Bitcoin investor sentiment slumps to a new low, even as macro and equities show improvement

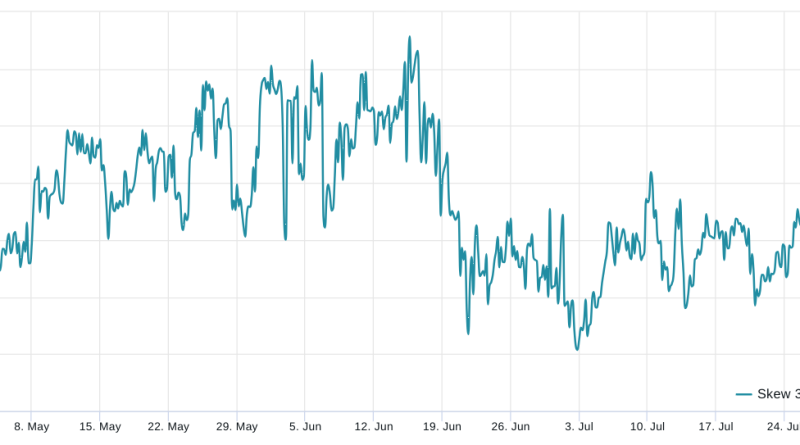

Bitcoin (BTC) surpassed the $30,000 resistance on June 21, or 40 days earlier, after a notable 19.5% gain in a week. Because then, it has been moving within a variety filled with occasional moderate corrections and BTC price trades near $29,300. While these debt consolidation periods prevail in standard markets, they tend to make crypto financiers rather anxious.As Bitcoins price repeatedly fails to break the $31,000 level, traders are ending up being significantly tense and their belief is worsening. This pattern might reverse suddenly, regardless of any relevant news or macroeconomic elements that may support an upward relocation andcrypto traders feelings can amplify positive and unfavorable price swings, causing blissful and fear-led rate action. Bitcons low volatility sessions have traders anxious The increased stress and anxiety amongst traders is partially due to Bitcoins historic volatility, which used to be much greater than its current levels. Presently, the 33% annualized 50-day volatility is the most affordable in 6 months, contrasting sharply with the 60% or higher volatility observed for 245 days throughout 2022. Regardless of the reasoning for this shift, the recent period has been reasonably calm for Bitcoins price.To put it in viewpoint, think about that car and electrical battery manufacturer Tesla (TSLA), a top-10 global possession and part of the S&P 500 index, currently experiences a 58% annualized volatility. In contrast, graphics chipmaker NVidia (NVDA) has actually regularly shown a 70% or greater volatility for most of 2021. While some experts utilize volatility data to predict trends, its necessary to note that this sign depends on absolute rate modifications, yielding the very same outcome for both upward and down rate swings. Therefore, volatility just supplies information about the magnitude of day-to-day oscillations.However, apart from cost changes, there are other metrics that can indicate investors enjoyment or absence of interest in an asset, such as assessing its market share or market dominance.Bitcoin dominance shows decreasing interest relative to altcoinsOn July 30, Bitcoins market share in the total crypto capitalization dropped to 49.5%, the lowest figure considering that June 16. Bitcoin (BTC) dominance, % terms. Source: TradingViewThis decline can be partially credited to a favorable legal choice for Ripple Labs on July 13, which minimized regulative threats for altcoins. Industry agents think this choice will benefit crypto exchanges Coinbase and Binance in their SEC claims. The reducing dominance of Bitcoin marks a trend shift from the gains observed in between December 2022 and June 2023 when it increased from 40.2% to 52%. Lackluster network activity is another sign of unfavorable financier belief Bitcoins 1-year active supply, representing the amount of distinct BTC transacted in the tracking 12 months, reached its most affordable level given that February 2016 at 6.0 million BTC as of July 26. This information, compared to the 6.2 million BTC activity three months prior, raises issues, particularly with the potential approval of area ETFs in the U.S.Bitcoin 1-year active supply, BTC. Source: Coin MetricsThe reducing variety of Bitcoin moved on-chain might have been offset by the increased use of the Lightning Network as an alternative option. Nevertheless, this Layer 2 solution currently holds a simple $138 million in Total Value Locked (TVL) and shows a near unmoving 16,382 nodes in the past 30 days.Related: US banking advocacy group supports Sen. Warrens reestablished crypto billBitcoin choices traders are losing confidenceThe primary “worry and greed” metric for Bitcoin alternatives, the 25% delta alter, suggests that bulls are becoming less positive in time. Readings above 7% suggest traders expect a drop in Bitcoins price, while periods of excitement normally yield a -7% skew.Bitcoin 30-day choices 25% delta alter. Source: LaevitasCurrently, the 30-day metric remains flat at 1%, showing a balanced demand in between call (buy) choices and protective puts, indicating a neutral market. Nevertheless, it does show a reduced appetite amongst bulls compared to the 2% to 14% discount rate on neutral-to-bearish put (sell) options in between June 19 and July 29. This derivatives data highly supports the concept that traders have become less confident considering that the $29,500 assistance level broke.As financiers mood worsens and signs indicate increased tension, Bitcoin cost faces mounting pressure in the near term. Falling dominance, dull network activity and concerns in the choices markets all contribute to the prospective negative effect on Bitcoin cost. On a favorable note, if traders stay mindful and expect additional downward motion, the probability of extreme liquidations among leverage traders is reduced.This post is for general details functions and is not meant to be and must not be taken as legal or financial investment suggestions. The opinions, ideas, and views revealed here are the authors alone and do not always reflect or represent the views and viewpoints of Cointelegraph.

Currently, the 33% annualized 50-day volatility is the lowest in 6 months, contrasting dramatically with the 60% or higher volatility observed for 245 days throughout 2022. The decreasing dominance of Bitcoin marks a pattern shift from the gains observed in between December 2022 and June 2023 when it increased from 40.2% to 52%. Readings above 7% recommend traders expect a drop in Bitcoins rate, while periods of enjoyment normally yield a -7% skew.Bitcoin 30-day alternatives 25% delta alter. It does show a reduced appetite among bulls compared to the 2% to 14% discount rate on neutral-to-bearish put (sell) choices between June 19 and July 29.