The US Dollar Is Soaring While The GDP Contracts

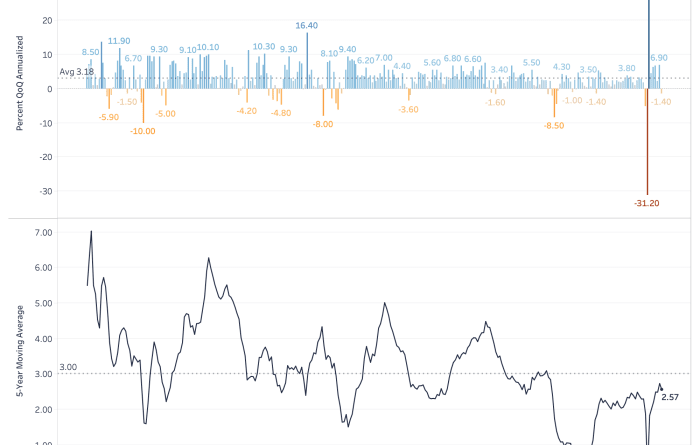

Revisiting The Dollar Bitcoin Relationship In more recent issues, weve highlighted that over the last few months, bitcoins cost has actually been a function of larger macroeconomic conditions of rising yields and credit unwinding resulting in increased equity market volatility and increasing U.S. dollar strength.As of late, the Dollar Currency Index (DXY) which tracks the relative strength of the U.S. dollar measured against other crucial global currencies, is striking new 20-year highs as major currencies like the euro, Japanese yen and British pound continue to compromise. The current increase comes as the Bank of Japan triples down on their yield curve control efforts, buying an unrestricted quantity of 10-year bonds every organization day to cap yields at 0.25%. DXY strength compared to other deteriorating currenciesSo what does a rising DXY imply for bitcoin and other assets? Even with the dollar cheapening versus genuine items, services and financial properties, all debtors are required to offer USD-denominated possessions to cover liabilities throughout deleveraging events. Today, we also get the latest U.S. Q1 2022 gross domestic item (GDP) data revealing that the economy contracted by 1.4% compared to 1.1% expansion agreement. The growth degeneration throughout significant global economies that will usher in a market routine shift to a more deflationary environment later this year has actually been an essential assumption in our base case to anticipate more downside for danger assets in 2022. If were to see wider market expectations for development cut even more this year then that modification is likely more disadvantage for danger properties. U.S. GDP contracting with the deleveraging of the economyFinal NoteIn our view, the worst is yet to play out for markets and bitcoin. That said, the kind of credit relaxing and deleveraging were facing today is among the essential reasons that we anticipate the case for bitcoin to grow in the market as these events unfold..