JPMorgan Sees 28% Upside For Bitcoin: Report

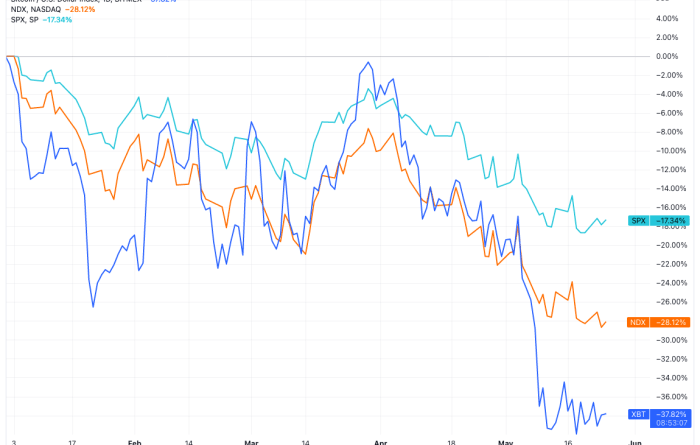

Banking giant JPMorgan said in a note Wednesday that bitcoin and cryptocurrencies are now amongst its preferred “alternative” investments, Markets Insider reported.Assets considered as dangerous, which typically consists of bitcoin in the minds of professional and institutional investors, have actually plunged in 2022 amid tighter monetary policies and several decades-high inflation numbers in the U.S. and around the world.Bitcoin and equities have broadly toppled so far this year against a background of less liquidity on the marketplace and low potential customers for the Russian-Ukrainian war to come to a close anytime soon. Image source: TradingView.However, Bitcoins high sell-off, in addition to that of other cryptocurrencies, has actually been more profound that in other alternative investments such as private equity, personal debt, and property, JPMorgan reportedly said. For that reason, the bank pictures more room for rebound in the “digital assets” class than in other alternative possessions.”We therefore replace realty with digital assets as our favored alternative property class together with hedge funds,” the banks strategists composed, per the report.JPMorgans strategists reportedly said in the note that the bank was sticking to its view that $38,000 was a reasonable price for bitcoin– about 27.5% greater than its $29,798 price at press time on Wednesday early morning. Bitcoins affordable evaluation becomes part of the reason why the bank has a more optimistic outlook for the digital currency going forward.”The past months crypto market correction looks more like capitulation relative to last January/February and going forward we see upside for bitcoin and crypto markets more usually,” the note said, per the report.Despite the greater beauty of the sector, JPMorgan reportedly said in the note that it has changed Bitcoin and cryptocurrencies from an “obese” ranking to a “underweight” one– meaning that the bank is now less eager on the asset class and suggests a lower direct exposure in an investment portfolio.