Abracadabra proposes hiking loan interest rate by 200% to manage Curve risk

Others supported the proposition declaring it could extremely well assist the financing procedure eliminate CRV exposure.If @MIM_Spell really attempts this, I d say theres a great chance $MIM loses all $CRV determines relatively quickly.41 m MIM (61% of total mcap) is on Curve!$ SPELL #DeFi https://t.co/vpm3bH4xct— DefiMoon (@DefiMoon) August 2, 2023

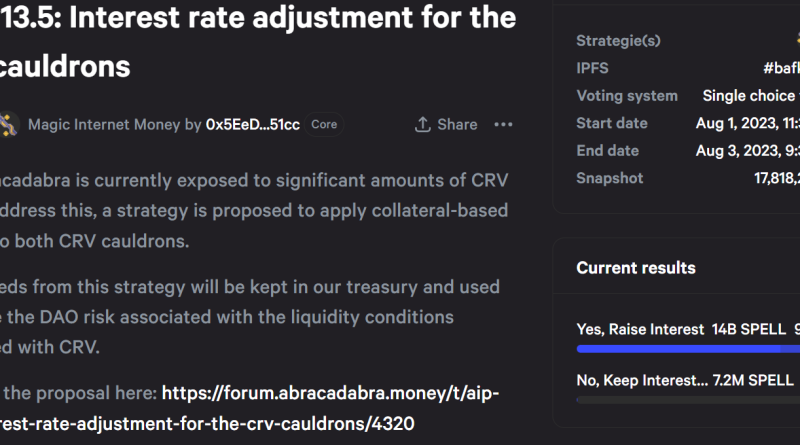

In order to address this concern a brand-new proposal has actually been made to apply collateral-based interest to both CRV cauldrons. The enhancement proposition called for an increase in the interest rate in order to minimize Abracadabras total CRV direct exposure to around $5 million borrowed MIM.Related: Ethical hacker obtains $5.4 M for Curve Finance amid exploitThe proposition intends to apply collateral-based interest similar to what the decentralized autonomous company (DAO) did with the WBTC and WETH cauldrons. The proposal noted that as the principal is paid back, the base rate would decrease.Interest rate trek proposition, Source: AbracadabraThe voting for the proposition opened on Aug. 1 and will last until Aug. 3, and at press time a mammoth 99% of the votes were cast in favor of the proposal. Abracadabra enhancement proposal ballot snapshot, Source: AbracadabraThe proposition likewise drew different responses from the crypto community consisting of Frax Finance executive Drake Evans who called it a governance carpet.

Abracadabra Money, a cross-blockchain lending platform, has actually proposed increasing the interest rate on its outstanding loans to manage dangers connected with its Curve (CRV) exposure. The proposal drew combined reactions from the neighborhood, and numerous questioned the tactic of customizing loan terms, while others called it a terrific plan to lower direct exposure to CRV.Abracadabra procedure permits users to make money by utilizing interest-bearing assets such as CRV, CVX and YFI as security to mint Magic Internet Money (MIM), a USD-pegged stablecoin. Spell is the native governance and staking token of the platform. Abracadabra is exposed to considerable amounts of CRV risk due to current exploits on the DeFi procedure, leading to a liquidity crisis. The occurrence has actually changed the liquidity conditions that caused the listing of CRV as security on Abracadabra. In order to resolve this problem a new proposition has actually been made to use collateral-based interest to both CRV cauldrons. CRV cauldrons are liquidity swimming pools on the financing protocol. The improvement proposition called for an increase in the rate of interest in order to reduce Abracadabras total CRV direct exposure to around $5 million obtained MIM.Related: Ethical hacker obtains $5.4 M for Curve Finance amidst exploitThe proposition aims to apply collateral-based interest similar to what the decentralized self-governing company (DAO) did with the WBTC and WETH cauldrons. All interest will be charged straight on the cauldrons security and will instantly move into the protocols treasury to increase the reserve aspect of the DAO. The DeFi protocol proposition estimated that for an $18 million principal loan amount, the base rate would be 200%. At this rates of interest, the loan would be totally covered within 6 months. The proposal noted that as the principal is paid back, the base rate would decrease.Interest rate hike proposition, Source: AbracadabraThe voting for the proposition opened on Aug. 1 and will last till Aug. 3, and at press time a massive 99% of the votes were cast in favor of the proposal. Abracadabra improvement proposition ballot photo, Source: AbracadabraThe proposal also drew various reactions from the crypto neighborhood including Frax Finance executive Drake Evans who called it a governance carpet. Im sorry however jacking interest rates to 200% through governance is a rug. Altering the essential terms of a loan (10x rate of interest) in a single deal is extremely bad and we ought to call it out.Very supportive to securing procedure integrity however rugging is not the way https://t.co/sqWy7R0YPq— Drake Evans (version 3) (@DrakeEvansV1) August 2, 2023

Curve founder Michael Egorov has almost $100 million in loans across numerous loaning protocols backed by 427.5 million CRV which is 47% of the blood circulation supply of the Curve token. Curve creator has 51.65 million CRV security and 14 million MIM financial obligation positions on Abracadabra.With the rate of Curve experiencing a stress test, the danger of a token dump has increased. In the meantime, a lot of the loaning protocols are trying to find methods to clear from their CRV exposure.Collect this short article as an NFT to protect this moment in history and reveal your support for independent journalism in the crypto space.Magazine: Should crypto jobs ever work out with hackers? Probably

Related Content

- Binance launches Bitcoin mining cloud services amid SEC crackdown in the US

- Bitcoin’s recovery may trigger buying in these 4 altcoins

- 100%+ BTC price gains? Bitcoin faces ‘massively overvalued’ stocks

- Celsius creditors allege Wintermute facilitated ‘wash trading’ — Report

- Crypto Biz: Binance Connect goes dark, Prime Trust is bust and PayPal unveils Crypto Hub