Bitcoin, Ethereum bears are back in control — Two derivative metrics suggest

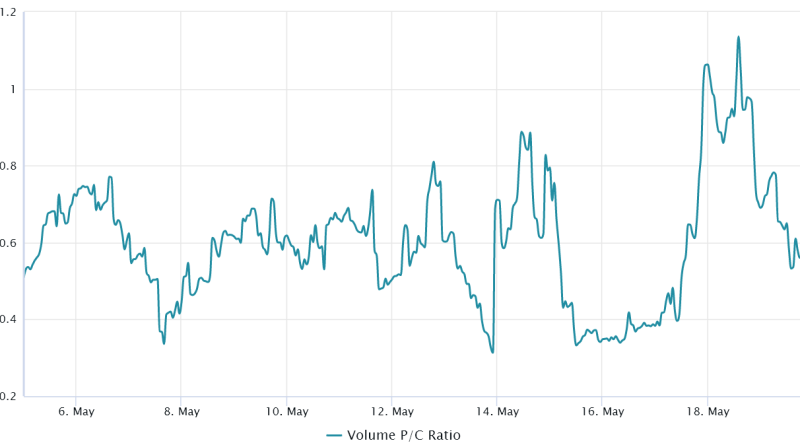

A bearish market structure has been pressing cryptocurrencies prices for the previous 6 weeks, driving the overall market capitalization to its least expensive level in two months at $1.13 trillion. Oddly, even Litecoin (LTC) showed no extreme long need after a 14.5% weekly rally.To leave out externalities that might have entirely impacted futures markets, traders can determine the markets sentiment by measuring whether more activity is going through call (buy) alternatives or put (sell) options. Even as Bitcoin briefly remedied down to $26,800 on May 12, there was no substantial surge in demand for the protective put options.Glass half complete, or financiers prepping for the worst?The options market shows whales and market makers reluctant to take protective puts even after Bitcoin crashed 8.3% in between May 10 and May 12. Less than two weeks stay till June 1, when the U.S. Treasury Department has actually alerted that the federal government might be not able to pay its debts.Related: U.S. debt ceiling crisis: bullish or bearish for Bitcoin?It is unclear whether the total market capitalization will be able to break from the descending wedge formation.

A bearish market structure has been pushing cryptocurrencies rates for the previous 6 weeks, driving the total market capitalization to its most affordable level in 2 months at $1.13 trillion. Strangely enough, even Litecoin (LTC) displayed no excessive long demand after a 14.5% weekly rally.To exclude externalities that may have solely impacted futures markets, traders can determine the markets belief by determining whether more activity is going through call (buy) alternatives or put (sell) options. Even as Bitcoin briefly remedied down to $26,800 on May 12, there was no considerable rise in need for the protective put options.Glass half full, or investors prepping for the worst?The options market reveals whales and market makers unwilling to take protective puts even after Bitcoin crashed 8.3% between May 10 and May 12.

Related Content

- ‘This is the trigger’ — Arthur Hayes says it’s time to bet on Bitcoin

- Bitcoin futures data highlight investors’ bullish view, but there’s a catch

- Is The Bitcoin Price Still Correlated With Financial Markets?

- Price analysis 10/4: BTC, ETH, BNB, XRP, SOL, ADA, DOGE, TON, DOT, MATIC

- Top 10 Effective Bitcoin Stocks to Watch in 2025: The Ultimate Guide