Latam crypto holders flock to Bitget following Binance, Coinbase suits

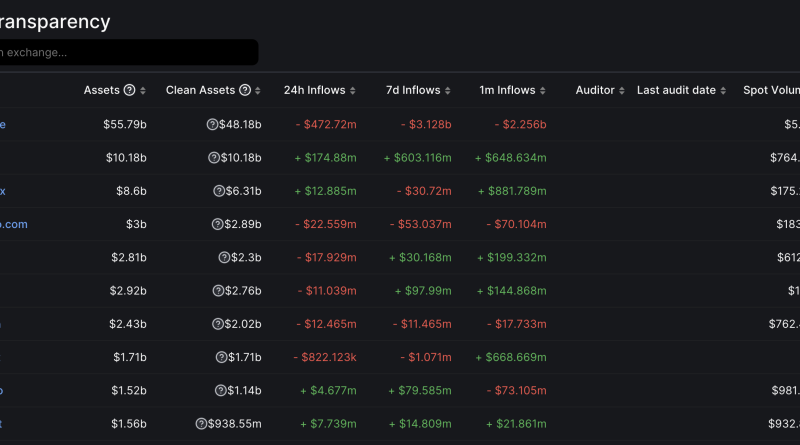

Crypto exchange Bitget has actually seen a rise in brand-new accounts in Latin America following lawsuits by United States regulators versus significant rivals Binance and Coinbase.As compared to everyday averages, new users in the area increased by 43% from June 6 to 9, with Brazil and Argentina leading market share development, a representative from Bitget told Cointelegraph. On June 5, crypto exchange Binance was taken legal action against by the U.S. Securities and Exchange Commission for 13 charges, including supposed sale and deal of securities, failure to register as an exchange or broker, and commingling of funds. The largest inflow of funds was reported by crypto exchange OKX, which received $603 million in deposits over the previous week.CEX Transparency control panel. Given that March, it has partnered with regional payment service providers to offer crypto purchases, and make it possible for deposits and withdrawals in the regional currency.Magazine: Best and worst nations for crypto taxes– Plus crypto tax ideas

Crypto exchange Bitget has actually seen a surge in brand-new accounts in Latin America following lawsuits by United States regulators against significant rivals Binance and Coinbase.As compared to everyday averages, brand-new users in the region increased by 43% from June 6 to 9, with Brazil and Argentina leading market share growth, a representative from Bitget told Cointelegraph. According to the exchange, new customers in Brazil soared 54%, with a 208% dive in total deposits. In Argentina, its client base increased by 33%, while funds transferred expanded 87%. The crypto exchange also runs in Venezuela, Colombia, and Mexico. Over the last couple of days, Bitgets total deposits increased 134% in the region. Bitget has more than 8 million clients throughout 100 countries. The company did not reveal the overall variety of users in Latin America. The figures are discussed by current advancements in the United States. On June 5, crypto exchange Binance was sued by the U.S. Securities and Exchange Commission for 13 charges, including alleged sale and offer of securities, failure to register as an exchange or broker, and commingling of funds. According to data from DefiLlama, Binance net outflows in the past 7 days sits at $3.128 billion since writing, while Bitget has seen its deposits increase by $14.8 million. The largest inflow of funds was reported by crypto exchange OKX, which received $603 million in deposits over the previous week.CEX Transparency dashboard. Source: DefiLlama” The crypto market is still extremely new and has actually experienced significant growth in the last few years. [.] favorable policies are being implemented in places like Hong Kong, Dubai, Singapore and brand-new opportunities are emerging. We are persuaded that things will settle down over time, with the market combining itself amongst the greatest ones in the contemporary economy,” told Cointelegraph Gracy Chen, handling director of Bitget. Targeted by U.S. regulators, Coinbase was sued on June 6 for apparently offering unregistered securities and running as an unregistered security broker since 2019. SECs Chair Gary Gensler accused the crypto exchange of depriving clients of important defenses that avoid scams and manipulation, in addition to not supplying appropriate safeguards versus disputes of interest. In the last 24 hours, Coinbases trade volume has actually changed by 113.06% to $1.5 billion.Binance has previously ranked Brazil among its top global markets, and its regional partner was just recently approved a payment company license in the nation. Coinbase is likewise expanding its local operations. Since March, it has actually partnered with regional payment providers to use crypto purchases, and make it possible for deposits and withdrawals in the regional currency.Magazine: Best and worst nations for crypto taxes– Plus crypto tax pointers

Related Content

- Everything You Need to Know About Buying and Selling Bitcoins Safely

- Bitcoin halving can take BTC price to $148K by July 2025 — Pantera Capital

- How Bitcoin Can Enrich Our Interior Lives

- Friend.tech generates over $1M fees in 24h, surpassing Uniswap, Bitcoin networks

- Bitcoin OG keeps faith in bull market as BTC price bounces 8%