SEC’s Gensler claims ‘parallels’ between Binance and FTX, yet one wasn’t sued

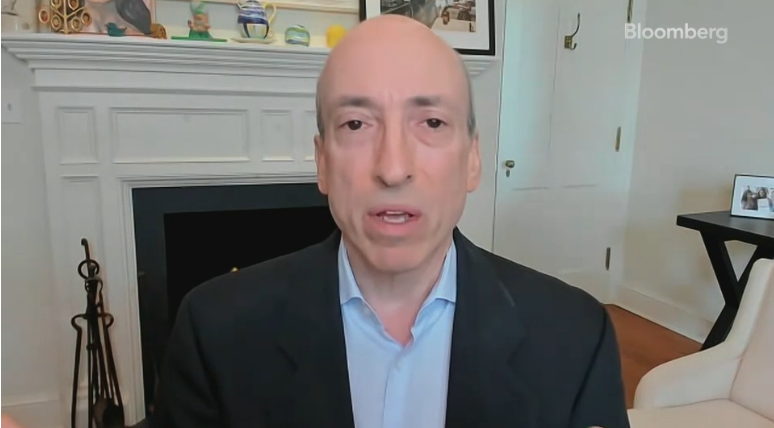

The United States securities chair has hinted at “parallels” in between crypto exchange Binance and collapsed exchange FTX– particularly their declared usage of sibling companies to move funds. Speaking to Bloomberg on June 6, the U.S. Securities and Exchange Commission chair Gary Gensler, indicated FTXs supposed scams and manipulation concerning its sibling firm Alameda Research, consisting of the declared role that its founder Sam Bankman-Fried played in it. SECs Gary Gensler consulting with Bloombergs David Westin. Source: Bloomberg” Theres a service model that packages and commingles functions that we dont see, nor would we enable elsewhere, in financing,” he said. On June 5, the SEC submitted a grievance against Binance pressing a total of 13 charges. One of the accusations in the fit claims that funds from Binance and Binance.US were commingled into an account managed by the Changpeng Zhao-associated Merit Peak Limited.Another allegation claims that Binance.US took part in wash trading through its “main concealed market making trading company Sigma Chain,” which is owned by Zhao.” Platform after platform, entrepreneurs […] are attempting to construct wealth for themselves and their financiers through sis organizations– hedge funds– trading versus the consumers,” stated Gensler. Wheres the FTX lawsuit?The recent interview is likely to add more fuel to the ongoing dispute on Twitter– why hasnt the SEC sued FTX? They didnt take legal action against FTX. https://t.co/FVgi5l6VcI— CZ Binance (@cz_binance) June 6, 2023

Thank you for reading this post, don't forget to subscribe!

In a June 6 tweet, Ripple CEO Brad Garlinghouse stated the most current string of lawsuits is an effort by the SEC to “distract” from the agencys “FTX ordeal.” Others recommended that FTXs considerable donations towards political celebrations and Bankman-Frieds regular lobbying in Washington D.C. in the past could also be a factor. Why didnt the SEC sue FTX?Oh thats ideal they permitted public servants to take * contributions * and colluded with them to further oppress Americans https://t.co/EgKhB99e46— Wendy O (@CryptoWendyO) June 6, 2023

Wheres the FTX lawsuit?The recent interview is most likely to add more fuel to the continuous debate on Twitter– why hasnt the SEC took legal action against FTX? In a June 6 tweet, Ripple CEO Brad Garlinghouse stated the latest string of lawsuits is an effort by the SEC to “distract” from the companys “FTX ordeal.” Thielen likewise thinks theres an idea of “embarrassment” for those that did not visualize the problems at FTX, consisting of lawmakers.Related: Binance.” It must be noted that while the SEC has not announced a lawsuit against the FTX exchange itself, the regulator has laid charges against its creators and previous executives.These consist of previous FTX CEO Sam Bankman-Fried, former Alameda Research CEO Caroline Ellison, previous FTX co-founder Gary Wang and former FTX director of engineering Nishad Singh.Cointelegraph got in touch with the SEC for remark but did not receive an instant reaction.

“People understood that after FTX, its actually billions of dollars.” Thielen also believes theres a notion of “shame” for those that did not anticipate the issues at FTX, consisting of lawmakers.Related: Binance.” It needs to be noted that while the SEC has not revealed a claim versus the FTX exchange itself, the regulator has actually laid charges against its creators and former executives.These consist of previous FTX CEO Sam Bankman-Fried, former Alameda Research CEO Caroline Ellison, former FTX co-founder Gary Wang and former FTX director of engineering Nishad Singh.Cointelegraph contacted the SEC for comment however did not receive an instant reaction.