Bitcoin Bollinger Bands echo move that ended in 40% January gains

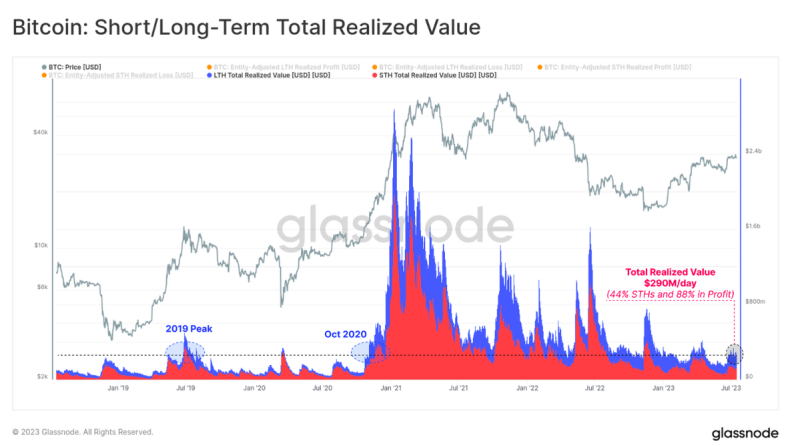

Bitcoin (BTC) is lining up a burst of volatility that might match its 40% January gains, on-chain information suggests.In the most current edition of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode revealed the tightest Bollinger Bands because the start of 2023. BTC cost due “strong moves”– but instructions unknownBTC rate has actually acted in a tight range for an entire month, using $30,000 as a centerpiece for sideways behavior.This, popular analyst Aksel Kibar states, is putting both bulls and bears to the test.”Seems like $BTCUSD is tiring lots of traders perseverance,” he summarized on July 21.”That is normally the condition you see previously strong moves. Not sure about the direction. I will stick with my distinct boundaries. I understand that increased volatility is around the corner. Record the directional move.”BTC/USD annotated chart. Source: Aksel Kibar/TwitterAccording to Bollinger Bands habits, that move ought to come quicker rather than later.The classic volatility sign is presently printing an indication that the days of rangebound BTC rate action are numbered.Bollinger Bands use basic variance around a basic moving average to determine when a possessions price is due a shift in trend.On BTC/USD, its upper and lower band are uncommonly close together at present– more compact, in fact, than at any time because Bitcoin started its 2023 advantage.”The digital asset market continues to see remarkably little volatility, with the traditional 20-day Bollinger Bands experiencing a severe squeeze,” “The Week On-Chain” commented. It added that with a series of simply 4.2%, this marked the “quietest BTC market given that the lull in early January.”At the time, Bitcoin saw a breakout which then continued throughout the month, bringing January gains to around 40%. Bitcoin Bollinger Bands Range chart (screenshot). Source: GlassnodeBitcoin hodlers funnel early 2019Continuing, Glassnode noted that at current levels, there was little by way of active selling– either for revenue or loss.Related: Bitcoin declines at 21-day trendline– How low can BTC cost go?This absence of “understood” activity comes despite the BTC cost gains given that January, and is a historically common phenomenon in periods after cost cycle lows.”This compression in volatility is matched by cyclical lows in realized earnings and loss being secured by the market,” it wrote.The amount of losses plus profits currently equates to around $290 million each day. “Whilst this is a considerable amount on a nominal basis, it is once again comparable to the 2019 peak, and to October 2020 where BTC rates were 50% lower than they currently are,” Glassnode discussed. “As such, it suggests that although the Bitcoin market cap is ~ 2x bigger today, investors who are holding big profits or losses are incredibly reluctant to spend their coins on-chain.”Bitcoin Short/Long-Term Total Realized Value chart (screenshot). Source: GlassnodeMagazine: Should you orange pill children? The case for Bitcoin kids booksThis short article does not contain financial investment guidance or recommendations. Every investment and trading move includes danger, and readers must conduct their own research when deciding.

Bitcoin (BTC) is lining up a burst of volatility that might match its 40% January gains, on-chain information suggests.In the latest edition of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode exposed the tightest Bollinger Bands because the start of 2023. BTC rate due “strong moves”– but instructions unknownBTC price has acted in a tight variety for an entire month, utilizing $30,000 as a focal point for sideways behavior.This, popular expert Aksel Kibar says, is putting both bulls and bears to the test. Source: Aksel Kibar/TwitterAccording to Bollinger Bands habits, that move need to come quicker rather than later.The traditional volatility indicator is presently printing an obvious indication that the days of rangebound BTC price action are numbered.Bollinger Bands utilize standard deviation around a simple moving average to determine when a propertys price is due a shift in trend.On BTC/USD, its upper and lower band are uncommonly close together at present– more compact, in truth, than at any time since Bitcoin started its 2023 upside. Source: GlassnodeBitcoin hodlers funnel early 2019Continuing, Glassnode noted that at present levels, there was little by method of active selling– either for profit or loss.Related: Bitcoin turns down at 21-day trendline– How low can BTC price go?This absence of “recognized” activity comes in spite of the BTC cost gains since January, and is a historically common phenomenon in durations after rate cycle lows.

Related Content

- FTX seeks to reverse payments made to Shaq, Naomi Osaka and Miami Heat

- Australia’s $145M exchange scandal, Bitget claims 4th, China lifts NFT ban: Asia Express

- Grayscale GBTC discount falls to 16% as markets bet on Bitcoin ETF approval

- Bitcoin Growth Forecast: 5 Powerful Strategies for 2025 Success

- Weekly close risks BTC price ‘double top’ — 5 things to know in Bitcoin this week