Ethereum price outlook weakens, but ETH derivatives suggests $1.6K is unlikely

” ETH price disregards banking crisisCuriously, the VIX indicator, which determines how traders are pricing the risks of extreme cost oscillations for the S&P 500 index, reached its most affordable level in 18 months at 15.6% on May 1. It is worth noting that overconfidence is the primary motorist for surprise moves and large liquidations in derivatives markets, meaning low volatility does not always precede durations of cost stability.The financial environment has aggravated substantially after the U.S. reported its very first quarter gross domestic item (GDP) development of 1.1%, below the 2% market consensus. Ethereum derivatives show modest confidenceEther quarterly futures are popular among whales and arbitrage desks, and they normally trade at a slight premium to find markets, indicating that sellers are asking for more cash to postpone settlement for a longer period.As an outcome, futures agreements on healthy markets need to trade at a 5% to 10% annualized premium– a scenario understood as contango, which is not special to crypto markets.Ether 3-month futures annualized premium. Bullish markets, on the other hand, tend to drive the skew metric listed below -8%, indicating that bearish put alternatives are in less demand.Ether 60-day choices 25% delta alter: Source: LaevitasThe 25% alter ratio is currently at 1 as protective put choices are trading in line with the neutral-to-bullish calls.

” ETH cost neglects banking crisisCuriously, the VIX indicator, which measures how traders are pricing the threats of extreme cost oscillations for the S&P 500 index, reached its most affordable level in 18 months at 15.6% on May 1. It is worth noting that overconfidence is the primary driver for surprise relocations and large liquidations in derivatives markets, suggesting low volatility does not always precede durations of price stability.The economic environment has intensified considerably after the U.S. reported its first quarter gross domestic item (GDP) growth of 1.1%, below the 2% market agreement. Investors are now pricing higher chances of an international recession as the U.S. Federal Reserve is expected to raise interest rates above 5% on May 3.

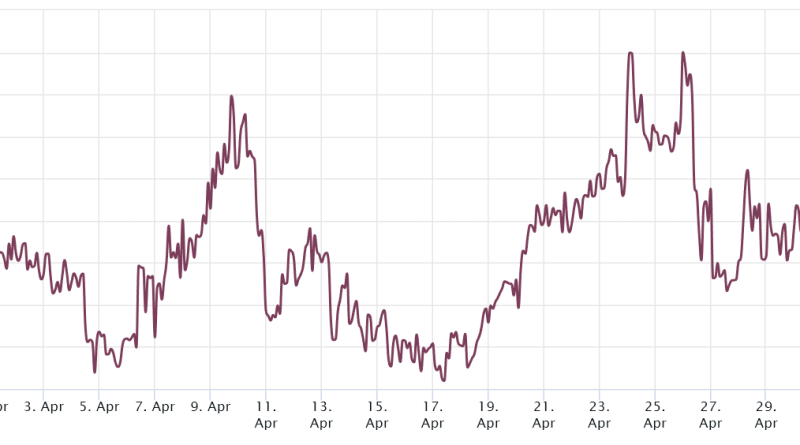

If the U.S. financial obligation level continues to increase while rates of interest stay high, the federal government will be forced to increase financial obligation payments, further pressing its fragile fiscal situation. Such a circumstance should be favorable for limited properties, but what can Ethereum derivatives metrics inform us about expert traders threat appetite? Lets take a look. Ethereum derivatives display modest confidenceEther quarterly futures are popular among whales and arbitrage desks, and they usually trade at a small premium to find markets, suggesting that sellers are requesting for more cash to postpone settlement for a longer period.As an outcome, futures contracts on healthy markets should trade at a 5% to 10% annualized premium– a scenario called contango, which is not distinct to crypto markets.Ether 3-month futures annualized premium. Source: Laevitas.chSince April 19, the Ether futures premium has actually been stuck near 2%, suggesting that professional traders hesitate to turn neutral despite ETH rate screening $1,950 resistance on April 26. The absence of demand for take advantage of longs does not always imply a cost decline. As an outcome, traders need to examine Ethers choices markets to learn how whales and market makers value the possibility of future price movements.Related: Venmo will allow fiat-to-crypto payments in MayThe 25% delta skew shows when market makers and arbitrage desks overcharge for benefit or drawback protection. In bearish market, options traders increase their odds of a rate drop, triggering the alter sign to increase above 8%. Bullish markets, on the other hand, tend to drive the alter metric listed below -8%, indicating that bearish put choices are in less demand.Ether 60-day alternatives 25% delta skew: Source: LaevitasThe 25% alter ratio is currently at 1 as protective put alternatives are trading in line with the neutral-to-bullish calls. Thats a bullish indicator given the six-day 7.8% correction given that ETH price failed to break the $1,950 resistance. Far, Ethereums cost has failed to display strength while the baking sector developed a huge chance for decentralized monetary systems to showcase its openness and resilience versus traditional markets. On the other hand, derivatives metrics show no sign of extreme worry or leveraged bearish bets, indicating low chances of retesting the $1,600 support in the near term.This post does not consist of investment recommendations or suggestions. Every financial investment and trading move involves threat, and readers should conduct their own research when deciding.

Related Content

- Can Sony and Microsoft bring blockchain to gaming consoles?

- Bitcoin-centric AI language model aims to drive BTC education and adoption

- SEC’s Gensler claims ‘parallels’ between Binance and FTX, yet one wasn’t sued

- Price analysis 7/14: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, LTC, MATIC, DOT

- End of ‘Uptober’ targets $40K BTC price — 5 things to know in Bitcoin this week