Bitcoin, gold and the debt ceiling — Does something have to give?

Still, some analysts and financiers argue that the U.S. debt ceiling standoff is merely a “program” because, ultimately, additional money will hit the markets.The US Debt Ceiling talks are all show.Theyre going to print the dollar into oblivion.You require to own difficult assets to secure your wealth.– MacroJack (@macrojack21) May 17, 2023

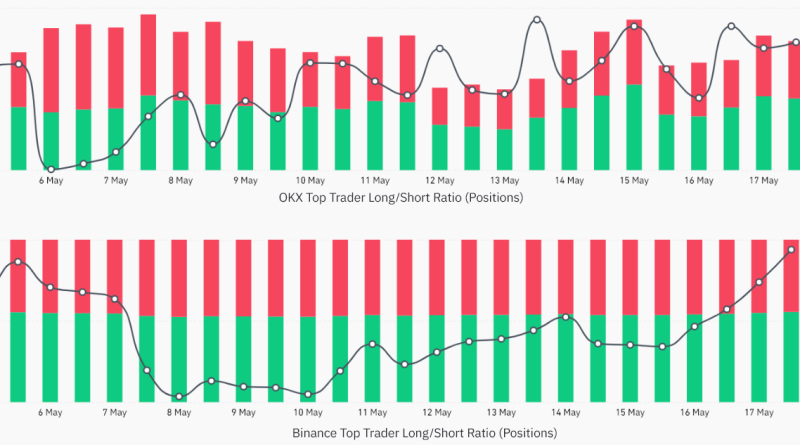

In the U.S., retail sales increased 0.5% year-over-year in April, slightly lower than anticipated but far from being an economic crisis indicator.Lets look at Bitcoin derivatives metrics to much better comprehend how expert traders are positioned in the present market environment.Bitcoin margin and futures prefer bullish momentumMargin markets supply insight into how expert traders are positioned due to the fact that they allow investors to borrow cryptocurrency to take advantage of their positions.OKX, for circumstances, offers a margin-lending sign based on the stablecoin/BTC ratio. Traders can increase their exposure by obtaining stablecoins to buy Bitcoin. Source: CoinGlassDespite Bitcoin trading down 8% considering that May 5, pro traders have just recently increased their bullish positions to their highest level in two weeks, according to the long-to-short indicator.For instance, the ratio for OKX increased from 1.08 on May 12 to 1.25 on May 18. In other words, Bitcoins market structure is bullish, so odds favor a rally toward $28,000 if the U.S. debt ceiling stand-off continues.This article is for general details purposes and is not meant to be and must not be taken as legal or investment guidance.

Traders can increase their direct exposure by borrowing stablecoins to buy Bitcoin. Source: CoinGlassDespite Bitcoin trading down 8% given that May 5, pro traders have actually recently increased their bullish positions to their highest level in two weeks, according to the long-to-short indicator.For instance, the ratio for OKX increased from 1.08 on May 12 to 1.25 on May 18. In other words, Bitcoins market structure is bullish, so odds favor a rally toward $28,000 if the U.S. debt ceiling stand-off continues.This short article is for general information functions and is not meant to be and ought to not be taken as legal or investment recommendations.

This post does not consist of investment recommendations or suggestions. Every investment and trading move includes danger, and readers ought to conduct their own research when making a choice.

Related Content

- How AI is changing the way humans interact with machines

- Binance customers represented by entity, citing inadequate representation

- Kraken looking to ‘solve’ industry challenges amid layer-2 rumors

- Bitcoin can still hit $19K, warns trader ahead of BTC price ‘big move’

- What Black Investors Can Teach You About Bitcoin