Examining global successes and challenges in regulating crypto: Report

Vietnam forbade the usage of Bitcoin (BTC) and other similar cryptocurrencies as payment methods.South and North AmericaOn the other hand, the United States has no overarching regulatory structure for cryptocurrencies. The Securities and Exchange Commission has actually taken a specific interest in the space and has actually brought a number of high-profile enforcement actions against business that have violated securities laws in relation to their crypto offerings.In South America, cryptocurrency guideline is still in its early phases, with each nation taking a various technique toward the emerging technology. In contrast, France has actually executed a tax regime that is beneficial to cryptocurrency deals, as just transforming crypto into fiat currency, understanding gains surpassing 305 euros ($337) from the disposal of possessions, and obtaining crypto through mining are taxable events.Exploring the potential customers Regulating crypto is tough due to its decentralized nature, however an international regulative body for crypto could assist.

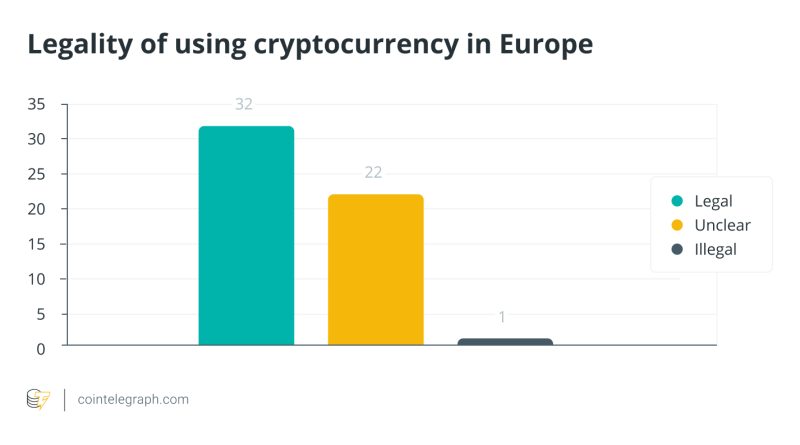

The usage and popularity of cryptocurrencies have considerably increased in current years, however their decentralized nature makes them hard to control, and the absence of a clear framework has led to concerns about money laundering, terrorist financing and customer protection. Over 90 nations have actually introduced cryptocurrency policies since 2014, with 28 embracing crypto-related laws in 2022. The Cointelegraph Research Blockchain Regulation Database provides a summary of the legal landscape surrounding blockchain and cryptocurrency worldwide along with the guidelines that apply to various activities. Through its user-friendly interface, the database provides details on matters such as the legal status of crypto in several jurisdictions, the most recent news and updates, and compliance help with Anti-Money Laundering (AML) and Combating the Financing of Terrorism requirements. Its upgraded weekly and reviewed monthly for perfect data precision, meaning it can be an useful tool for those included in the crypto space.Explore the Cointelegraph Research Regulation Database reportThe regulative landscape for crypto differs widely throughout the globe. Nations like Japan and Switzerland have actually developed clear rules around cryptocurrencies. Japan has actually been acknowledged as “well established” and an “early mover” in crypto policy, while Switzerland updated its Financial Market Supervisory Authority AML ordinance in November 2022 to prevent big payments from being split to prevent identity checks.AsiaSouth Korea has executed a law to manage virtual assets under which all crypto company need to register with financial regulators and adjust their AML and Know Your Customer (KYC) systems. The countrys Ministry of Justice likewise prepares to introduce a “Virtual Currency Tracking System” in 2023 to combat money laundering and establish an independent tracking system in the 2nd half of the year.China adopted a more powerful stance by prohibiting preliminary coin offerings, a frequently utilized approach to raise funds for cryptocurrency endeavors. The Chinese federal government has actually taken procedures to manage the crypto exchange and mining industries, expressing issues over monetary instability and illegal activities. Vietnam forbade the usage of Bitcoin (BTC) and other comparable cryptocurrencies as payment methods.South and North AmericaOn the other hand, the United States has no overarching regulative structure for cryptocurrencies. Nevertheless, the Securities and Exchange Commission has taken a particular interest in the space and has actually brought a number of prominent enforcement actions against business that have actually breached securities laws in relation to their crypto offerings.In South America, cryptocurrency policy is still in its early phases, with each nation taking a various approach towards the emerging technology. On May 5, 2022, the Central Bank of the Argentine Republic (BCRA) provided a declaration explicitly specifying that banks are restricted from facilitating crypto transactions on behalf of customers or providing digital property trading services to consumers. The Colombian government, in turn, has taken a more proactive approach to cryptocurrency policy, with cryptocurrency exchanges needed to register with the federal government and AML and KYC requirements in location to monitor transactions.EuropeThe European Union is actively regulating cryptocurrencies and in March 2023 introduced an upgraded Sixth Anti-Money Laundering Directive that requires cryptocurrency exchanges to carry out KYC checks on their customers and report suspicious deals. The EU is also currently thinking about a brand-new regulative structure for cryptocurrencies that would align them with existing financial regulations. In Germany, cryptocurrencies are acknowledged as financial instruments and go through the exact same regulations as other financial instruments. On the other hand, France has implemented a tax regime that agrees with to cryptocurrency deals, as just transforming crypto into fiat currency, realizing gains surpassing 305 euros ($337) from the disposal of assets, and getting crypto through mining are taxable events.Exploring the potential customers Regulating crypto is difficult due to its decentralized nature, however an international regulatory body for crypto might help. Clear, foreseeable frameworks have the possible to enhance confidence and advancement and help safeguard consumers from fraud. Crypto policy is a complex, ever-changing field, with each nation looking for to develop a private approach. Therefore far in 2023, the efforts of legislators only continue to intensify. The opinions expressed in this article are for general informative functions only and are not meant to offer particular suggestions or suggestions for any individual or on any specific security or investment product.