SEC crackdown on crypto staking in the US could boost decentralization

Ethereum staking is getting tricky for numerous U.S.-based validators as staking service companies, particularly centralized exchanges, are combating a regulatory battle with the Securities and Exchange Commission (SEC). In February, Kraken crypto exchange settled with the SEC for $30 million and closed its staking services for U.S customers. The SEC declared that the service qualified as a security and that Kraken should acquire the required license to operate.Today we charged Kraken with stopping working to sign up the deal and sale of their crypto asset staking-as-a-service program, where investors move crypto assets to Kraken for staking in exchange for advertised annual investment returns of as much as 21 percent.

While it may help decentralization, the SECs stance on crypto staking might imply problem for U.S.-based company. It remains to be seen whether firms like Coinbase uproot and move abroad, desert substantial market share in the domestic market, or make efforts to comply with SEC guidance and U.S. securities laws.

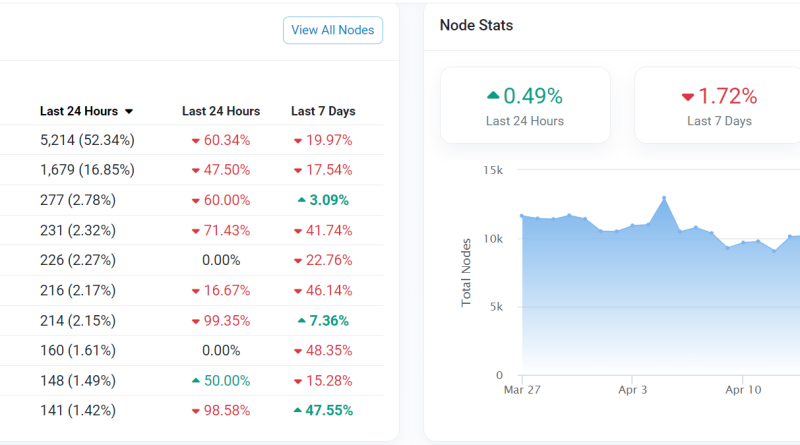

Coinbase– one of the very first crypto exchanges to go public in the U.S.– also offers staking services and is attempting to force the SEC to respond to a petition it submitted concerning assistance for cryptocurrencies.Coinbase CEO Brian Armstrong claimed that the SECs efforts to curtail staking service providers would prohibit retail staking in the United States. “If overseas exchanges with no Know Your Customer or Anti-Money Laundering compliance end up being major beneficiaries of the SEC cracking down on regulated, domestic, central exchanges, customer protection might be the least most likely outcome,” he said.The rise of decentralized stakingWhile U.S. regulators are securing down on staking services, crypto supporters are attempting to persuade regulators that high-yield financing interests used by centralized entities and staking benefits on the Ethereum blockchain are not the same.Staking crypto on a blockchain like Ethereum contributes to everyday deal verification. On the other hand, the SEC is looking to brand all kinds of staking services under a standard banner, Konstantin Boyko-Romanovsky, CEO of staking service supplier Allnodes, informed Cointelegraph.Boyko-Romanovsky said prohibiting centralized exchanges from using staking services would even more improve decentralization. He also kept in mind that the federal governments approach might suppress adoption as lots of newcomers to crypto in the U.S. rely on central entities such as Coinbase for staking services.He noted that staking pools may become more popular amongst retail stakers, explaining:” Staking swimming pools will most likely experience an increase in involvement from the United States, as the concept of staking pools equalizes access to staking opportunities and associated benefits. It would likely benefit consumers more than trying to require crypto instruments into existing fiat currency molds,” he said.Recent: What the Gensler hearing suggests for US crypto policy and policyThe problems of central staking services may work in favor of decentralized staking services and staking pools.

Coinbase– one of the very first crypto exchanges to go public in the U.S.– likewise offers staking services and is trying to require the SEC to answer a petition it filed relating to assistance for cryptocurrencies.Coinbase CEO Brian Armstrong declared that the SECs efforts to cut staking service suppliers would restrict retail staking in the United States. On the other hand, the SEC is looking to brand name all kinds of staking services under a basic banner, Konstantin Boyko-Romanovsky, CEO of staking service supplier Allnodes, informed Cointelegraph.Boyko-Romanovsky stated prohibiting centralized exchanges from offering staking services would even more enhance decentralization. He likewise kept in mind that the governments method might stifle adoption as numerous newbies to crypto in the U.S. rely on centralized entities such as Coinbase for staking services.He noted that staking swimming pools may become more popular amongst retail stakers, discussing:” Staking swimming pools will most likely experience a boost in participation from the United States, as the concept of staking swimming pools equalizes access to staking chances and associated rewards.