Coinbase stock will be ‘weighed down’ until US rules are clear: Citi

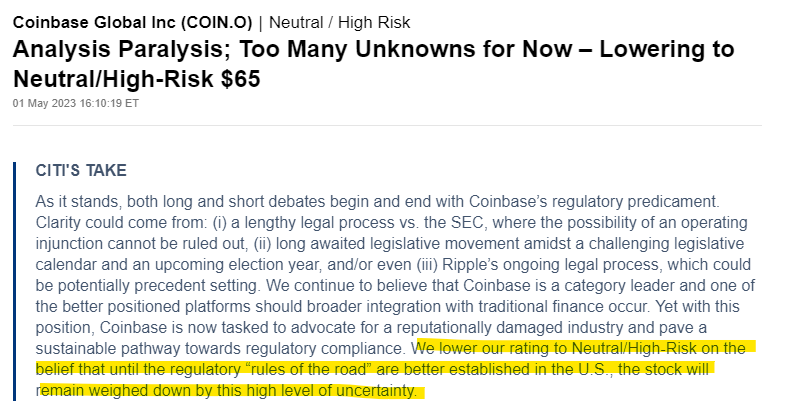

Crypto exchange Coinbases stock price will continue to be “weighed down” up until regulators develop the legal “rules of the road” in the United States, according to investment analysts from Citi.As per reports on May 1, the financial investment bank downgraded shares of the crypto exchange from “Buy” to “Neutral” and decreased its cost target– citing “too lots of unknowns” as the business fights it out with regulators. Screenshot of the analyst note from Citi. Source: Twitter” Until the regulatory guidelines of the road are better established in the U.S., the stock will remain weighed down by this high level of uncertainty,” Citi analyst Peter Christiansen wrote in a May 1 note.In March, Coinbase divulged it had actually gotten a Wells notification from the Securities and Exchange Commission (SEC) over possible offenses of securities laws– signaling possible future enforcement action. In April, it shot back at the SEC, submitting a federal court action engaging the SEC to offer clarity into the regulative treatment of particular digital assets. Later on in the month, Coinbase CEO Brian Armstrong and Chief Legal Office Paul Grewal released a public action to the March Wells notice on YouTube. 1/ Today were sharing our “Wells action” to the SEC. As part of our action, @iampaulgrewal and I took a seat to explain why were confident in the realities and on the law, and why a Wells notification is not in the finest interest of the US. https://t.co/zkNaWGgtcK— Brian Armstrong (@brian_armstrong) April 27, 2023

“As it stands, both long and short disputes begin and end with Coinbases regulative situation,” said Christiansen, noting there could be a few ways the regulative scuffle could play out: “Clarity might come from: (i) a lengthy legal process vs. the SEC, where the possibility of an operating injunction can not be ruled out, (ii) long-awaited legal movement amidst a challenging legislative calendar and an upcoming election year, and/or even (iii) Ripples continuous legal procedure, which might be possibly precedent setting,” the expert wrote. The expert noted that the most recent SEC developments do not suggest that the celebrations are close to any resolution. Related: Coinbase is planning to establish crypto trading platform outside United States: ReportAt the time of writing, Coinbase is trading at $51.32, down 58.5% over the past year, as per Yahoo Finance.Coinbase share cost over a year duration. Source: GoogleItsstock price slumped around 16% on March 22 after it divulged it got the Wells notice. The business has actually recently ended up being the target of 2 proposed class action lawsuits, one of which declares it breached personal privacy laws in Illinois over its collection of consumer biometrics, and the other alleging particular executives made money from expert details when the company went public. Magazine: Crypto guideline– Does SEC Chair Gary Gensler have the last word?