US ‘dominates’ crypto startup funding in Q2: Report

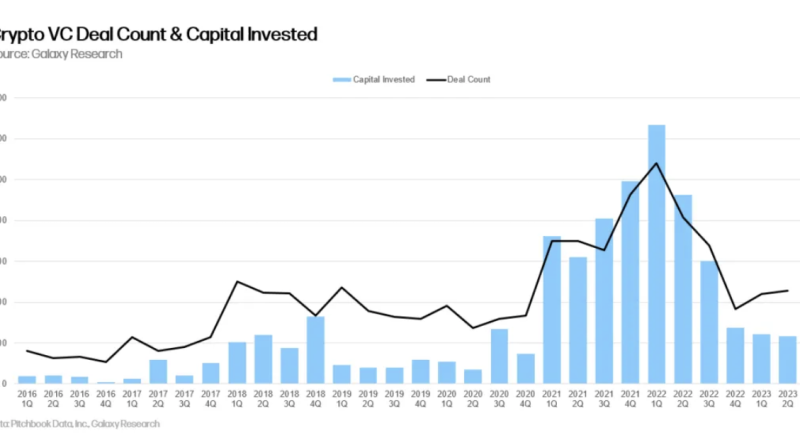

Despite dealing with regulative scrutiny in the United States, crypto firms continue to innovate, with nearly half of all capital expense streaming towards U.S. crypto companies, according to a current report.Published by crypto financial investment firm Galaxy Digital on July 14, the report mentioned that US-based crypto start-ups had a substantial share of interest from equity capital firms.” US-based crypto startups accounted for more than 43% of all deals completed and raised more than 45% of the capital invested by VC firms.” This was followed by the United Kingdom declaring 7.7% of capital financial investment, Singapore with 5.7% and South Korea with 5.4%. It was noted that the total amount of capital invested in crypto and blockchain startups continued to decrease quarter on quarter.” Only $720m was raised by 10 new crypto VC funds in Q2 2023″ it noted, mentioning that this is the most affordable since the beginning of the COVID-19 pandemic, in Q3 2020.” Crypto and blockchain start-ups raised less money throughout the last three quarters integrated than they did in just Q2 in 2015.” It was additional kept in mind that while business in the “broad Web3 classification” had more offers, business in the “trading classification” raised more capital.Extract from Galaxy Research Q2 Report comparing total VC deal count to overall capital financial investment given that Q1 2016. Source: Galaxy ResearchRelated: SEC accepts BlackRocks Bitcoin ETF application, signaling regulative reviewThis comes amid the United States Securities and Exchange Commission taking action against a number of U.S. crypto companies in recent times.Most just recently, its case versus Ripple, declaring that its native token XRP (XRP) is a security, was ruled partially in favor of Ripple on July 13, stating that it is not a security for retail sales.Cointelegraph previously reported on June 18 that Ripple CEO Brad Garlinghouse thinks the SEC is “aiming to kill” development and the cryptocurrency market in the U.S.Garlinghouse argued that the SECs handling of the Hinman speech files during the Ripple case isnt about “any one token or any one blockchain,” however more so the overall position that the SEC has towards the crypto industry. This comes after the SEC took action versus significant crypto exchanges Binance and Coinbase only a day apart on June 5 and June 6, declaring an offense of securities laws and using unregistered securities.Magazine: Experts want to provide AI human souls so they dont eliminate us all

Related Content

- Bitcoin ETFs: A $600B tipping point for crypto

- Price analysis 10/2: SPX, DXY, BTC, ETH, BNB, XRP, SOL, ADA, DOGE, TON

- Meta launches metaverse game, Bitcoin Ordinals creator proposes numbering change: Nifty Newsletter

- Ex-Pimco, Millennium execs set up crypto advisory business

- Tether’s game plan in El Salvador: Why invest in Volcano Energy?