5 key highlights of the SEC’s lawsuit against Binance

The U.S. Securities and Exchange Commission (SEC) submitted a suit against Binance on June 5, alleging that the exchange was involved in the sale of unregistered securities. In its 136-page grievance, the SEC accuses Binance and its founder, Changpeng “CZ” Zhao, of taking part in a complicated conspiracy that involved scams, disputes of interest, a lack of disclosure and willful disregard for the law. The claims, according to SEC Chair Gary Gensler, center on deceiving financiers about threat controls, tampering with trade volumes, hiding vital functional information, and flouting U.S. securities laws. In order to avoid regulatory analysis, Binance allegedly created weak controls while covertly disobeying them to keep its highly valuable U.S. consumers. Today we charged Binance Holdings Ltd. (Binance); U.S.-based affiliate, BAM Trading Services Inc., which, together with Binance, operates https://t.co/swcxioZKVP; and their founder, Changpeng Zhao, with a variety of securities law violations.https:// t.co/ H1wgGgR5ir pic.twitter.com/IWTb7Et86H— U.S. Securities and Exchange Commission (@SECGov) June 5, 2023

Thank you for reading this post, don't forget to subscribe!

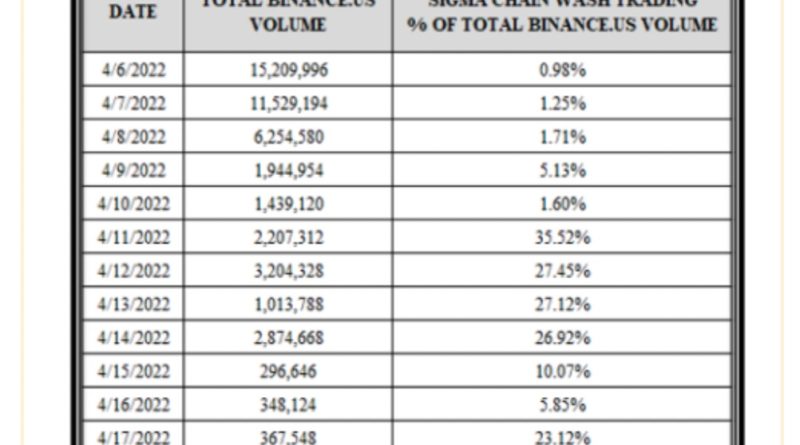

Here are the key highlights from the SECs complaint: Unregistered securities offeringAccording to the SEC, Changpeng Zhao has actually been operating Binance.com and Binance.US as exchanges, brokers, dealers and cleaning companies given that a minimum of July 2017. The problem claims that these business have actually earned a minimum of $11.6 billion through a variety of methods, including transaction costs collected from American customers. According to the SECs problem, Binance.com needs to have signed up as a cleaning company, broker-dealer and exchange, while Binance.US and BAM Trading need to have registered as cleaning companies and exchanges, respectively. BAM Trading likewise needed to register as a broker-dealer, and it was charged with the unregistered offer and sale of Binance.US staking-as-a-service program.Controversial practice of enabling United States clients to use Binance.comZhao launched Binance in Shanghai in 2017, however the exchange has been evasive about where its primary office is located ever given that. Binances parent company is located in the Cayman Islands, which makes its organizational structure more complicated. The SEC declares that, despite openly declaring that Binance restricted U.S. consumers from trading, the exchange surreptitiously allowed them to keep using the platform, demonstrating an intentional disregard for U.S. securities laws.Binance developed a substantial variety of user represent individuals who offered Know Your Customer identity confirmation info that showed their area within the United States from the preliminary launch of the Binance.com platform until at least September 2019. There were likewise users who appeared to be physically situated in the United States based on their web procedure addresses used to access the platform.CZ as a control personIn order to develop Binance.US, a platform serving American customers in accordance with U.S. laws, Binance and BAM Trading announced cooperation in 2019. The SEC, in contrast to Binance.USs assertion of independence, asserts that Zhao continued to supervise of the business. Significantly, Zhao– according to the SEC– gave Binance.US the order to onboard Sigma Chain and Merit Peak as market makers, both of which were run by Binance workers. Considering that the beginning of the Binance.com platform, the Zhao-owned Merit Peak has actually supplied non-prescription trading services on behalf of Binance. On the Binance.com platform, Merit Peak served as the counterparty for users, and on the Binance.US platform, it used market-making services. Related: SEC charges versus Binance and Coinbase are horrible for DeFiStarting a minimum of in 2021, Binance entities that were under Zhaos useful control transferred billion-dollar consumer properties to American bank accounts held by Merit Peak. These funds were then subsequently transferred to Trust Company A (a New York limited purpose trust company), and it appears that this transaction was connected to the issuance of Binances stablecoin known as Binance USD (BUSD). Investors were exposed to concealed counterparty threat as an outcome of utilizing Merit Peak as an intermediary to move customer funds to buy BUSD since this relationship was not publicly disclosed.Moreover, a number of Binance.USs savings account, consisting of one that had money from American consumers, had the head of the back office as the main operator, raising questions relating to Binances operational openness and fund segregation.Wash trading on Binance.US platformAccording to the SECs suit, BAM Trading and BAM Management, who are connected to Binance.US, misinformed both customers and equity investors about the effectiveness of market oversight and procedures to identify and stop manipulative trading on the platform. Nevertheless, wash trading on the Binance.US platform was a typical practice. This practice artificially inflates trading volumes, supplying a fictitious impression of market interest. The SECs charges called into question the reliability of trading volume information and the openness of Binance.USs market activities.Even prior to the platforms launch, senior authorities and staff at BAM Trading were aware of the possibility of wash trading. In correspondence sent to BAMs CEO– probably Catherine Coley, though she is not identified by name– and senior Binance executives, a co-founder of Binance and the head of the trade matching engine team expressed issue about the matching engines ability to let customers trade with themselves. They questioned whether it was required to comply with U.S./ SEC regulations and avoid this manipulation.An employee of Binance who was in charge of market monitoring was gotten in touch with by BAM Trading when it was revealed at a conference a year later that no steps versus market control had actually been put in place. The director of institutional sales at BAM Trading acknowledged the lack of safeguards versus wash trading in January 2021. Despite Binance.US clearly professing to forbid fraudulent trading, BAM Trading did not have deal monitoring systems in place until February 2022. It is likewise notable that a large percentage of this wash trading activity occurred through accounts linked to Sigma Chain, which served as a market maker on Binance.US. Sigma Chains many accounts and active trading on the Binance.US platform were both totally known to BAM Trading and BAM Management. Graphic contained in the SECs lawsuit illustrating the alleged wash-trading volume of COTI.Wash trading between Sigma Chains accounts continued after the platforms intro in 2019 until a minimum of June 2022. Following the introduction of the crypto asset security COTI on the Binance.US platform on April 6, 2022, Sigma Chain rapidly– the SEC declares– became included in extensive wash trading. Strategically, the platforms launch, the introduction of new securities, and the funding round all fell during times when financiers and equity financiers were most vulnerable.Diversion of consumer assets and misuse of funds by Zhao and Binance entitiesIn the SECs suit, Zhao and Binance are charged with diverting customer assets at their discretion, consisting of sending cash to the Switzerland-based Sigma Chain that is under Zhaos control.The SEC declared that Merit Peak and Sigma Chain were utilized to transfer tens of billions of dollars in between Binance, Binance.US and other connected entities. Significantly, the SEC disclosed that Sigma Chain spent $11 million acquiring a luxury yacht. The accusation raises questions about how Binance and its affiliated organizations handle client assets and recommends cash may have been improperly used.Additionally, the SEC charged that Merit Peaks U.S. checking account has actually furthermore been utilized as a “pass-through” account given that the launch of the Binance.US platform, receiving roughly $20 billion– including consumer funds– from both Binance platforms. Benefit Peak then apparently moved the bulk of this money to Trust Company A, perhaps for the function of buying BUSD. This undetected transfer of consumer funds to an ostensibly independent business like Merit Peak postured a serious danger because it might have left the money susceptible to loss or theft.The extent of the alleged misappropriation of funds and diversion of client possessions will be more checked out and scrutinized as the judicial processes progress. Guneet Kaur signed up with Cointelegraph as an editor in 2021. She holds a Master of Science in financial innovation from the University of Stirling and an MBA from Indias Guru Nanak Dev University.This post is for general information functions and is not meant to be and need to not be taken as legal or investment advice. The views, thoughts and opinions revealed here are the authors alone and do not always show or represent the views and opinions of Cointelegraph.

Related: SEC charges against Binance and Coinbase are dreadful for DeFiStarting at least in 2021, Binance entities that were under Zhaos advantageous control transferred billion-dollar client assets to American bank accounts held by Merit Peak. In correspondence sent out to BAMs CEO– presumably Catherine Coley, though she is not determined by name– and senior Binance executives, a co-founder of Binance and the head of the trade matching engine group revealed concern about the matching engines ability to let customers trade with themselves. Strategically, the platforms launch, the introduction of new securities, and the funding round all fell during times when investors and equity financiers were most vulnerable.Diversion of consumer properties and abuse of funds by Zhao and Binance entitiesIn the SECs suit, Zhao and Binance are charged with diverting customer possessions at their discretion, consisting of sending money to the Switzerland-based Sigma Chain that is under Zhaos control.The SEC declared that Merit Peak and Sigma Chain were used to transfer 10s of billions of dollars between Binance, Binance.US and other connected entities. The allegation raises concerns about how Binance and its associated companies deal with consumer properties and suggests cash might have been poorly used.Additionally, the SEC charged that Merit Peaks U.S. bank account has additionally been utilized as a “pass-through” account considering that the launch of the Binance.US platform, getting roughly $20 billion– consisting of client funds– from both Binance platforms.

Today we charged Binance Holdings Ltd. (Binance); U.S.-based affiliate, BAM Trading Services Inc., which, together with Binance, runs https://t.co/swcxioZKVP; and their founder, Changpeng Zhao, with a variety of securities law violations.https:// t.co/ H1wgGgR5ir pic.twitter.com/IWTb7Et86H— U.S. Securities and Exchange Commission (@SECGov) June 5, 2023

Related Content

- Beijing enforces lockdowns, expands COVID-19 mass testing

- ‘107,000 GPUs on the waitlist’ — Io.net beta launch attracts data centers, GPU clusters

- Digital yuan app adds prepaid Mastercard Visa top-ups for tourists

- Blockchains Have a ‘Bridge’ Problem, and Hackers Know It

- Bitcoin forks BCH, BSV and XEC soared last month, but are the gains organic and sustainable?