Bitcoin price falls under $30K as macro and regulatory worries take center stage

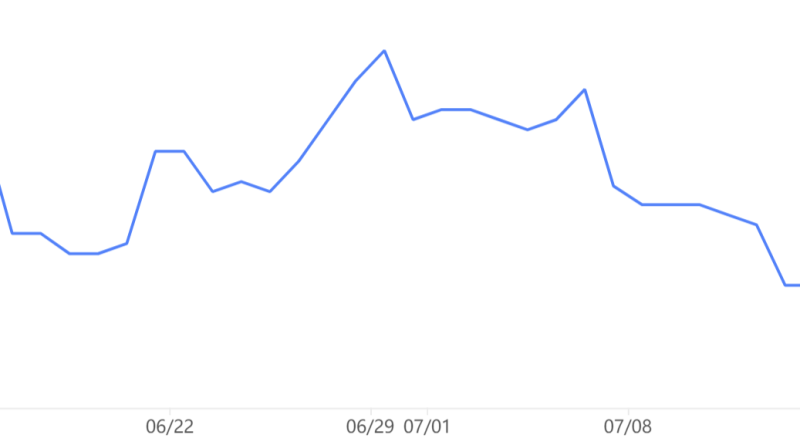

On the derivatives side, Bitcoin futures show increased demand, but Asian markets are slowing down.Bitcoin quarterly futures generally trade at a slight premium compared to spot markets, showing sellers desire to get more money in exchange for delaying settlement. Healthy markets typically exhibit BTC futures agreements trading at a 5% to 10% annualized premium, a situation known as contango, which is not distinct to crypto markets.Bitcoin 3-month futures premium. Source: LaevitasBetween July 14 and July 17, BTC futures kept a neutral-to-bullish 7% premium, surpassing the 5% threshold.

On the derivatives side, Bitcoin futures show increased need, but Asian markets are slowing down.Bitcoin quarterly futures usually trade at a small premium compared to spot markets, reflecting sellers willingness to receive more cash in exchange for delaying settlement. Healthy markets usually exhibit BTC futures contracts trading at a 5% to 10% annualized premium, a scenario understood as contango, which is not unique to crypto markets.Bitcoin 3-month futures premium. Source: LaevitasBetween July 14 and July 17, BTC futures maintained a neutral-to-bullish 7% premium, going beyond the 5% threshold.

Related Content

- Crypto developer commits $2M rug pull fraud to fuel gambling addiction

- Bloomberg Intelligence Report: Bitcoin Is Becoming A Risk-Off Asset As Inflation Rises

- Over $204M was lost in Q2 DeFi hacks and scams: Report

- FDIC alleges Cross River engaged in ‘unsafe’ lending practices

- Bitcoin options: How will tomorrow’s $4.7B expiry impact BTC price?