Ethereum derivatives flirting with bearishness: Mind the $1,820 support

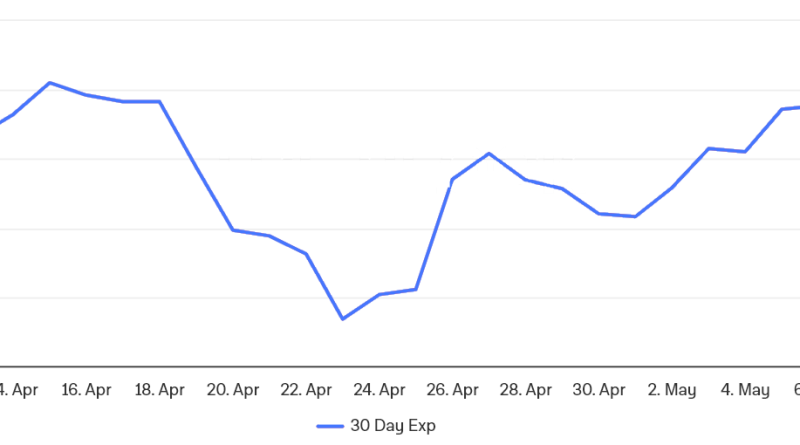

CME Groups FedWatch Tool showed 94% chances of stability at the present 5% to 5.25% range.Therefore, with no indications of a Fed pivot on the horizon, the demand for risk-on possessions such as cryptocurrencies should stay under pressure. The 25% call-to-put delta skew is a telling indication when arbitrage desks and market makers overcharge for advantage or drawback protection.In short, if traders expect an Ether rate drop, the skew metric will drop below 7%, and phases of excitement tend to have a positive 7% skew.Related: Arbitrums DAO to get over 3,350 ETH earnings from deal feesEther 30-day options 25% delta skew. Source: Amberdata & & The BlockAs displayed above, the ETH alternatives 25% call-to-put delta alter has actually been neutral for the past 2 weeks, as the protective put choices were trading at a fair rate relative to comparable neutral-to-bullish call options.Ether alternatives and futures markets suggest that pro traders are not positive, especially thinking about the 10.6% rally in between May 2-6.

Thank you for reading this post, don't forget to subscribe!

CME Groups FedWatch Tool revealed 94% chances of stability at the current 5% to 5.25% range.Therefore, with no signs of a Fed pivot on the horizon, the need for risk-on properties such as cryptocurrencies ought to remain under pressure. The 25% call-to-put delta alter is a telling indication when arbitrage desks and market makers overcharge for upside or disadvantage protection.In short, if traders expect an Ether price drop, the alter metric will drop below 7%, and stages of excitement tend to have a positive 7% skew.Related: Arbitrums DAO to get over 3,350 ETH profits from transaction feesEther 30-day alternatives 25% delta alter. Source: Amberdata & & The BlockAs displayed above, the ETH alternatives 25% call-to-put delta skew has been neutral for the past 2 weeks, as the protective put choices were trading at a reasonable price relative to similar neutral-to-bullish call options.Ether options and futures markets recommend that pro traders are not confident, particularly thinking about the 10.6% rally between May 2-6.

Related Content

- BlackRock files S-1 form for spot Ether ETF with SEC

- Polygon proposes upgrading MATIC into a multipurpose token for all chains

- DeFi protocol Balancer frontend is under attack, $238K crypto stolen

- Digital yuan app adds prepaid Mastercard Visa top-ups for tourists

- Infinex to list top 500 crypto assets, v2 coming early 2025