, well explore 2 more key ways in which bitcoin works to rectify existing economic imbalances.Footnotes1. Although this is often identified as “cash printing,” the real mechanics behind cash creation are complex. If you would like a brief description of how this takes place, Ryan Deedy, CFA (an editor of this piece) described the mechanics succinctly in a correspondence we had: “The Fed is not permitted to purchase USTs straight from the federal government, which is why they have to go through industrial banks/investment banks to bring out the transaction. […] To perform this, the Fed produces reserves (a liability for the Fed, and an asset for business banks). The business bank then uses those new reserves to buy the USTs from the government. When acquired, the Treasurys General Account (TGA) at the Fed increases by the associated quantity, and the USTs are transferred to the Fed, which will appear on its balance sheet as an asset.”2. From “Does the National Debt Matter” by Lyn Alden3. From “Why Every Fixed Income Investor Needs to Consider Bitcoin as Portfolio Insurance” by Greg Foss4. When I say “overly monetized,” Im describing capital flowing into investments that may otherwise be conserved in a shop of value or other form of cash if a more accessible and appropriate solution existed for retaining purchasing power.5. Now a book by the very same title.6. Said throughout a macroeconomics panel at Bitcoin 2022 ConferenceThis is a visitor post by Dan. Opinions expressed are completely their own and do not necessarily show those of BTC Inc or Bitcoin Magazine.

Related Content

- BTC price up, fundamentals down? 5 things to know in Bitcoin this week

- Paradigm accuses SEC of bypassing rules in Binance lawsuit

- FTX’s $3.4B crypto liquidation: What it means for crypto markets

- Price analysis 5/12: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC

- Latest update — Former FTX CEO Sam Bankman-Fried trial [Day 3]