Driving liquidity and efficiency: The essential role of crypto market makers

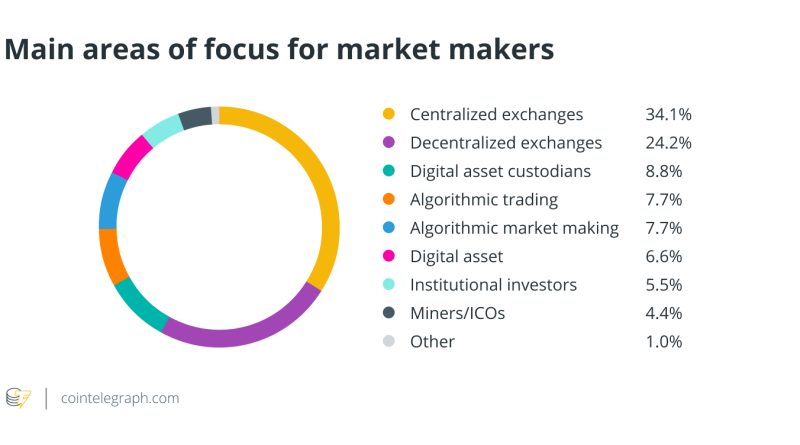

As the cryptocurrency market continues to develop, the importance of market makers in keeping liquidity and stability has actually grown respectively. Comparable to the worldwide pattern of increased policy, market makers are obtaining prominence in the progressing cryptocurrency landscape.By partnering with exchanges, such as Binance, Coinbase, KuCoin and others, market makers try to minimize spreads in highly liquid markets, benefiting both retail and institutional individuals. Cointelegraph Research has assembled a database of about 50 crypto market makers running worldwide, with comprehensive info on their activities and focus.Why are market makers needed?Market makers play an essential function in digital possession markets by absorbing unexpected changes in supply and demand, stabilizing rates and supplying a more foreseeable trading environment.However, it is likewise real that market makers may not constantly be efficient. Elements such as speculative trading, restricted liquidity and unexpected market movements can make it challenging for market makers to reduce cost volatility. Explore Cointelegraph Research Market Makers Database hereMarket makers preserve an existence in the market by simultaneously offering competitive bids and asking rates for a given cryptocurrency. To show, let us think about a scenario where a market maker positions a quote to buy a cryptocurrency at a rate of $99 and concurrently sets an ask rate to sell the same cryptocurrency at $100. The disparity in between these quote and ask rates, typically referred to as the spread, represents the earnings margin recorded by the market maker.Strategies and speculationsMarket makers utilize advanced algorithmic trading strategies to optimize their operations. These strategies include evaluating market information, recognizing trading chances, leveraging innovations and various trading strategies to supply constant liquidity and react to market changes efficiently. Market makers are not restricted to their function of liquidity companies. They can also be market manipulators and possess an in-depth understanding of the marketplace and its patterns, consisting of pending orders, the distribution of volumes and the levels at which take-profits and stop-losses are set.For example, if Ethers (ETH) rate is gradually rising, a market maker may notice a concentration of stop-loss orders around $2,500, accompanied by limited buyer interest at that level.To take benefit of this situation, a market maker may enter the marketplace with a substantial purchasing volume between $2,400 and $2,450 and soak up the available counter orders, considering their known volume. Subsequently, the price briefly dips to $2,500, setting off the stop-loss orders positioned by other traders. Quickly after, Ether experiences a fast rise, reaching, for instance, $2,600. At this moment, the marketplace maker will exit the trade.Staying notified and growing in the marketOverall, crypto market makers are crucial; nevertheless, they face a range of obstacles in the crypto area, consisting of regulative unpredictability, cost adjustment concerns and crypto volatility. Especially in the United States, the Securities and Exchange Commission has been actively keeping an eye on the cryptocurrency market, causing increased market issues. Appropriately, remaining updated with the most current industry shifts and techniques is essential to prospering in the crypto market-making landscape, and the Cointelegraph Research Market Makers Database is here to help.

Related Content

- Bitcoin surfs $30K as traders hope US trading will boost BTC price

- BlackRock has more to lose from a BTC price crash pre-Bitcoin ETF

- Bitcoin price holds $26K as derivatives data hints at end of volatility spike

- FTX has $222M in Bahamas real estate, 1,300 tokens: shareholder presentation

- Bitcoin-Backed Loans