Economics of Bitcoin ATM market could hinder wider adoption

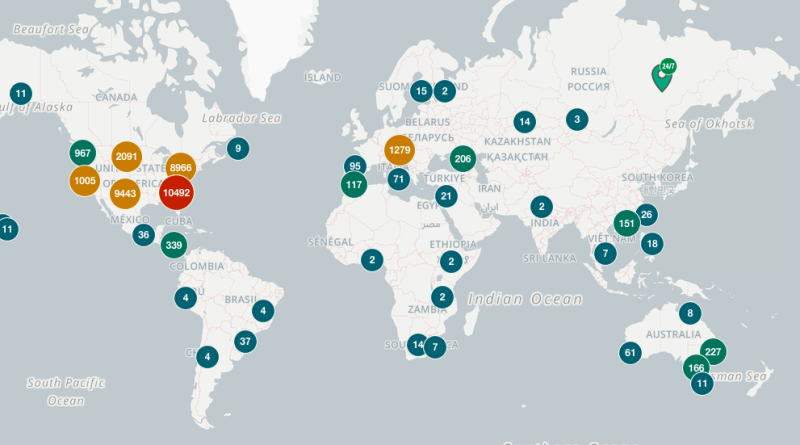

Over the previous years, nearly 40,000 cryptocurrency ATMs have actually popped up worldwide.Bitcoin (BTC) ATM service provider, Bitcoin of America, had actually sculpted out a piece of the market however just recently closed store in the United States State of Connecticut due to a lack of correct licensing.The Connecticut Department of Banking (DoB) issued a desist and stop order against the company, implicating it of running unlicensed crypto ATMs in the state. While the choice marked the end of the companys presence in the state, it likewise underscored the regulative hurdles dealt with by crypto ATM operators, especially in the United States.The closure also sent ripples throughout the crypto neighborhood, leading numerous industry observers to question the long-term efficacy and utility of these machines.Connecticut closure explainedDue to the nascency of the cryptocurrency industry, weding digital currencies with traditional monetary structures– as in the case of crypto ATMs– needs complex regulative supervision.”In a different event in March, state authorities in Ohio took 52 Bitcoin of America ATMs, as authorities believed scammers were utilizing the kiosks.Operating crypto ATMs is harder than it looksJason Grewal, chief legal officer for Web3 security company Sys Labs, informed Cointelegraph that running a crypto ATM includes much more than simply acquiring a license. The return on financial investment depends on a number of aspects, including the place of the business (e.g., business district, high-traffic area); the number of daily deals; the average deal size; the overall anticipated earnings from deal fees; and the marketing strategy to promote the crypto ATM in question.According to crypto ATM firm Chainbytes, a single Bitcoin ATM can earn up to $3,000 monthly, with gross regular monthly revenues of $30,000. After including 99 ATMs in late 2022, it leapfrogged El Salvador and Poland to become the fourth-largest crypto ATM center with around 473 kiosks.The future of crypto ATMsDespite the lots of difficulties restraining the development of the crypto ATM market, the area is expected to grow substantially in the coming years.

“In a separate event in March, state authorities in Ohio took 52 Bitcoin of America ATMs, as authorities believed scammers were using the kiosks.Operating crypto ATMs is harder than it looksJason Grewal, chief legal officer for Web3 security firm Sys Labs, told Cointelegraph that running a crypto ATM includes much more than simply acquiring a license. The return on investment depends on several aspects, including the place of the organization (e.g., industrial district, high-traffic location); the number of daily transactions; the average transaction size; the total expected revenue from deal charges; and the marketing strategy to promote the crypto ATM in question.According to crypto ATM firm Chainbytes, a single Bitcoin ATM can make up to $3,000 monthly, with gross monthly incomes of $30,000. After including 99 ATMs in late 2022, it leapfrogged El Salvador and Poland to become the fourth-largest crypto ATM center with around 473 kiosks.The future of crypto ATMsDespite the many hurdles hindering the growth of the crypto ATM market, the area is expected to grow significantly in the coming years.

Related Content

- Bitcoin speculators send 35K BTC to exchanges in new ‘elation inflow’

- FTX’s former external legal team disputes involvement in fraud allegations

- Bitcoin, Ethereum to shake off ‘toothless adversary’ SEC as FOMC looms

- Dear crypto writers: No one wants to read your ChatGPT-generated trash

- ‘Trusted seller’ vends fake Trezor wallets stealing crypto: Kaspersky