Kraken ordered by court to disclose user data to IRS for tax compliance

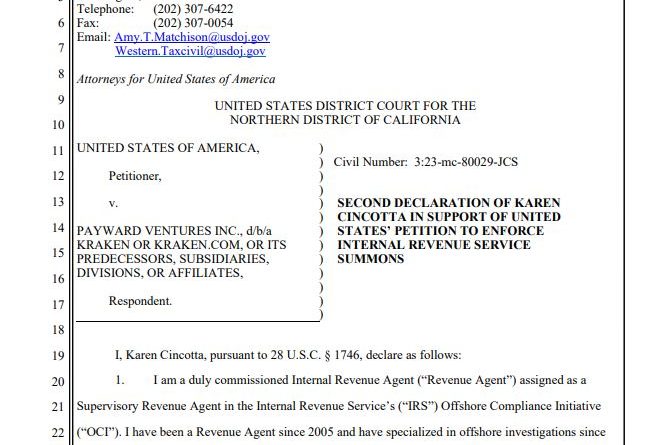

A federal court purchased crypto exchange Kraken to turn over account and transaction info to the Internal Revenue Service (IRS), which stated it needed that information to see if any of the exchanges users had actually underreported their taxes.As per the order issued on Friday, June 30, Kraken is needed to provide information of users who participated in deals exceeding $20,000 within a fiscal year, including their names (genuine or pseudonyms), birthdates, taxpayer recognition numbers, addresses, phone numbers, email addresses and different other documents.In February, the IRS sent a court petition in the Northern District of California soon after Kraken reached a settlement with the United States Security Exchange Commission (SEC) over claims of securities law offenses related to its staking service. The IRS claimed that it had provided a summons to Kraken in 2021, which the exchange stopped working to abide by, and now looks for to investigate potential tax commitments of users who performed crypto deals in between 2016 and 2020. Screenshot of the court order needing user data. Source: CourtlistenerAdditionally, Kraken will be required to launch blockchain addresses and transaction hashes, which are already included in the transaction data readily available for sharing. The exchange might likewise be asked to offer raw data to the IRS.Judge Joseph Spero, who presided over the case, appears to have dismissed the IRS attempt to get employment information and source of wealth from Kraken. The judge outrightly rejected several of the IRS requests.In the judges assessment of specific IRS demands, he specified that the Court needs to determine if the governments summons is properly focused, indicating it needs to not exceed what is necessary to accomplish its designated purpose.Related: Nifty News: Kraken NFT exits beta, Coinbases Stand with Crypto gains support, and moreAccording to the Courts findings, the details sought in the first three demands, which intend to recognize Kraken account holders falling within the Doe definition, is extremely broad and surpasses what is essential for the bulk of Doe users to develop their identities.Fridays ruling siding with the federal government comes in the middle of a deepening United States crackdown on cryptocurrency. The Securities and Exchange Commission this month submitted separate lawsuits accusing Coinbase of alleging and running a prohibited exchange that Binance.US mishandled customer funds, misguided regulators and financiers and broke securities guidelines. Magazine: Best and worst nations for crypto taxes– plus crypto tax tips