Bitcoin price races toward $27K, but a swift recovery is not confirmed by market data

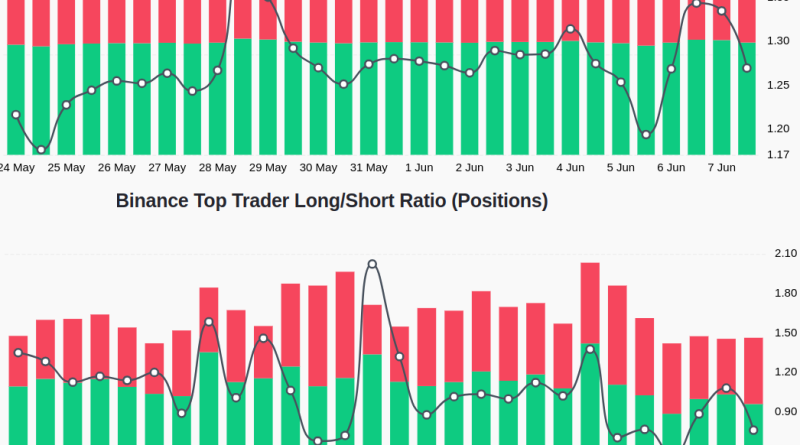

Those traders were most likely captured by surprise as the sign reached an outstanding 62 favoring longs, which is unsustainable.the and highly unusual OKX margin-lending ratio changed to 34 on June 6 as leveraged longs were required to reduce their direct exposure and extra margin was most likely deposited.Investors must also evaluate the Bitcoin futures long-to-short metric, as it omits externalities that may have exclusively affected the margin markets.Exchanges top traders Bitcoin long-to-short ratio. Source: CoinGlassThere are occasional methodological discrepancies in between exchanges, so readers need to keep an eye on modifications instead of absolute figures.Both OKXs and Binances leading traders have reduced their long-to-short ratios in between June 7 and June 8, showing an absence of self-confidence. At crypto exchange Binance, the long-to-short ratio decreased to 1.29 on June 8 from 1.35 on the previous day.Related: Bitcoin rebound fails in the middle of SEC crackdown on exchanges, raising possibility of a BTC cost capitulationOverall, Bitcoin bulls appear to be in a bad location, both from the worsening regulative crypto environment and the unfolding international economic crisis.

This post does not consist of financial investment recommendations or suggestions. Every investment and trading relocation involves risk, and readers should perform their own research study when deciding.

Those traders were most likely captured by surprise as the indication reached an excellent 62 favoring longs, which is highly unusual and unsustainable.The OKX margin-lending ratio adjusted to 34 on June 6 as leveraged longs were required to minimize their direct exposure and additional margin was most likely deposited.Investors need to likewise examine the Bitcoin futures long-to-short metric, as it leaves out externalities that may have entirely impacted the margin markets.Exchanges leading traders Bitcoin long-to-short ratio. Source: CoinGlassThere are occasional methodological disparities between exchanges, so readers must keep an eye on changes rather of absolute figures.Both OKXs and Binances top traders have reduced their long-to-short ratios between June 7 and June 8, showing a lack of confidence. At crypto exchange Binance, the long-to-short ratio decreased to 1.29 on June 8 from 1.35 on the previous day.Related: Bitcoin rebound fails amid SEC crackdown on exchanges, raising chance of a BTC cost capitulationOverall, Bitcoin bulls seem to be in a bad location, both from the worsening regulatory crypto environment and the unfolding worldwide economic crisis.

Related Content

- Tether credits USDT growth surge to ETF excitement, emerging markets

- Bitcoin miner mulls refunding 20 BTC reward to Paxos

- Stablecoin survival: Navigating the future amid global de-dollarization

- Bitcoin price fails $38.5K breakout as US GDP fuels Fed hard-landing woes

- Trezor CEO cites usability as top factor for hardware wallet: BTC Prague 2023