Bitcoin sell-off next? Binance BTC balance shoots up $1.5B in 1 month

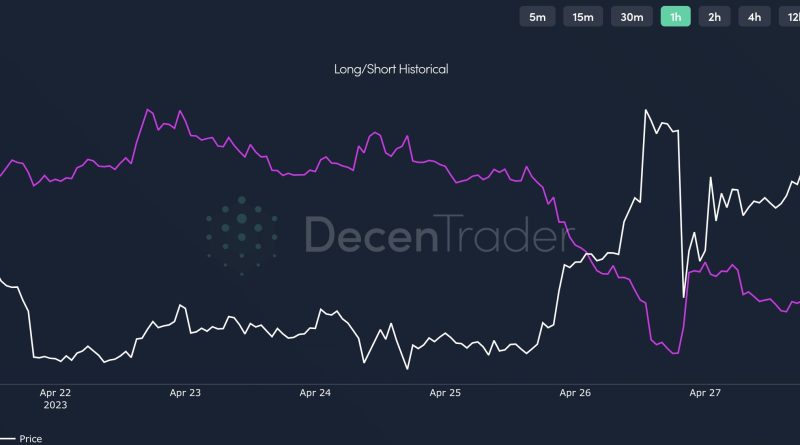

Bitcoin (BTC) traders might be preparing for a sell-off as information reveals tens of countless coins moving to exchanges.The most current figures from on-chain monitoring resource Coinglass validate that global trading volume leader Binances BTC balance increased by over 50,000 BTC ($1.5 billion) in the past 30 days.Binance takes lions share of exchange BTC balance increaseWith BTC/USD setting multi-month highs frequently given that mid-March, the temptation to cost both long-term (LTHs) and short-term holders (STHs) has no doubt increased.As Cointelegraph reported, actual selling pressure has thus far remained soft by historic standards, however on-chain information suggests that this might easily change.According to Coinglass, Binance alone now has 51,000 BTC more on its books than 30 days earlier. Versus Match 10, when BTC/USD briefly challenged $20,000 assistance, its balance is up by practically 100,000 BTC, separate data from analytics platform CryptoQuant confirms.Versus Match 10, when BTC/USD briefly challenged $20,000 assistance, its balance is up by practically 100,000 BTC, different information from analytics platform CryptoQuant confirms.Binance BTC balance vs. BTC/USD chart. Source: CryptoQuantWhats more, as big as those numbers seem, the previous week dwarfs the rate at which funds have actually gone into the exchanges wallets, with the balance tally up 22,000 BTC in the previous 7 days alone.Binance, with the largest trading volume of any exchange– the past 24 hours aloneworth over $10 billion– is something of an outlier. Other significant exchanges have in reality lost BTC or seen unimportant balance increases.Aggregate increases over 30 days to April 28 thus total around 14,000 BTC, with the combined overall holdings of the exchanges tracked by Coinglass now at 1.919 million BTC.Bitcoin exchange BTC balance vs. BTC/USD chart. Source: CoinglassBears wager on $30,000 BTC rate ceilingInvestor routines seen in current weeks perhaps increase pressure on bulls to turn $30,000 to support and continue increasing. Related: Smart cash eyes BTC bull run: 5 things to understand in Bitcoin this weekThe area around that level is the site of record historic deal volume, making the significance of $30,000 more than simply psychological.The existing state of liquidity across exchanges tracked by trading suite Decentrader on the other hand reveals that $35,000 is a crucial zone for liquidating leveraged BTC brief positions.BTC/ USD liquidity map (screenshot). Source: DecentraderIn part of ongoing market analysis, Decentrader noted that in spite of BTC/USD recovering from local lows to trade near $29,500 on the day, bets on $30,000 remaining out of reach as support were continuing to pile up.”Long Short ratio now revealing that there are more shorts than longs,” it summed up to Twitter fans. “This is at the same time as weve seen almost $1 billion in Open Interest return, suggesting a lot of people are shorting the $30k resistance.”Bitcoin long/short ratio chart. Source: Decentrader/ TwitterMagazine: Shirtless shitposting and searching SBF on the meme streets: Gabriel Haines, Hall of FlameThis short article does not contain investment suggestions or recommendations. Every investment and trading move includes danger, and readers should perform their own research when making a decision.