Celsius could repay all claims if Bitcoin, Ether prices rose 2X — Simon Dixon

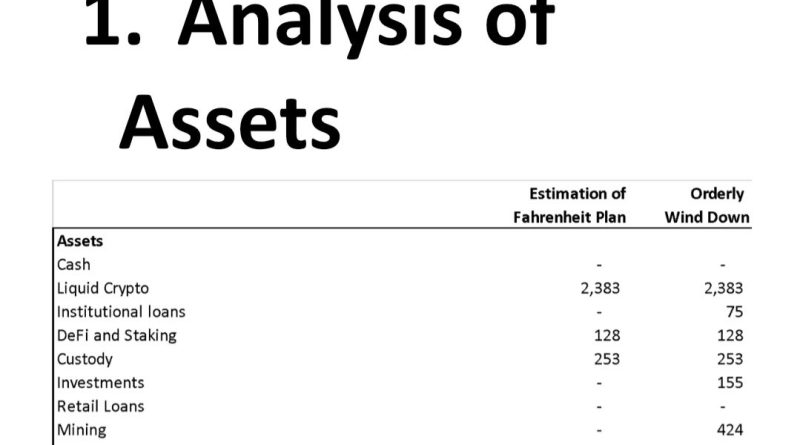

Insolvent crypto lending institution Celsius is battling a Chapter 11 bankruptcy with billions of dollars in claims made by numerous celebrations. A new estimate by the Bank of the Future suggests that the struggling crypto lender might likely pay back the claims if the rate of Bitcoin (BTC) and Ether (ETH)– two properties held by the company– doubled their present market prices.Simon Dixon, the founder of Bank of the Future– a crypto-centered investment company– tweeted the estimated rate BTC and ETH would need to reach for Celsius to repay all its claims and keep all other properties. Based on the last offer with the Fahrenheit consortium, which won the bid to get the properties of Celsius in May, if the BTC cost touches $54,879 and the ETH cost reaches $3,750, Celsius might pay back all claims from the price gratitude of both properties. In June, Celsius appealed in court to convert all its altcoins into Bitcoin and Ether to take full advantage of the worth of assets.Estimated cost of BTC and ETH for full healing. Source: Twitter Dixon noted that these price quotes are based upon “imperfect understanding made by the BF [Bank of the Future] internal financial investment banking group without any access to privileged details.” The brand-new restructuring plan under Fahrenheit consists of mining, institutional loans, financial investments valued at approximately $1.4 billion and $450 million in liquid crypto. The firm also shared a comparison between Fahrenheits recovery plans and the Blockchain Recovery Investment Consortium (BRIC)– a holding company affiliated with the Winklevoss-owned Gemini Trust– wind-down plans. The overall healing under the organized wind-down concerns $3.519 billion, which surpasses the overall possessions readily available at $3.417 billion. This disparity is accounted for by the variable cost.Comparison between Fahrenheit strategy and BRIC unwind. Source: TwitterThe return to retail debtors is around $339 million. Bank of the Future estimates suggests the healing is about 65% for both choices, which might increase to about 75%, presuming 10% of claims are unclaimed. 41.4% of recovery under the Fahrenheit plan remains in equity, with the staying 58.6% in liquid crypto. Only 12.4% of recovery under BRIC organized wind down is in equity, with the staying 87.6% in liquid crypto.Related: Celsius adds over 428K stETH to Lidos lengthening withdrawal queueDixon said financial institutions should battle to get out of the personal bankruptcy procedures prior to the end of 2023, or before the price of BTC and ETH struck the approximated mark. He added that to avoid “another carpet pull, we will require to battle tough versus it if it comes up.” It is really crucial that we get out of Chapter 11 prior to #Bitcoin & & $ETH method these numbers to avoid another rug pull that we will need to combat hard versus if it comes up. Estimation of the price of #BTC and $ETH (50/50 basis) at which declares might be paid completely: $BTC … pic.twitter.com/PITQV3pIGM— Simon Dixon (@SimonDixonTwitt) July 19, 2023

A brand-new estimate by the Bank of the Future recommends that the struggling crypto lender could likely pay back the claims if the rate of Bitcoin (BTC) and Ether (ETH)– 2 possessions held by the firm– doubled their current market prices.Simon Dixon, the creator of Bank of the Future– a crypto-centered investment company– tweeted the approximated rate BTC and ETH would need to reach for Celsius to repay all its claims and keep all other properties. Based on the last deal with the Fahrenheit consortium, which won the quote to get the possessions of Celsius in May, if the BTC price touches $54,879 and the ETH cost reaches $3,750, Celsius could pay back all claims from the price appreciation of both possessions. Only 12.4% of recovery under BRIC organized wind down is in equity, with the remaining 87.6% in liquid crypto.Related: Celsius includes over 428K stETH to Lidos extending withdrawal queueDixon stated lenders must combat to get out of the bankruptcy procedures prior to the end of 2023, or prior to the price of BTC and ETH struck the approximated mark.

Collect this short article as an NFT to maintain this moment in history and reveal your support for independent journalism in the crypto space.Magazine: Tiffany Fong flames Celsius, FTX and NY Post: Hall of Flame

Related Content

- From walls to wallets: Barcelona graffiti artists share their love for Bitcoin

- BTC price breakout by end of August? 5 things to know in Bitcoin this week

- Crypto for Beginners: A Comprehensive Guide to Understanding Digital Currencies

- Bitcoin: The Ultimate Guide to Understanding Its Growth and Potential

- Why Bitcoin Is A CDS On The Fed