SEC’s crypto actions surged 183% in 6 months after FTX collapse

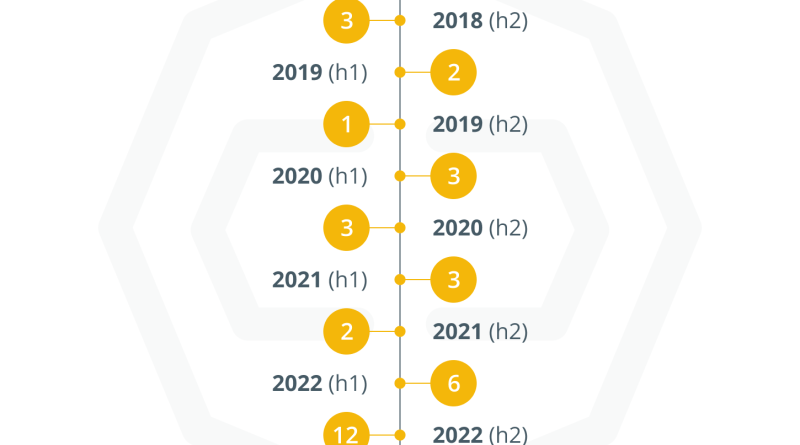

Cryptocurrency-related enforcement actions carried out by the United States securities regulator considerably increased in the 6 months following the personal bankruptcy of cryptocurrency exchange FTX.An analysis of press releases from the U.S. Securities and Exchange Commission (SEC), and news reports on its actions, discovered that in the six months preceding FTXs collapse, the SEC carried out around 6 enforcement actions.In the six months after FTXs insolvency on Nov. 11, 2022, SEC crypto-related enforcement actions leapt to at least 17, an approximated increase of 183% from the preceding period.Graph revealing the number of SEC enforcement actions in each six-month period relating to crypto.The analysis does not account for the two recent suits the SEC brought against Binance on June 5 and Coinbase a day later.The increased actions, consisting of the current ones taken against the two exchanges, led to some observers suggesting the SEC is attempting to redeem itself for failing to police FTX.MarketWatch reported that U.S. Representative French Hill said the current crackdown was a “cover your ass” relocation from the regulator and SEC chair Gary Gensler, while speaking at an occasion in Washington, D.C. on June 7. #BHLegSem 23 #BHEvents #Congress pic.twitter.com/D3B60qNgpS— BakerHostetler (@BakerHostetler) June 7, 2023

Hill declared that instead of Gensler “supervising FTX,” the SEC head was rather “out bashing Kim Kardashian since shes promoted crypto on some Super Bowl advertisement,” adding:” [Gensler] opened this year, in 2023, with all these enforcement actions; I think it appears like [cover your ass] to me.” Markus Thielen, the head of research and method at Matrixport, and author of the book Crypto Titans: How trillions were made and billions lost in the cryptocurrency markets, formerly informed Cointelegraph he thinks theres an air of “embarrassment” for those who didnt capture the problems at FTX.Related: SEC claims: 67 cryptocurrencies are now viewed as securities by the SECRipple CEO Brad Garlinghouse echoed the sentiment, declaring in a June 6 tweet that the SEC is “throwing lawsuits at the wall and hoping they sidetrack from the firms FTX fiasco.” Hall of Flame: Crypto Wendy on trashing the SEC, sexism, and how underdogs can win