Stablecoin survival: Navigating the future amid global de-dollarization

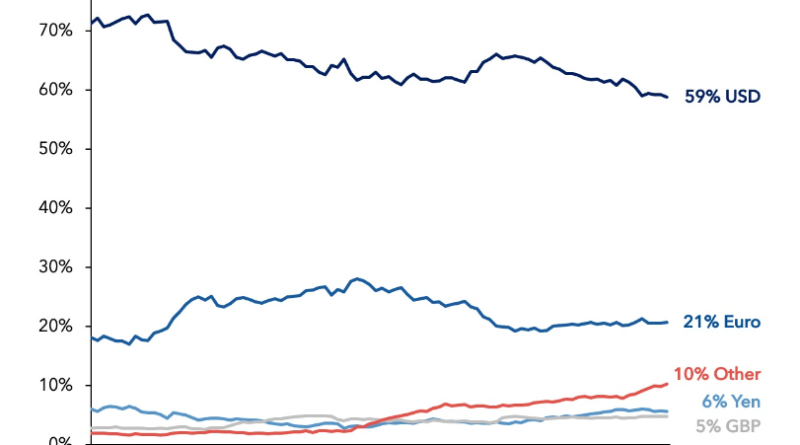

It is an empirical truth that the United States dollar is continuing to lose its dominant function as the international reserve currency, but what may happen to the stablecoin market should it be superseded?According to information from the International Monetary Fund, the U.S. dollar now accounts for just over 58% of worldwide foreign exchange reserves, a significant decrease from the 71% share it had in 2001. International foreign exchange reserves from 1999 to 2021. Source: IMFJeremy Allaire– the CEO of USD Coin (USDC) company Circle– highlighted this shift at the April 26 Consensus 2023 conference, arguing that the U.S. should execute stablecoin legislation and digitize the U.S. dollar to stay competitive amidst the “very active de-dollarization taking place.” De-dollarization describes the process of decreasing using the U.S. dollar in a countrys economy, and powerhouses like Russia and China are actively pursuing de-dollarization as they seek to change the U.S. dollar with digital assets, other fiat currencies, and potentially a BRICS currency between Brazil, Russia, India, China and South Africa.As an example of this de-dollarization taking place, the Chinese yuan has actually recently surpassed the U.S. dollar as Chinas many used cross-border currency according to Bloomberg, increasing to a high of 48% of transactions after it made up nearly 0% in 2010. Chinese Yuan surpasses US dollar as most-used currency in Chinas cross-border transactions for the very first time in history.Yuan-share increased to a record high of 48%, UP from nearly zero in 2010. U.S-share declined to 47%, DOWN from 83% over the very same period.Wow. pic.twitter.com/Lm3Rygpm45— Genevieve Roch-Decter, CFA (@GRDecter) April 26, 2023

” De-dollarization refers to the process of decreasing the usage of the U.S. dollar in a countrys economy, and powerhouses like Russia and China are actively pursuing de-dollarization as they look to replace the U.S. dollar with digital assets, other fiat currencies, and possibly a BRICS currency in between Brazil, Russia, India, China and South Africa.As an example of this de-dollarization taking place, the Chinese yuan has actually just recently overtaken the U.S. dollar as Chinas a lot of utilized cross-border currency according to Bloomberg, increasing to a high of 48% of deals after it made up almost 0% in 2010.” The sanctions put on Russia by the U.S. are a prime example of this global friction, and on April 16 Treasury Secretary Janet Yellen kept in mind that sanctions might run the risk of the U.S. dollar hegemony as targeted nations look for alternative currencies.Implications for the international economy Many individuals are most likely familiar with the video “Principles for Dealing with the Changing World Order by billionaire financier and hedge fund manager Ray Dalio, in which Dalio suggested that having the leading reserve currency “is a crucial factor in a country becoming the richest and most powerful empire,” which is an opinion shared by numerous pundits.The United States used its benefit of US dollar hegemony to develop an aggressive military to bully the entire world.De-dollarization will cause the United States dollar to collapse, precisely comparable to what occurs when Ponzi plans collapse. In an April 11 survey of economic experts, 50% of them disagreed with Krugmans assertion that the benefits are only minor.A time for innovation in the stablecoin marketAccording to CoinMarketCap, every stablecoin with a market cap surpassing $1 billion is pegged to the U.S. dollar, which makes sense provided its dominant status.As the U.S. dollar continues to lose its dominance, nevertheless, these stablecoins might see their use diminish.Tether highlighted that stablecoins are “particularly beneficial for citizens in emerging markets who might deal with high levels of inflation and currency instability,” or those in nations with restricted access to monetary services, so even if the U.S. dollar and stablecoins pegged to it lessen, others will likely step in.Schwerin noted that “big concerns are currently now reaching out outside the U.S. to cater for exactly this situation,” referencing stablecoins like Circles Euro Coin (EUROC) which is pegged to the euro, adding:” There will have to be quite a lot of improvisation and experimentation, which is excellent for development.

Another example that might be more familiar to crypto users can be seen in El Salvador, which in 2021 became the very first nation on the planet to utilize Bitcoin (BTC) as a legal tender.Following news that crypto exchange Coinbase is releasing a derivatives exchange in Bermuda, some crypto supporters such as endeavor capitalist David Sacks have even recommended that the U.S. may be attempting to prevent crypto companies from accessing bank services in the nation in an intentional effort to drive them overseas out of worry that crypto could even more consume into the supremacy of the U.S. dollar.Speaking to Cointelegraph, Dr. Joachim Schwerin– primary economic expert for the European Commission– suggested changes worldwides leading reserve currency regularly happen, adding:” Since we have records on financial data, the function of globally leading currency has actually changed every 80 to 110 years. Times of sped up worldwide frictions that considerably impact trade patterns greatly accelerate such changes.” The sanctions put on Russia by the U.S. are a prime example of this worldwide friction, and on April 16 Treasury Secretary Janet Yellen kept in mind that sanctions might run the risk of the U.S. dollar hegemony as targeted nations try to find alternative currencies.Implications for the international economy Many individuals are likely familiar with the video “Principles for Dealing with the Changing World Order by billionaire investor and hedge fund supervisor Ray Dalio, in which Dalio suggested that having the leading reserve currency “is a key aspect in a nation becoming the richest and most effective empire,” which is an opinion shared by numerous pundits.The US used its benefit of United States dollar hegemony to construct an aggressive military to bully the entire world.De-dollarization will cause the US dollar to collapse, exactly comparable to what takes place when Ponzi schemes collapse. pic.twitter.com/GALHzBj0AI— Richard (@ricwe123) April 18, 2023

In an April 11 study of economists, 50% of them disagreed with Krugmans assertion that the benefits are just minor.A time for development in the stablecoin marketAccording to CoinMarketCap, every stablecoin with a market cap going beyond $1 billion is pegged to the U.S. dollar, which makes sense given its dominant status.As the U.S. dollar continues to lose its supremacy, however, these stablecoins might see their use diminish.Tether highlighted that stablecoins are “particularly useful for residents in emerging markets who might face high levels of inflation and currency instability,” or those in nations with minimal access to monetary services, so even if the U.S. dollar and stablecoins pegged to it diminish, others will likely step in.Schwerin kept in mind that “huge issues are currently now reaching out outside the U.S. to cater for exactly this situation,” referencing stablecoins like Circles Euro Coin (EUROC) which is pegged to the euro, including:” There will have to be quite a lot of improvisation and experimentation, which is great for development.” Schwerin noted that he didnt understand precisely what would work, but expressed optimism that the crypto community would be able to quickly find solutions.Tether said that it “has always been at the leading edge of innovation,” and pointed to other items it has released such as Tether Gold (XAUT)– a stablecoin collateralized by gold– as well as other fiat-backed stablecoins.While stablecoins can be designed in very various methods, the most regularly utilized ones are currently both fully/over-collateralized and exogenous (backed by external properties). As long as stablecoins have adequate security, their users should not be stressed that a transition away from U.S. pegged stablecoins will cause any liquidity issues, particularly when a high proportion of the security is saved as extremely liquid assets.