FASB rules ‘eliminate the poor optics’ that shied firms from crypto: Analyst

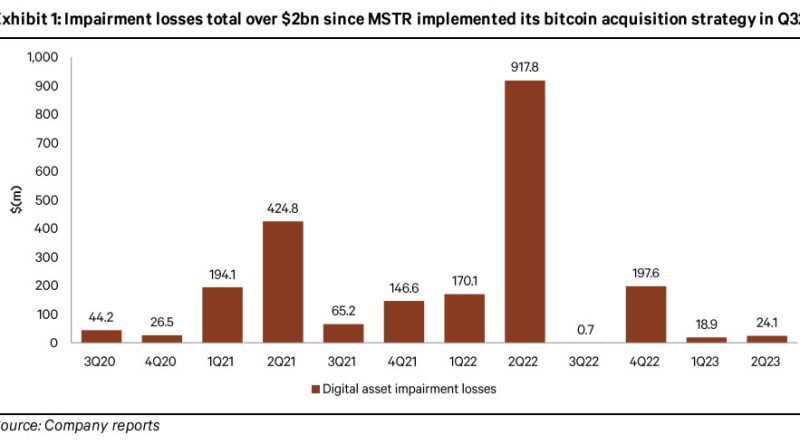

The United States Financial Accounting Standards Boards brand-new rules for crypto accounting will eliminate the “poor optics” that pestered companies holding digital properties, according to experts from Berenberg Capital.On Sept. 6, the U.S. Financial Accounting Standards Board (FASB) approved new guidelines for cryptocurrencies with regard to how business report the reasonable value of their holdings on their balance sheets.In a follow-up analyst note from Berenbergs senior equity research expert Mark Palmer, the analyst argued the modifications would be particularly useful for companies such as Microstrategy, who will soon be able to report their digital property holdings each quarter without having to understand impairment losses.” The change ought to assist MicroStrategy and other companies that hold digital assets to eliminate the poor optics that have actually been created by problems losses under the guidelines that the FASB has had in place,” it wrote. Related: MicroStrategy returns to benefit and now owns $4.4 B worth of BitcoinAccording to Berenbergs note, MicroStrategy CEO Michael Saylor oncesaid that the primary factor more firms have actually not adopted a BTC financial investment strategy is because of the FASBs “hostile” and “punitive” treatment of crypto.

Related Content

- Bitmain to start shipping new Bitcoin Antminer T21 in January 2024

- The Agenda podcast chats with Energy Web on how to fight climate change with help of blockchain

- Bitcoin Lightning company River raises $35M amid ‘new wave of institutional adoption’

- Community-powered crypto trading: CryptoRobotics joins Cointelegraph Accelerator

- SwirlLend rugs on new Coinbase layer 2 Base as large number of scammers reported