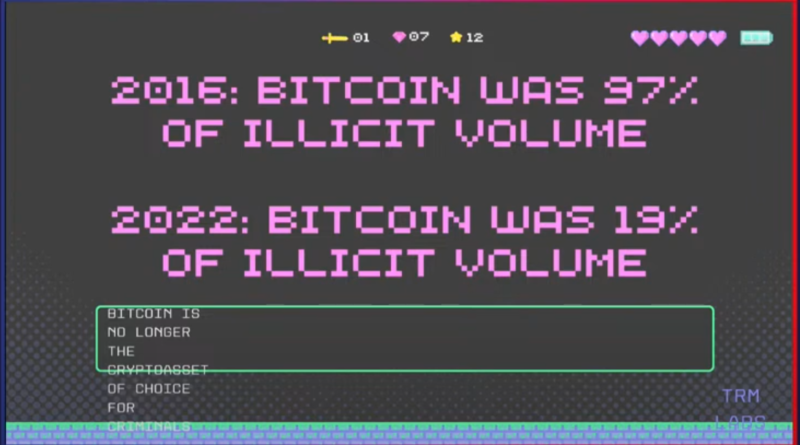

Bitcoin no longer asset of choice for criminals – former Elliptic crypto advisor

Criminal activity in Web3 is moving away from Bitcoin (BTC) to stablecoins while ponzi schemes remain prevalent, according to Elliptics previous head of technical crypto advisory.Tara Annison shared the newest insights from the murky world of cryptocurrency-related criminal activity throughout a discussion on the final day of EthCC in Paris, dealing with a broad range of ways in which digitals possessions are either helping with criminal offense or being utilized to wash funds. As the cryptocurrency industry has matured, the establishment of decentralized finance (DeFi) procedures, mixing stablecoins and services present new avenues for criminals to explore.Source: Tara Annison.Criminals have actually shifted towards using dollar-denominated assets, like USD Coin (USDC), as their easy accessibility and ability to be laundered through decentralized exchanges (DEXs). They utilize a coin swap service, they use a mixer, they utilize a bridge, all generally to attempt and throw blockchain analytics firms off the path.” Annison also touched in the increasing use of cryptocurrencies to evade sanctions and finance terrorist activities, highlighting TRON and USDT as popular properties for illegal use.The development of metaverse experiences has also seen the space draw in dubious actors.

Crime in Web3 is shifting away from Bitcoin (BTC) to stablecoins while ponzi plans stay widespread, according to Elliptics former head of technical crypto advisory.Tara Annison shared the most current insights from the dirty world of cryptocurrency-related criminal activity throughout a discussion on the final day of EthCC in Paris, addressing a variety of ways in which digitals properties are either facilitating criminal activity or being utilized to launder funds. According to Annison, Bitcoin is no longer the cryptocurrency of option to perform illicit activities or wash money. As the cryptocurrency industry has actually developed, the establishment of decentralized financing (DeFi) protocols, mixing stablecoins and services present brand-new avenues for lawbreakers to explore.Source: Tara Annison.Criminals have moved towards using dollar-denominated assets, like USD Coin (USDC), as their simple availability and capability to be washed through decentralized exchanges (DEXs). “The criminals utilize that as a target point. Its also super easy to wash through Dexs. Theres deep liquidity, really great volume, so thats quite fretting.” Annison highlighted a prospective silver lining from a law enforcement perspective, noting that centralized issuers like Circle could freeze particular USDC tokens before criminals are able to “exit ramp out of the asset” into fiat through DEXs or centralized exchanges.” What were seeing now is an increased variety of accounts with USDC and USDC being blacklisted, and these are frozen funds that the wrongdoers now cant access.” Ponzi and pyramid plans stay a function of the sector, with Annison keeping in mind that $7.8 billion were taken from unwitting victims of these kinds of scams. Related: How the IRS seized $10B worth of crypto utilizing blockchain analyticsCriminals are discovering more advanced methods to launder funds. Annison said chain switching and asset swapping prevails as bad guys attempt to hide illicit activity.” Weve seen that to the tune of about $4.1 billion. They hop throughout using a dex. They utilize a coin swap service, they utilize a mixer, they use a bridge, all essentially to attempt and throw blockchain analytics companies off the trail.” Annison stated that $1.2 billion taken from DEXs eventually ends up on centralized exchanges. In contrast to previous years, frauds in the sector are down 46%. The factor, according to Annison, is the ongoing bearish market which has actually inevitably made the sector less attractive for cybercriminals.” Theyre less hyped up, the prices are lower, so its not as profitable for crooks. So a minimum of next time were in a bear market. Do keep in mind that the scams are at least down.” Annison also touched in the increasing use of cryptocurrencies to evade sanctions and financing terrorist activities, highlighting TRON and USDT as popular assets for illegal use.The advent of metaverse experiences has likewise seen the area bring in wicked actors. Numerous criminal offenses are also emerging in virtual worlds, including phishing attacks, NFT theft, wallet polluting, and augmented reality hacks.Annisons discussion highlighted the truth of criminal activity in the sector, which will require increased watchfulness and security procedures to secure users and fight illegal activities.Magazine: US enforcement firms are turning up the heat on crypto-related criminal activity

Related Content

- Canadians are moving past crypto speculative trading: Coinbase country head

- Gold Miners Outshine Bitcoin Miners To Start 2022. Will It Last?

- Bitcoin price must take $26K, trader says after ‘textbook short squeeze’

- Girl Gone Crypto thinks ‘BREAKING’ crypto news tweets are boring: Hall of Flame

- Crypto Biz: Binance Connect goes dark, Prime Trust is bust and PayPal unveils Crypto Hub