Over $204M lost to DeFi hacks and scams in Q2: Finance Redefined

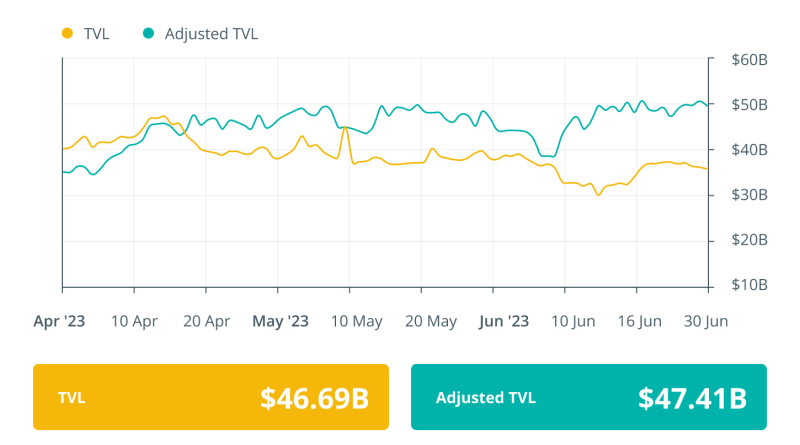

Welcome to Finance Redefined, your weekly dosage of essential decentralized finance (DeFi) insights– a newsletter crafted to bring you the most significant advancements from the previous week.The second quarter of 2023 saw over $208 million made use of and hacked from DeFi protocols, and with just $4.5 million of funds recuperated, overall losses to exploits were over $204 million.The DeFi community is an ever-growing market with billions of dollars in day-to-day trading volume. Still, it remains niche to a little population in the crypto market and out of reach for some. For a thorough introduction of DeFi, have a look at the new report from Cointelegraph Research entitled: “Investing in DeFi: A Comprehensive Guide.”The DeFi loaning protocol Maple Finance has actually decided to offer direct loans to some debtors instead of relying exclusively on pool delegates to offer capital to fill deep space left by insolvent significant loaning procedures like BlockFi.The appeal of Bitcoins BRC-20 token standard has led many leading wallet provider to include support for the brand-new token requirement, and Optimism network transactions rose 67% following the Bedrock upgrade.The top 100 DeFi tokens continued their bullish momentum into the last week of June, with the majority of tokens selling green.Over $204 million was lost in Q2 DeFi hacks and rip-offs: ReportOver $204 million was lost in DeFi hacks and rip-offs in the second quarter of 2023, according to a June 27 report from Web3 portfolio app De.Fi.The report, titled “Q2 De.Fi Rekt Report,” was partially based upon information from De.Fis Rekt Database. Over $208.5 million was made use of throughout the quarter, but $4.5 million was recuperated through prosecutions, handle hackers and other recovery techniques. According to the report, the number of DeFi hacks in Q2 increased by “nearly 7 times” year-over-year, with 117 events compared with only 17 in the exact same quarter of 2022. In overall, over $665 million was lost throughout the first half of 2023. Continue readingMaple Finance reveals direct lending to fill deep space left by BlockFi, CelsiusWeb3 loaning platform Maple Finance has announced the launch of a direct loaning program, according to a June 28 truth sheet from the platforms development group. The program is intended to replace services previously provided by Celsius, BlockFi and other now-bankrupt lenders.In the past, Maple counted on credit professionals, called “pool delegates,” to provide capital for these loans. For instance, Celsius utilized Maple to develop a Wrapped Ether (WETH) loaning pool in February 2022. Continue readingOptimism network deals rose 67% following Bedrock upgrade– NansenTransactions on the Optimism network surged 67% following its June 7 “Bedrock” upgrade, according to a June 26 Twitter thread from blockchain analytics firm Nansen. The network had seen less than 300,000 deals per day prior to the upgrade, however this figure increased to over 550,000 by the middle of June.Optimism saw a sharp increase in transactions immediately following the hard fork, rising to over 400,000 from around June 5 to 9. Volume increased slower after the preliminary spike, reaching a peak of over 550,000 on or around June 15. It then started to fall slowly, reaching 500,000 deals per day by the end of the time data was collected around June 23, according to a chart posted in Nansens Twitter thread.Continue readingWallet suppliers present BRC-20 token assistance regardless of market drawdownOn June 21, self-custody wallet company BitKeep revealed assistance for BRC-20 tokens provided on the Bitcoin network. With the function, users can view, rank and transfer BRC-20 tokens and nonfungible tokens. Developers also specified BRC-20 in-wallet swaps are coming “in [the] future.” Last month, cryptocurrency exchange OKX also revealed assistance for BRC-20 assets by means of the OKX Wallet app. Lots of centralized and decentralized exchanges have actually also presented BRC-20 support. Continue readingDeFi market overviewDeFis total market price saw a bullish rise after 3 bearish weeks. Information from Cointelegraph Markets Pro and TradingView shows that DeFis leading 100 tokens by market capitalization had a bullish week, with many tokens trading in the green. The overall worth locked in DeFi procedures remained listed below $50 billion.Thanks for reading our summary of this weeks most impactful DeFi advancements. Join us next Friday for more stories, insights and education concerning this dynamically advancing area.

Welcome to Finance Redefined, your weekly dose of essential decentralized financing (DeFi) insights– a newsletter crafted to bring you the most considerable developments from the past week.The second quarter of 2023 saw over $208 million exploited and hacked from DeFi procedures, and with simply $4.5 million of funds recovered, total losses to exploits were over $204 million.The DeFi ecosystem is an ever-growing industry with billions of dollars in day-to-day trading volume. For a comprehensive introduction of DeFi, examine out the new report from Cointelegraph Research entitled: “Investing in DeFi: A Comprehensive Guide.”The DeFi financing protocol Maple Finance has decided to use direct loans to some customers rather of relying exclusively on swimming pool delegates to provide capital to fill the space left by bankrupt major loaning protocols like BlockFi.The popularity of Bitcoins BRC-20 token standard has led many leading wallet service providers to add assistance for the new token standard, and Optimism network transactions surged 67% following the Bedrock upgrade.The top 100 DeFi tokens continued their bullish momentum into the last week of June, with the majority of tokens trading in green.Over $204 million was lost in Q2 DeFi hacks and frauds: ReportOver $204 million was lost in DeFi hacks and rip-offs in the 2nd quarter of 2023, according to a June 27 report from Web3 portfolio app De.Fi.The report, titled “Q2 De.Fi Rekt Report,” was partially based on data from De.Fis Rekt Database. The overall value locked in DeFi protocols remained listed below $50 billion.Thanks for reading our summary of this weeks most impactful DeFi advancements.