FDIC pins Signature Bank’s failure on poor governance and illiquidity

The United States Federal Deposit Insurance Corps (FDIC) post-mortem assessment of Signature Bank of New York (SBNY) exposed poor management and inadequate threat management practices as the root cause for its collapse.Signature Bank was closed down by federal regulators on March 12 in a quote to secure the U.S. economy and strengthen public self-confidence in the banking system. FDIC was designated to handle the insurance coverage process. @federalreserve @USTreasury @FDICgov problem declaration on actions to protect the U.S. economy by enhancing public self-confidence in our banking system, making sure depositors cost savings remain safe: https://t.co/YISeTdFPrO— Federal Reserve (@federalreserve) March 12, 2023

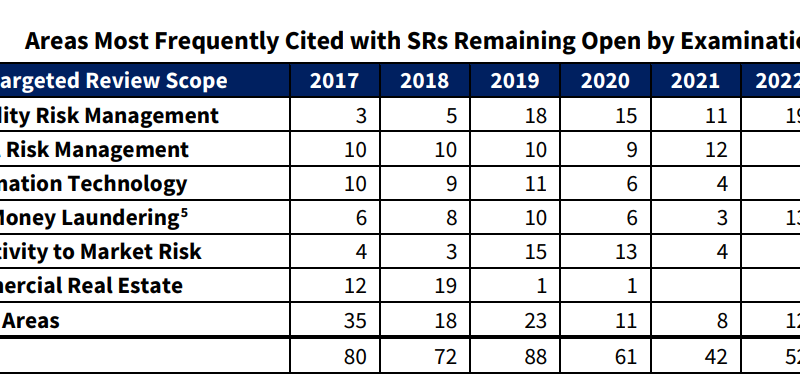

The United States Federal Deposit Insurance Corps (FDIC) post-mortem assessment of Signature Bank of New York (SBNY) exposed bad management and inadequate threat management practices as the root cause for its collapse.Signature Bank was shut down by federal regulators on March 12 in a bid to secure the U.S. economy and enhance public confidence in the banking system. On April 29, FDICs report on the matter highlighted the collapse of significant United States banks– Silvergate Bank and Silicon Valley Bank– caused illiquidity due to deposit runs. Source: FDICDue to non-compliance with the suggestions, the FDIC had actually downgraded SBNYs Liquidity component ranking to “3” starting in 2019, even more highlighting the requirement to enhance its funds management practices.Related: Ludicrous to think Signature Banks collapse was linked to crypto, says NYDFS headTwo government bodies were supposedly examining Signature Bank for cash laundering prior to its collapse.

On April 29, FDICs report on the matter highlighted the collapse of significant US banks– Silvergate Bank and Silicon Valley Bank– triggered illiquidity due to deposit runs. Source: FDICThe report likewise exposed that Signature Bank frequently denied dealing with FDICs concerns or executing the regulators supervisory recommendations. Source: FDICDue to non-compliance with the suggestions, the FDIC had downgraded SBNYs Liquidity element score to “3” starting in 2019, even more highlighting the requirement to improve its funds management practices.Related: Ludicrous to believe Signature Banks collapse was connected to crypto, says NYDFS headTwo federal government bodies were supposedly investigating Signature Bank for cash laundering prior to its collapse.

Related Content

- Bitcoin all-time high in 2025? BTC price idea reveals ‘bull run launch’

- ‘We screwed up’ — Coinbase CLO responds to outrage after exchange associated Pepe with hate groups

- BTC miner Rhodium faces lawsuit over an alleged $26M in unpaid fees: Report

- Lido on Solana wind down ‘deemed a necessity’ after low fees, says staking firm

- Just Bitcoin or diversify? 5 cryptocurrencies to watch in the next few days