The Fed has little ammo left as $30K Bitcoin price becomes key battle line

Such an undesirable result of curbing inflation could further shake the core of the financial system as shown by the newest bank failure, this time of First Republic Bank.Therefore, an eventual Bitcoin (BTC) rate development above $30,000 might be a definitive indication of financiers understanding shifting from seeing Bitcoin as a risk possession to a scarce digital property that straight benefits from a weaker standard banking system.But to assess whether Bitcoins strength above $28,000 is sustainable, an investor should analyze if extreme take advantage of has been used by purchasers and whether expert traders are pricing higher chances of a market recession utilizing BTC derivatives.Bitcoin futures reveal low need from utilize buyersBitcoin quarterly futures are popular among whales and arbitrage desks. Even as the BTC cost flirted with $30,000 on April 26, there were no signs of demand for leveraged longs.Related: Balaji pays out his crazy $1M Bitcoin bet, 97% under price targetMoreover, the Bitcoin futures premium has actually stagnated near 2% since April 23, suggesting that purchasers are unwilling to use take advantage of, which is healthy for the market. That need to come as a surprise given that the Bitcoin price rallied 10% between April 25 and April 30, when it last evaluated the $30,000 resistance.Consequently, Bitcoin alternatives and futures markets suggest that expert traders are not placing their chips on the BTC rate breaking above $30,000 anytime quickly. On the other hand, those whales are pricing in comparable odds of surprise negative and favorable moves.Ultimately, offered that the Fed clearly has a limit to raising interest rates without triggering an economic crisis, Bitcoins cost should be positively affected, regardless of the choice on May 3.

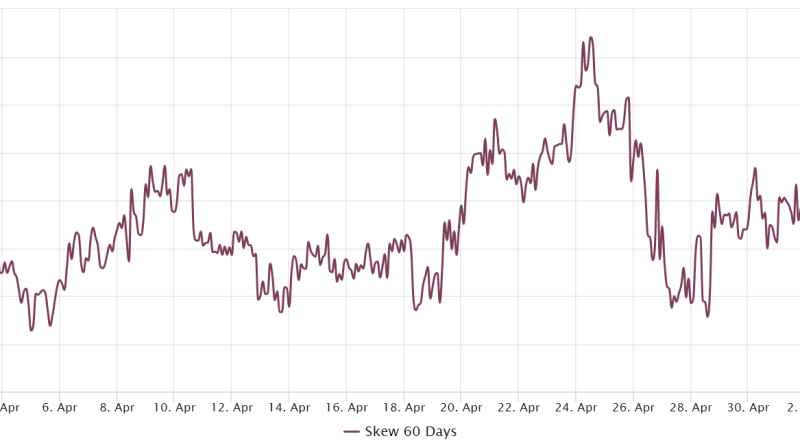

As the market intelligence platform Decentrader pointed out, the remarks from Fed chairman Jerome Powell are most likely to bring surprise components, either indicating further steps to decrease the economy or signaling greater chances of the terminal rates of interest being close to 5%. Powell is set to hold an interview at 2:30 pm Eastern Time.From an employment viewpoint, the reserve bank has reason to think that the market continues to be overheated. The U.S. government reported 1.6 task openings for every out of work employee in March. Additionally, according to the “ADP National Employment Report” launched on May 3, personal payrolls increased by 296,000 jobs in April, well above the 148,000 market consensus.However, raising rates of interest has negative effects for families and small companies in specific. Funding and home loans become more expensive, while buying fixed income ends up being more appealing. Such an unwanted effect of curbing inflation could further shake the core of the monetary system as shown by the latest bank failure, this time of First Republic Bank.Therefore, an ultimate Bitcoin (BTC) rate breakthrough above $30,000 could be a conclusive indication of investors understanding moving from seeing Bitcoin as a risk property to a limited digital possession that directly benefits from a weaker conventional banking system.But to assess whether Bitcoins resilience above $28,000 is sustainable, a financier needs to evaluate if extreme take advantage of has been utilized by purchasers and whether expert traders are pricing higher odds of a market downturn using BTC derivatives.Bitcoin futures reveal low demand from utilize buyersBitcoin quarterly futures are popular amongst whales and arbitrage desks. These fixed-month contracts generally trade at a small premium to spot markets, indicating that sellers are asking for more money to delay settlement.As a result, futures agreements in healthy markets must trade at a 5 to 10% annualized premium– a circumstance known as contango, which is not special to crypto markets.Bitcoin two-month futures annualized premium. Source: LaevitasThe data suggests Bitcoin traders have been extra cautious over the previous couple of weeks. Even as the BTC price flirted with $30,000 on April 26, there were no signs of need for leveraged longs.Related: Balaji pays out his crazy $1M Bitcoin bet, 97% under rate targetMoreover, the Bitcoin futures premium has actually stagnated near 2% considering that April 23, suggesting that buyers hesitate to use leverage, which is healthy for the marketplace. By avoiding futures agreement direct exposure, it greatly reduces the risk of big liquidations throughout negative Bitcoin rate moves.Bitcoin choices traders stay neutralThe Bitcoin choices market can likewise help a trader comprehend whether a recent correction has caused investors to become more positive. The 25% delta alter is a telling sign when arbitrage desks and market makers overcharge for upside or downside protection.In short, if traders anticipate a Bitcoin price drop, the alter metric will rise above 7%, and phases of enjoyment tend to have an unfavorable 7% skew.Bitcoin 60-day alternatives 25% delta alter. Source: LaevitasThe alternative deltas 25% alter has actually shown well balanced need in between call and put choices for the past four weeks. That need to come as a surprise considered that the Bitcoin rate rallied 10% between April 25 and April 30, when it last tested the $30,000 resistance.Consequently, Bitcoin choices and futures markets recommend that expert traders are not putting their chips on the BTC cost breaking above $30,000 anytime quickly. On the other hand, those whales are pricing in comparable chances of surprise unfavorable and favorable moves.Ultimately, considered that the Fed clearly has a limit to raising rates of interest without triggering an economic crisis, Bitcoins cost must be positively impacted, despite the choice on May 3. Fed chair Powell will ultimately require the U.S. Treasury to inject more money into the economy to include the banking crisis, which will be advantageous for a scarce possession such as Bitcoin.This short article does not include financial investment suggestions or recommendations. Every investment and trading move involves threat, and readers must perform their own research when making a decision.

The Bitcoin cost effectively protected the $28,000 support on May 2, but it has yet to prove the strength needed to recover the $29,200 level from April 30. $30K ends up being important for Bitcoin bullsSome analysts will pin the recent downtrend on the expectation of an interest rate boost by the United States Federal Reserve on May 3, but in truth, the market is pricing 92% odds of a modest 25-basis-point boost to its greatest level because September 2007.$ DXY up/ #Bitcoin down on the other days PMI information release. Market is now pricing in a very high possibility of 25bps raise at tomorrows #FOMC. This is most likely primarily priced in for BTC, but the remarks later on (more rates/pause) will likely bring the volatility. https://t.co/H5qtGpd8gA pic.twitter.com/BmdsNRtb1f— Decentrader (@decentrader) May 2, 2023

Related Content

- Bitcoin’s ‘Great Accumulation,’ Binance.US resumes fiat withdrawals, and other news: Hodler’s Digest, June 18-24

- Just How Big Is The Everything Bubble?

- Bitcoin Bollinger Bands hit key zone as BTC price fights for $27K

- FTX, Genesis reach in-principle agreement to settle bankruptcy case

- William Clemente III tips Bitcoin will hit six figures toward end of 2024: Hall of Flame