Coinbase was aware of securities law violations, SEC claims in letter

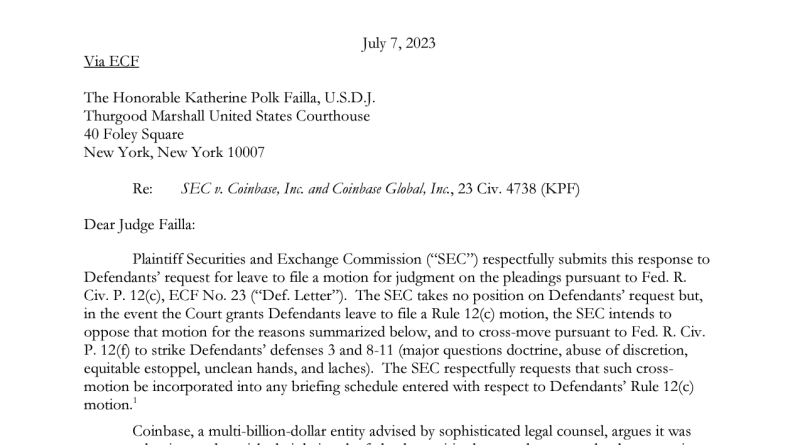

The United States Securities and Exchange Commission (SEC) filed an action to Coinbases claims that the regulator does not have jurisdiction to prosecute the crypto exchange.According to a letter sent out by the SEC to a district judge on July 7, Coinbase had knowledge of the likelihood that federal securities laws would apply to its operations, openly notifying its shareholders about the possibility of properties traded on its platform being classified as securities. As per the SEC, Coinbase is a “multi-billion-dollar entity recommended by sophisticated legal counsel” that is intentionally “ignoring more than 75 years of managing law under Howey” in an effort “to build its own test for what constitutes an investment agreement. Coinbase also pointed out that 2 years after going public, the SEC submitted charges for activities “extensively described” to the regulator and the basic public.Speaking with Cointelegraph, business and securities lawyer Roland Chase explained that “all that the SEC is licensed to do by Congress is to evaluate the going public documents and supply comments and ask questions in an effort to improve the businesss disclosure to potential investors,” including that federal securities laws governing the “going public” procedure are disclosure-based.

Thank you for reading this post, don't forget to subscribe!

Related Content

- There could be 24 CBDCs live by 2030: BIS survey

- Bitcoin price falls to $29.5K, but on-chain data reflects investors’ growing interest

- Bitcoin ‘death cross’ sees BTC price dip $1K erasing Uptober gains

- BNB Chain hard fork to improve security and compatibility with EVM chains

- Futurama’s latest reboot takes aim at Bitcoin miners